Singapore. November 12, 2025 — Verde AgriTech Ltd (TSX: NPK | OTCQX: VNPKF) (“Verde” or the “Company”) announces its operating and financial results for the period ended September 30, 2025 (“Q3 2025”). All figures are in Canadian dollars, unless stated otherwise. Average exchange rate in Q3 2025: C$1.00 = R$4.04.

“Verde has a great deal underway—both in Enhanced Rock Weathering and in our rare-earths exploration—and we look forward to updating the market on those fronts separately. Today’s release is deliberately focused on Q3 financial performance. The Great Brazilian Agriculture Crisis continues to weigh on demand, with elevated insolvencies across the sector, but we have executed with discipline: cutting costs, tightening credit, and concentrating on resilient, long-cycle customers. Our agronomic trials in eucalyptus and sugarcane are progressing well and are opening channels where a small group of buyers could, together, absorb volumes beyond our current capacity. While industry conditions remain challenging, Q3 shows clear sequential improvement and the operational rigor to keep building from here,” said Cristiano Veloso, Founder and Chief Executive Officer of Verde AgriTech.

Q3 2025 Highlights

Operational and Financial Highlights

- EBITDA before non-cash events was $0.1 million in Q3 2025, compared to -$0.03 in Q3 2024, representing the first positive EBITDA since Q2 2023.

- Sales volume in Q3 2025 was 85,136 tons; a 16% reduction compared to Q3 2024.

- Revenue in Q3 2025 was $5.9 million, an 18% decrease from the same period last year.

- Gross margin excluding freight was 60% during the quarter, in line with Q3 2024.

- Net loss in Q3 2025 was $2.1 million, compared to a $2.3 million loss in Q3 2024.

- Cash in Q3 2025 was $3.6 million, compared to $3.4 million in Q3 2024. Short-term receivables in the quarter were $7.9 million, compared to $11.3 million in Q3 2024.

- During the period, Verde was granted a Brazilian patent for its advanced fertilizer production technology combining glauconitic siltstone and beneficial microorganisms. The Company holds five patents in Brazil with National Institute of Industrial Property (INPI) and has three patent applications pending.

Sustainability Highlights

- Product sold in Q3 2025 has the potential to capture up to 10,214 tons of carbon dioxide (“CO2”) from the atmosphere via Enhanced Rock Weathering (“ERW”).[1] The potential net amount of carbon captured is estimated at 7,106 tons of CO2. In addition to its carbon removal potential, Q3 2025 sales avoided the emissions of 4,155 tons of CO2e, by substituting potassium chloride (“KCl”) fertilizers.[2] Combining the potential carbon removal and carbon emissions avoided by the use of the product since the start of production in 2018, Verde’s total potential impact stands at 329,933 tons of CO2.[3]

- 6,740 tons of chloride have been prevented from being applied into soils in Q3 2025, by farmers who used the Product in lieu of KCl fertilizers.[4] A total of 188,742 tons of chloride has been prevented from being applied into soil by Verde’s customers since the Company started production.[5]

Recent Events

- Subsequent to quarter end, Verde announced the discovery of a continuous, clay-hosted rare earth element mineralized zone in Minas Gerais, Brazil, covering approximately 5,500 hectares across 13 mineral rights. The zone was defined through integrated geological mapping, geochemistry, and spectral or geophysical datasets, and confirmed by trench sampling (see news release dated October 6, 2025). The commencement of a three-rig drilling program, was announced shortly after this discovery, which focuses on defining initial high-quality magnet rare earths resources (see news release dated October 9, 2025).

- In addition, Verde’s Board has reviewed the initial trench sampling work and has decided to accelerate the project, now formally named the Minas Americas Global Alliance magnetic rare earths project (the “Project”), laying out key project milestones (see news release dated October 21, 2025), which includes: completing mobilization; confirming ionic clay mineralization with summary of ionic adsorption diagnostics together with full leachate impurity and radiological screening, completing initial drilling and additional trenching (Q4 2025), releasing results from an ANSTO recovery test (Q1 2026); publishing a maiden NI 43-101 mineral resource estimate (Q1 2026) and publishing a preliminary economic assessment (PEA) (mid-2026). Verde is fully funded to execute the initial Project work program while continuing its fertilizer operations.

- More recently, Verde confirmed ionic-adsorption behaviour across multiple trenches at the Minas Americas Global Alliance Project reporting that ammonium-sulfate leach tests returned primary leach solutions (“PLS”) with very strong magnet rare earth (neodymium (Nd), praseodymium (Pr), dysprosium (Dy), terbium (Tb)) grades and exceptionally low impurities (thorium/ uranium (Th/U) at, or below, detection) (see news release dated October 21, 2025).

“Despite the Great Brazilian Agricultural Crisis that began in early 2023 amidst a backdrop of tight credit and higher rates, our team delivered Verde’s first positive EBITDA after eight consecutive negative quarters and we are cautiously optimistic that this momentum will continue into 2026,” continued Mr. Veloso. “We have grown our sales volumes at a 6-year CAGR of 49%, and that discipline—protecting cash generation and finishing Q3 with $3.6 million—positions us well. Looking ahead, we expect Q4 2025 into Q1 2026 to be stronger than the past year, signaling a potential end to the Brazilian agricultural crisis and a return to growth.”

Q3 2025 In Review

Market Analysis

Agricultural and fertilizer sector

The agribusiness sector continued to face pressure during Q3 2025 as part of the Great Brazilian Agricultural Crisis, with ongoing challenges such as geopolitical tensions, extreme climate risks, high input costs, financing difficulties and trade volatility, creating uncertainties for output and market stability.[6] However, Verde began to see some recovery from the agricultural downturn that started in early 2023. The Companhia Nacional de Abastecimento (Conab) September report expects Brazilian’s soybean, corn and grain production to remain high, reaffirming the country’s resilience in agricultural output. Brazilian farmers have begun the 2025/26 planting season, and Conab’s initial outlook suggests another increase in corn and soybean acreage. The expansion reflects rising domestic biofuel demand and robust exports that continue to set shipment records.[7] At the same time, global demand for potash is strengthening, supported by population growth, food security, precision farming, specialized fertilizers, and a focus on efficiency. The market is projected to reach US$34.8 billion by 2033, suggesting a 9-year CAGR of 2.66%.[8] Taken together with projected 5-year and 10-year growth rates of ~2.3-2.5% per year and 2.5% per year, respectively, suggests a cautiously optimistic outlook for the sector.[9]

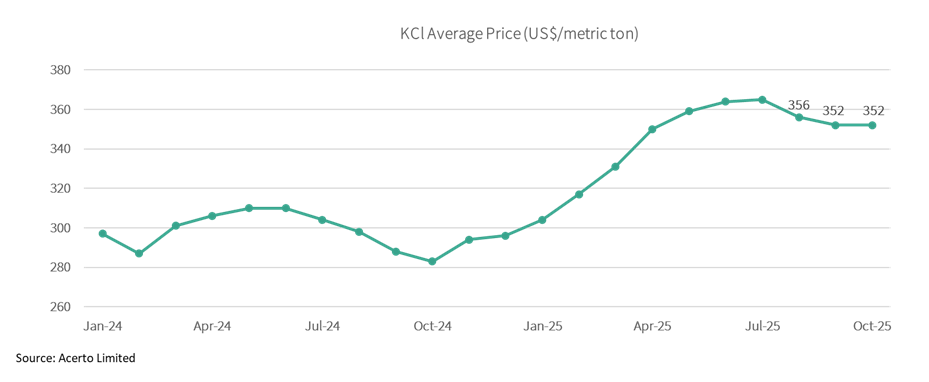

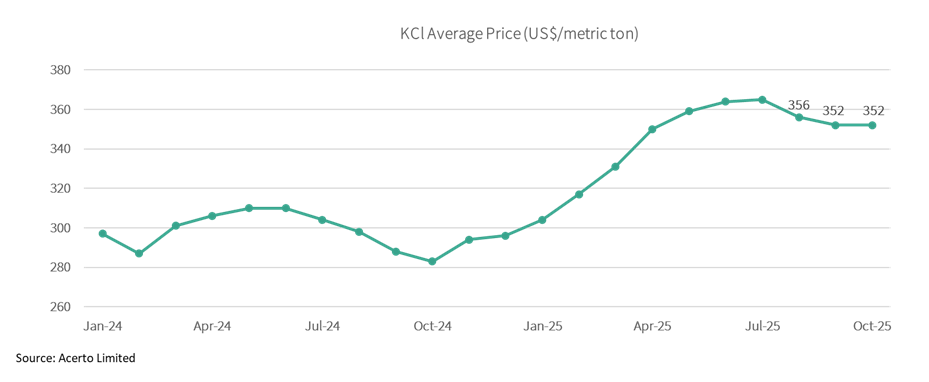

Despite this, input cost challenges, particularly high fertilizer prices, combined with relatively steady crop prices, have impacted the profitability of Brazil’s soy and corn producers during the 2025/26 harvest, currently being planted.[10] During the quarter, fertilizer prices, especially for potassium chloride (KCI), remained high, above US$350/metric ton. [11] This may lower the gross margins for producers even amid strong demand for grains and other agricultural products. [12]

Figure 1: Average potassium chloride (KCl) prices per metric ton

Brazilian farmers relying on leased land or loans face further challenges from high interest rates and accumulated leverage. According to Experian’s Agro Judicial Recovery Indicator, the sector registered 565 requests for judicial measures in Q2 2025, up 31.7% from the previous quarter.[13]

The government recently announced a R$12.0 billion (approximately USD 2.21 billion) rural credit and debt-relief program aimed at supporting up to 100,000 mostly small and medium farmers, affected by extreme weather. [14] While the initiative is designed to ease short-term cash flow pressures, reduce credit risk, and support input demand (including fertilizers), many farmers are finding it difficult to access the funds. Banks responsible for intermediating the operations require substantial collateral, but most farmers have already pledged their available assets to other creditors.

Like Verde, other players in the sector adopted measures to safeguard operations and improve resilience. Fertilizer producers face a combination of climate-related delays, lower technology adoption, and farmer cost containment. Many have launched debt restructuring efforts to reduce short-term liabilities, preserve liquidity, and secure more sustainable financial terms on existing debt.[15] These actions reinforce a sector-wide emphasis on cost discipline, credit selectivity, and long-term stability. Verde maintained a conservative commercial strategy throughout the quarter, limiting sales exposure to higher-risk clients.

Rare earths market

The price for rare earths elements remained elevated in Q3 2025. Despite China implementing stricter export controls on rare earth elements and related technologies, citing national security concerns[16], the global market continues to grow, with projections showing a 7-year CAGR of 10.2%, from US$3.74 billion in 2024 to US$8.14 billion by 2032.[17] Brazil, which holds the world’s second-largest, rare earths reserves at 21 million metric tons[18], is taking steps to strengthen its position, offering financial guarantees and tax incentives to support domestic mining and processing of strategic minerals.[19] Driven by rising global demand for strategic minerals, investments in Brazil’s rare earths sector are forecast to climb 49% by 2029.[20]

Macroeconomic Conditions

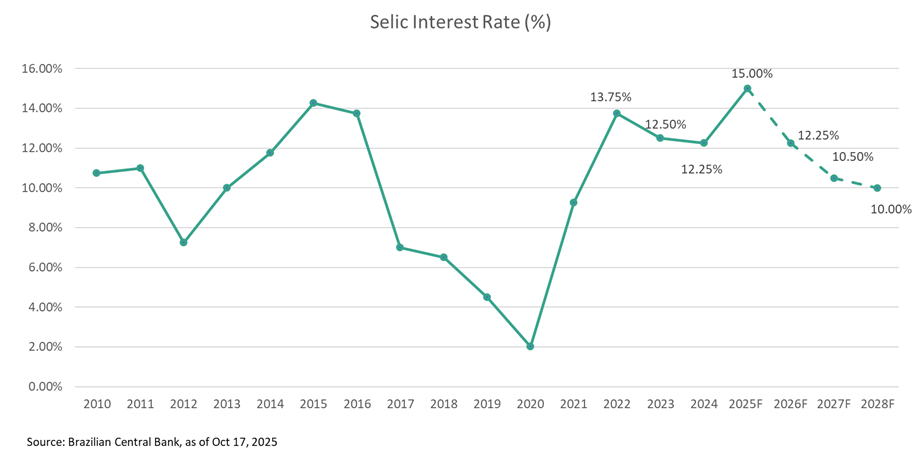

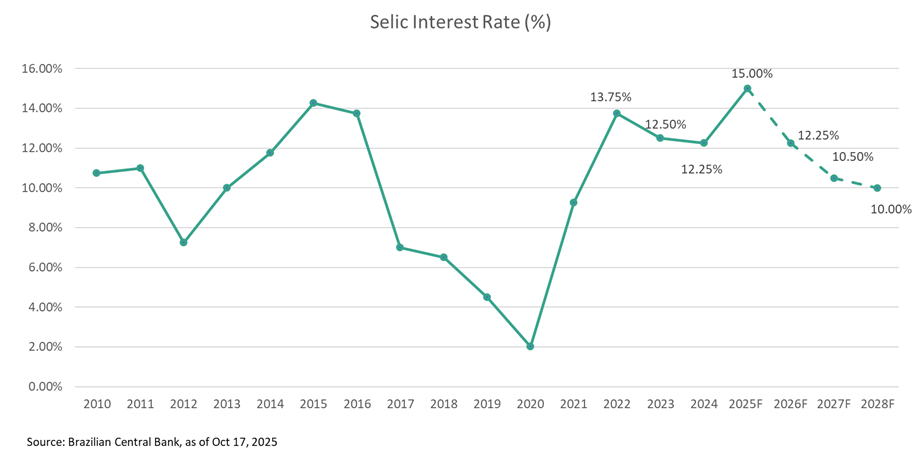

Under a tight monetary policy, with record-high SELIC interest rates of 15%, Brazil’s economy is expected to have grown by around 0.3% in the quarter,[21] with a full-year growth projected by Brazilian Central Bank at 2.0%.[22] While the SELIC rate remains elevated, there may be an interest rate cut if inflation continues to ease. Current forecasts indicate the rate will gradually decline to 12.25% in 2026 and further to 10% by 2028. Inflation forecasts for 2025 and 2026 stand at 4.80% and 3.60%[23], respectively, suggesting a cautiously optimistic outlook that Brazil’s macroeconomic environment may be on a path toward stabilization in the medium term.

Figure 2: Selic Interest Rates

The agriculture industry continues to navigate an increasingly challenging credit environment. Working capital remains tight for many farmers, and more suppliers have shifted toward post-harvest payment terms, often requiring payment nine to 12 months after the harvest. As discussed earlier, a government subsidy introduced earlier this year aims to ease short-term credit constraints. In reality, however, many farmers still struggle to access these funds, as banks are requiring collateral that they often cannot provide, and available guarantees remain limited. As a result, credit approvals and disbursements continue to lag, forcing farmers and producers to carefully manage liquidity, cash flow and credit exposure throughout the supply chain.

Global political developments involving key Brazilian trading partners, along with ongoing discussions around taxation and regulation, have introduced some uncertainty for farmers considering long-term investments. In response, many are taking a more conservative approach, prioritizing essential inputs and maintaining financial discipline. While this cautious sentiment has moderated short-term fertilizer demand, it also reflects a broader focus on operational efficiency and strategic resource allocation. As greater clarity emerges around policy and market dynamics, purchasing activity may begin to recover.[24]

External Factors

Revenue and costs are affected by external factors including changes in the exchange rates between the C$ and R$ along with fluctuations in potassium chloride spot CFR Brazil, agricultural commodities prices, interest rates, among other factors. For further details, please refer to the Q3 2025 Year in Review section.

Results of Operations

The following table provides information about three months ended September 30, 2025, as compared to the three months ended September 30, 2024. All amounts in CAD $’000.

|

3 months

ended

Sep 30, 2025 |

3 months ended

Sep 30, 2024 |

9 months ended

Sep 30, 2025 |

9 months

ended

Sep 30, 2024 |

| Tons sold ‘000 |

85 |

101 |

213 |

271 |

| Average Revenue per ton sold $$ |

69 |

71 |

63 |

69 |

| Average Production cost per ton sold $ |

(17) |

(18) |

(17) |

(20) |

| Average Gross Profit per ton sold $ s |

52 |

53 |

46 |

49 |

| Gross Margin |

75% |

75% |

73% |

71% |

| |

|

|

|

|

| Revenue |

5,873 |

7,161 |

13,525 |

18,709 |

| Production costs(1) |

(1,447) |

(1,830) |

(3,520) |

(5,316) |

| Gross Profit |

4,426 |

5,331 |

10,005 |

13,393 |

| Gross Margin |

75% |

75% |

73% |

71% |

| Sales and marketing expenses |

(907) |

(895) |

(2,649) |

(2,844) |

| Product delivery freight expenses |

(2,301) |

(2,630) |

(5,149) |

(6,767) |

| General and administrative expenses |

(955) |

(1,054) |

(3,053) |

(3,467) |

| Allowance for expected credit losses |

(163) |

(785) |

(670) |

(1,018) |

| EBITDA (2) |

100 |

(33) |

(1,516) |

(703) |

| Share Based and Bonus Payments (Non-Cash Event)(3) |

8 |

(104) |

(225) |

(2,146) |

| Depreciation, Amortisation and P/L on disposal of plant and equipment (3) |

(798) |

(758) |

(2,344) |

(2,479) |

| Operating Profit after non-cash events |

(690) |

(895) |

(4,085) |

(5,328) |

| Interest Income/Expense (4) |

(1,389) |

(1,431) |

(4,191) |

(4,372) |

| Net Profit before tax |

(2,079) |

(2,326) |

(8,276) |

(9,700) |

| Income tax (5) |

(7) |

(10) |

(17) |

(27) |

| Net Profit |

(2,086) |

(2,336) |

(8,293) |

(9,727) |

|

|

|

|

|

|

(1) – Non GAAP measure

(2) – Included in General and Administrative expenses in financial statements

(3) – Included in General and Administrative expenses and Cost of Sales in financial statements

(4) – Please see Summary of Interest-Bearing Loans and Borrowings notes

(5) – Please see Income Tax notes

Operating and Financial Results

Sales Performance

In Q3 2025, revenue from sales declined by 18%, accompanied by a 3% decline in the average revenue per ton compared to Q3 2024. Excluding freight expenses (FOB price), the average revenue per ton declined by 6%, primarily driven by the devaluation of the Brazilian Real by 5.1% and a reduction in sales of specialty products, which decreased from 17% to 15% of the sales mix. The shift reflects farmers’ increasing preference for lower value-added products, as many continue to face restricted cash flows.

Verde maintains a rigorous credit approval process for customers purchasing specialty fertilizers, due to the inclusion of third-party raw materials in these products. This more stringent evaluation helps safeguard operational continuity and mitigates risks associated with the fulfillment of purchase agreements.

The Company reported a net loss of $2.1 million in Q3 2025, compared to a net loss of $2.3 million in Q3 2024. The year-over-year improvement of $0.2 million primarily reflects lower non-cash expense from a reduction in the allowance for expected credit losses

Basic loss per share totaled $0.04 in Q3 2025, the same as in Q3 2024.

Production Costs [25]

The average cost per ton decreased by 6% in Q3 2025, primarily due to an 5.1% devaluation of the Brazilian Real, alongside a lower proportion of specialty product orders compared to regular products.

Production costs include all direct costs from mining, processing, and the addition of other nutrients to the Product, such as sulphur and boron. It also includes the logistics costs from the mine to the plant and related salaries.

Financing Activities

As a result of Q2 2025 debt restructuring, the Company required less cash for interest and principal payments during the period.

| Loans

CAD $’000 |

Before renegotiation |

After renegotiation |

| Short-term loans |

43,316 |

3,458 |

| Long-term loans |

7,562 |

45,484 |

| Total |

50,878 |

48,942 |

Financial Position

As of September 30, 2025, Verde held cash of $3.6 million, compared to $3.4 million at the end of Q3 2024. Short-term receivables recorded during the quarter were $7.9 million. The total cash and short-term receivables were $11.5 million in Q3 2025.

Outlook

For the balance of 2025 and into 2026, the Company expects continued operational improvement in its fertilizer business versus the prior 24 months. Verde anticipates improving market conditions, with early signs of recovery in H2 2025—supported by higher grain output, the potential for lower Brazilian interest rates, and moderating inflation—pointing to a near-term easing of the agricultural downturn.

Following the discovery of high-grade magnet rare earth mineralization at the Minas Americas Global Alliance magnetic rare earths project, the Board has initiated a strategic review and outlined several key project milestones which include: confirming ionic clay mineralization with summary of ionic adsorption diagnostics together with full leachate impurity and radiological screening (now confirmed), completing initial drilling and additional trenching (Q4 2025), releasing results from an ANSTO recovery test (Q1 2026); publishing a maiden NI 43-101 mineral resource estimate (Q1 2026) and publishing a preliminary economic assessment (PEA) (mid-2026).

Q3 Results Conference Call

The Company will host a conference call to discuss Q3 2025 results and provide an update. Subscribe using the link below and receive the conference details by email.

The Company’s financial statements and related notes for the period ended September 30, 2025 are available to the public on SEDAR+ at www.sedarplus.ca and the Company’s website at www.investor.verde.ag/.

About Verde AgriTech

Verde AgriTech is dedicated to advancing sustainable agriculture through the innovation of specialty multi-nutrient potassium fertilizers. Our mission is to increase agricultural productivity, enhance soil health, and significantly contribute to environmental sustainability. Utilizing our unique position in Brazil, we harness proprietary technologies to develop solutions that not only meet the immediate needs of farmers but also address global challenges such as food security and climate change. Our commitment to carbon capture and the production of eco-friendly fertilizers underscores our vision for a future where agriculture contributes positively to the health of our planet.

For more information on how we are leading the way towards sustainable agriculture and climate change mitigation in Brazil, visit our website at https://verde.ag/en/home/.

For additional information please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

Cautionary Language and Forward-Looking Statements

Cautionary Note Regarding Mineral Resources and Reserves (NI 43-101 / CIM)

Unless otherwise indicated, all scientific and technical information in this news release has been prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards (May 10, 2014). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that any part of an Inferred Mineral Resource will be converted into Measured or Indicated Mineral Resources or into Mineral Reserves. The results of any preliminary economic assessment (“PEA”) or pre-feasibility study (“PFS”), to the extent referenced, are preliminary in nature and include inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves; there is no certainty that the PEA or PFS results will be realized.

Cautionary Note to U.S. Investors

The terms “Mineral Resource,” “Inferred Mineral Resource,” “Indicated Mineral Resource,” and “Measured Mineral Resource,” and “Mineral Reserve,” as used herein, are defined in accordance with NI 43-101 and the CIM Definition Standards, which differ in certain respects from the requirements of the U.S. Securities and Exchange Commission (“SEC”), including Subpart 1300 of Regulation S-K (“S-K 1300”). Accordingly, information contained herein may not be comparable to similar information made public by U.S. companies subject to the SEC’s reporting and disclosure requirements.

Forward-Looking Information and Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). Forward-looking statements are made as of the date of this news release and relate to future events or performance. Often, but not always, forward-looking statements can be identified by words such as “expects,” “anticipates,” “plans,” “projects,” “estimates,” “envisages,” “assumes,” “intends,” “strategy,” “goals,” “objectives,” or variations (including negative variations) of such words and phrases, or statements that certain actions, events or results “may,” “could,” “would,” “might,” or “will” be taken, occur or be achieved.

Forward-looking statements in this news release include, without limitation, statements with respect to: (i) estimates of the tonnage and grades of Mineral Resources and Mineral Reserves; (ii) the potential amount of CO₂ removal per tonne of rock and the development, verification, issuance and sale of carbon-removal credits; (iii) the PFS representing a viable development option for the Project and the timing of related disclosures; (iv) estimates of initial and sustaining capital costs, operating and total costs, payback periods, net cash flow, net present value and economic returns; (v) future production volumes (produced and sold) and sales assumptions for Super Greensand® and K Forte®; (vi) the Company’s competitive position in Brazil and potash market demand; (vii) recommendations of any special committee; (viii) the terms, timing, court approval and financial impact of any debt restructuring; and (ix) the potential outcomes of re-assaying certain core samples.

These forward-looking statements are based on the Company’s and its consultants’ reasonable assumptions, estimates and opinions as of the date hereof, including, without limitation: (i) the presence and continuity of Mineral Resources and Mineral Reserves at estimated grades; (ii) geotechnical, hydrological and metallurgical characteristics of rock consistent with sampled results; (iii) capacities, availability and performance of equipment and personnel at estimated costs and timelines; (iv) foreign exchange rates; (v) realized sales prices, market size and adoption for the Company’s products; (vi) applicable discount, tax and royalty rates; (vii) availability and cost of acceptable financing; (viii) anticipated mining loss and dilution; (ix) receipt of required permits and other regulatory approvals on acceptable terms; (x) reasonable contingency allowances; (xi) successful execution of operating plans; (xii) the fulfilment of environmental assessment commitments and community arrangements; and (xiii) for carbon-removal activities, the applicability of methodologies, verification, permanence, monitoring and market acceptance.

Forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Such risks and uncertainties include, without limitation: risks related to court approvals and the completion of any debt restructuring; variations in grade or recovery; adverse geotechnical, hydrological or metallurgical conditions; changes in project parameters as plans continue to be refined; cost escalation and inflationary pressures; labour availability; fluctuations in commodity prices and demand (including potash); foreign-exchange volatility (including Brazilian Real–Canadian dollar); availability and terms of financing; changes in tax and royalty regimes; delays in permitting or stakeholder agreements; competitive pressures; infrastructure and operational risks; regulatory changes affecting mining, fertilizers and carbon-removal markets; and, for carbon-removal activities, risks relating to methodology eligibility, additionality, durability/permanence, leakage, monitoring, verification, certification, policy shifts and pricing, any of which could affect the issuance, saleability or value of credits. Additional information about risk factors is described in the Company’s most recent Annual Information Form filed on SEDAR+ (www.sedarplus.com) and in other continuous disclosure filings. The foregoing list is not exhaustive, and there can be no assurance that forward-looking statements will prove accurate.

Readers are cautioned not to place undue reliance on forward-looking statements. Except as required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Financial Outlook / Future-Oriented Financial Information

This news release may contain future-oriented financial information or financial outlooks (collectively, “FOFI”) within the meaning of applicable securities laws, including, without limitation, estimates of capital and operating costs, net present value, internal rate of return, payback and projected revenues or cash flows. Such FOFI are provided to describe the anticipated effects of proposed project development and may not be appropriate for other purposes. The FOFI are based on the assumptions and subject to the risks described above, and actual results may vary materially.

Currency, Units and Trademarks

Unless otherwise stated, all figures are in Canadian dollars (C$). Tonnages are metric tonnes. Super Greensand® and K Forte® are registered trademarks of the Company.

[1] The carbon capture potential of Verde’s products, through Enhanced Rock Weathering (ERW), is 120 kg CO2e per ton of K Forte®. For further information, see “Verde’s Products Remove Carbon Dioxide From the Air”.

[2] K Forte® is a fertilizer produced in Brazil using national raw materials. Its production process has low energy consumption from renewable sources and, consequently, a low environmental and GHG emissions footprint. Whereas the high carbon footprint of KCl results from a complex production process, involving extraction, concentration, and granulation of KCl, in addition to the long transportation distances to Brazil, given that 95% of the KCl consumed in the country is imported. 12Mt of K Forte® is equivalent to 2Mt of KCl in K2O content. Emissions avoided are calculated as the difference between the weighted average emissions for KCl suppliers to produce, deliver, and apply their product in each customer’s city and the emissions determined according to K Forte®’s Life Cycle Assessment for its production, delivery, and application in each customer’s city.

[3] From 2018 to Q3 2025, the Company has sold 2.4 million tons of Product, which can potentially remove up to 261,948 tons of CO2. Additionally, this amount of Product could potentially avoid up to 67,985 tons of CO2 emissions.

[4] Verde’s Product is a salinity and chloride-free replacement for KCl fertilizers. Potassium chloride is composed of approximately 46% of chloride, which can have biocidal effects when excessively applied to soils. According to Heide Hermary (Effects of some synthetic fertilizers on the soil ecosystem, 2007), applying 1 pound of potassium chloride to the soil is equivalent to applying 1 gallon of Clorox bleach, with regard to killing soil microorganisms. Soil microorganisms play a crucial role in agriculture by capturing and storing carbon in the soil, making a significant contribution to the global fight against climate change.

[5] 1 ton of Product (10% K2O) has 0.1 tons of K2O, which is equivalent to 0.17 tons of potassium chloride (60% K2O), containing 0.08 tons of chloride.

[6] Source: Perspectives for Agriculture – Volume 13 – 2025/2026 Harvest, Companhia Nacional de Abasteciento, September 19, 2025. Available at: https://www.gov.br/conab/pt-br/acesso-a-informacao/institucional/publicacoes/perspectivas-para-a-agropecuaria/perspectivas-para-a-agropecuaria-volume-13-safra-2025-2026-1

[7] Source: Brazil begins planting with expected record acreage driven by high demand but low margins, Farmdoc Daily, University of Illinois at Urbana-Champaign, October 20, 2025. Available at: https://farmdocdaily.illinois.edu/2025/10/brazil-begins-planting-with-expected-record-acreage-driven-by-high-demand-but-low-margins.html

[8] Source: Potash Market Report – Business Research Insights, October 20, 2025. Available at: https://www.businessresearchinsights.com/market-reports/potash-market-120921

[9] Source: Brazil: 2025 article iv consultation—press release; staff report; and statement by the executive director for Brazil, International Monetary Fund, June 27, 2025. Available at: https://www.elibrary.imf.org/view/journals/002/2025/194/article-A000-en.pdf

10 Source: Soy and corn farmers could face losses this harvest, Valor International, October 17, 2025. Available at: https://valorinternational.globo.com/agribusiness/news/2025/10/17/soy-and-corn-farmers-could-face-losses-this-harvest.ghtml

[11] Available at: Acerto Limited

[12] Source: Brazil begins planting with expected record acreage driven by high demand but low margins, Farmdoc Daily, University of Illinois at Urbana-Champaign, October 20, 2025. Available at: https://farmdocdaily.illinois.edu/2025/10/brazil-begins-planting-with-expected-record-acreage-driven-by-high-demand-but-low-margins.html

[13] Source: Judicial Reorganization: requests grow almost 32% in agribusiness in the second quarter of 2025, shows Serasa Experian indicator, Serasa Experian, September 29, 2025. Available at: https://www.serasaexperian.com.br/sala-de-imprensa/agronegocios/recuperacao-judicial-solicitacoes-crescem-quase-32-no-agro-em-segundo-trimestre-de-2025-mostra-indicador-da-serasa-experian/

[14] Source: Brazil’s Lula announces $2.2 bln debt relief package for farmers, Reuters, September 5, 2025. Available at: https://www.reuters.com/business/finance/brazils-lula-announces-22-bln-debt-relief-package-farmers-2025-09-05/

[15] Source: Lavoro Restructures $460 Million Debt to Secure Crop Input Supply, The AgriBiz, June 18, 2025. Available at: https://www.theagribiz.com/international/lavoro-restructures-460-million-debt-to-secure-crop-input-supply/

[16] Source: Concerned carmakers race to beat China’s rare earths deadline, Reuters, October 21, 2025. Available at: https://www.reuters.com/business/autos-transportation/concerned-carmakers-race-beat-chinas-rare-earths-deadline-2025-10-21/

[17] Source: Rare Earth Elements Market Size, Share & Industry Analysis and Regional Forecast, 2024-2032, Fortune Business Insights, October 6, 2025. Available at: https://www.fortunebusinessinsights.com/rare-earth-elements-market-102943

[18] Source: Brazil’s rare earth projects seek partnerships to enhance energy security, S&P Global, June 6, 2025. Available at: https://www.spglobal.com/commodity-insights/en/news-research/latest-news/metals/060625-brazils-rare-earth-projects-seek-partnerships-to-enhance-energy-security

[19] Source: Brazil eyes financial guarantees, tax breaks for strategic minerals, Reuters, September 5, 2025. Available at: https://www.reuters.com/business/brazil-eyes-financial-guarantees-tax-breaks-strategic-minerals-2025-10-16/

[20] Source: Brazilian Rare earth investments to rise 49% by 2029, Agencia Brazil, October 22, 2025. Available at: https://agenciabrasil.ebc.com.br/en/economia/noticia/2025-10/brazilian-rare-earth-investments-rise-49-2029

[21] Source: Brazil’s economy slows sharply in second quarter but still beats forecasts, Reuters, September 2, 2025. Available at: https://www.reuters.com/world/americas/brazils-economy-slows-sharply-second-quarter-still-beats-forecasts-2025-09-02/

[22] Source: Brazilian Central Bank, Projections for GDP growth in 2025 and 2026, September 2025. Report. Available at: https://www.bcb.gov.br/content/ri/inflationreport/202509/rpm202509b1i.pdf

[23] As of September 30, 2025. Source: Brazilian Central Bank

[24] Source: “US sanctions could cause chaos on Latam farms run on Russian fertilizers,” Reuters, July 21, 2025. Available at: https://www.reuters.com/world/americas/us-sanctions-could-cause-chaos-latam-farms-run-russian-fertilizers-2025-07-21

[25] Verde’s production costs and sales price are based on the following assumptions:

- Micronutrients added to the product increase its production cost, rendering K Forte® less expensive to produce.

- Production costs vary based on packaging type, with bulk being less expensive than Jumbo Bags.

- Plant 1 produces K Forte® Jumbo Bags and Low-Carbon Specialty Fertilizer Products, while Plant 2 exclusively produces K Forte® Bulk. Therefore, Plant 2’s production costs are lower than Plant 1’s costs.

Singapore. August 07, 2025. — Verde AgriTech Ltd (TSX: “NPK”) (“Verde” or the “Company”) announces its financial results for the period ended June 30, 2025 (“Q2 2025”). All figures are in Canadian dollars, unless stated otherwise. Average exchange rate in Q2 2025: C$1.00 = R$4.08.

Q2 2025 Highlights

Operational and Financial Highlights

- Verde’s sales volume in Q2 2025 was 80,354 tons; a 6% reduction compared to Q2 2024, which generated $4.8 million in revenue during the quarter.

- Gross margin excluding freight was 58% during the quarter, compared to Q2 2024 gross margin of 55%.

- Sales and Marketing expenses in Q2 2025 were -$0.9 million, compared to -$1.0 million in Q2 2024.

- Positive operating cash inflow of $0.2 million was recorded during the quarter, compared to -$0.3 million cash outflow in Q2 2024.

- EBITDA before non-cash events was -$0.2 million in Q2 2025, compared to nil in Q2 2024.

- Net loss in Q2 2025 was -$2.4 million, compared to a -$2.6 million loss in Q2 2024.

- Cash of $2.4 million in Q2 2025 compared to $2.7 million in Q2 2024. Short-term receivables in the quarter were $8.2 million compared to $12.8 million in Q2 2024.

- The Company successfully completed the renegotiation of short-term and long-term loans in Q2 2025, with approximately 99.5% of loans classified as long-term versus 19.8% prior to the renegotiation. Short-term loans totaled $0.2 million in the quarter, compared to $22.9 million in Q2 2024.

Sustainability Highlights

- Product sold in Q2 2025 has the potential to capture up to 9,640 tons of carbon dioxide (“CO2”) from the atmosphere via Enhanced Rock Weathering (“ERW”).[1] The potential net amount of carbon captured is estimated at 6,890 tons of CO2. In addition to the carbon removal potential, Q2 2025 sales avoided the emissions of 4,102 tons of CO2e, by substituting potassium chloride (“KCl”) fertilizers.[2] Combining the potential carbon removal and carbon emissions avoided by the use of the product since the start of production in 2018, Verde’s total potential impact stands at 315,564 tons of CO2.[3]

- 6,368 tons of chloride have been prevented from being applied into soils in Q2 2025, by farmers who used the Product in lieu of KCl fertilizers.[4] A total of 182,002 tons of chloride has been prevented from being applied into soil by Verde’s customers since the Company started production.[5]

“Against a backdrop of tight credit and elevated interest rates, our team delivered a resilient second quarter,” said Cristiano Veloso, Founder and Chief Executive Officer of Verde AgriTech. “By renegotiating more than 99 per cent of our debt into long‑term maturities, cutting unit production costs, and preserving a best‑in‑class 58 per cent gross margin (ex‑freight), we have fortified the balance sheet and protected cash flow while Brazil’s farm economy cycles through unprecedented volatility.”

“At the same time, every ton we sold in Q2 puts money back in growers’ pockets and carbon back in the ground. Since first production, our products have the potential to remove or avoid over 315,000 tons of CO₂ and have kept 182,000 tons of chloride out of Brazilian soils. That double dividend—higher crop productivity and climate impact—continues to differentiate Verde in the fertilizer market.”

“Looking ahead to the second half, our presence in core regions, launching tailored multi‑nutrient formulations. These priorities position Verde to capture the upside when sector demand rebounds, while creating enduring value for our customers, communities and shareholders.”

Q2 2025 In Review

Market Analysis

In Q2 2025, Brazil’s agricultural input sector continued to navigate the lingering effects of a prolonged downturn that began in 2022. High indebtedness among farmers and distributors, combined with limited access to credit and adverse market dynamics, led to cautious purchasing behavior. Many agribusinesses remain engaged in debt renegotiation processes — either judicial or informal — while suppliers across the chain have tightened credit policies and prioritized liquidity.[6]

Despite this challenging backdrop, certain indicators signaled a possible shift in market dynamics. Potash prices, particularly for potassium chloride (KCl), remained stable and showed a modest upward trend throughout the quarter.[7]

Like Verde, other players in the sector adopted measures to safeguard operations and improve resilience. Companies face a combination of climate-related delays, lower technology adoption, and farmer cost containment. Many have launched debt restructuring efforts to reduce short-term liabilities, preserve liquidity, and secure more sustainable financial terms.[8] These actions reinforce a sector-wide emphasis on cost discipline, credit selectivity, and long-term stability. Verde maintained a conservative commercial strategy throughout the quarter, limiting sales exposure to higher-risk clients.

Macroeconomic Conditions

The macroeconomic environment in Brazil remained restrictive during Q2 2025. The SELIC rate stood at 15.00% at the end of the quarter and remained unchanged in the following month[9]— still among the highest real interest rates globally. These financing conditions continue to constrain credit availability for rural producers and delay investments in agricultural inputs. Projections suggest that the SELIC will remain at current levels through the end of 2025[10], while JP Morgan foresees it to gradually decrease to 10.75% by the end of 2026.[11]

Inflation forecasts for 2025 and 2026 stand at 5.10% and 4.40%[12], respectively, suggesting a cautiously optimistic outlook that Brazil’s macroeconomic environment may be on a path toward stabilization in the medium term. Although working capital remains tight for many farmers, especially during the critical period for purchasing inputs such as fertilizers, the industry has adapted by shifting payment terms to post-harvest settlements, typically between 9 and 12 months. This practice, while standard in the agricultural sector, requires careful management of cash flow and credit exposure across the supply chain.

Global political developments involving key Brazilian trading partners, along with ongoing discussions around taxation and regulation, have introduced some uncertainty for farmers considering long-term investments. In response, many are taking a more conservative approach, prioritizing essential inputs and maintaining financial discipline. While this cautious sentiment has moderated short-term fertilizer demand, it also reflects a broader focus on operational efficiency and strategic resource allocation. As greater clarity emerges around policy and market dynamics, purchasing activity may begin to recover.[13]

External Factors

Revenue and costs are affected by external factors including changes in the exchange rates between the C$ and R$ along with fluctuations in potassium chloride spot CFR Brazil, agricultural commodities prices, interest rates, among other factors. For further details, please refer to the Q2 2025 Year in Review section.

Results of Operations

The following table provides information about three months ended June 30, 2025, as compared to the three months ended June 30, 2024. All amounts in CAD $’000.

| All amounts in CAD $’000 |

3 months ended

Jun 30, 2025 |

3 months ended

Jun 30, 2024 |

6 months ended

Jun 30, 2025 |

6 months ended

Jun 30, 2024 |

| Tons sold ‘000 |

80 |

85 |

128 |

170 |

| Average Revenue per ton sold $$ |

60 |

76 |

60 |

68 |

| Average Production cost per ton sold $ |

(16) |

(21) |

(16) |

(21) |

| Average Gross Profit per ton sold $ s |

44 |

55 |

44 |

47 |

| Gross Margin |

73% |

72% |

73% |

70% |

| |

|

|

|

|

| Revenue |

4,800 |

6,480 |

7,652 |

11,548 |

| Production costs(1) |

(1,316) |

(1,815) |

(2,073) |

(3,486) |

| Gross Profit |

3,484 |

4,665 |

5,579 |

8,062 |

| Gross Margin |

73% |

72% |

73% |

70% |

| Sales and marketing expenses |

(891) |

(979) |

(1,742) |

(1,949) |

| Product delivery freight expenses |

(1,733) |

(2,541) |

(2,848) |

(4,137) |

| General and administrative expenses |

(1,048) |

(1,058) |

(2,098) |

(2,414) |

| Allowance for expected credit losses |

6 |

(87) |

(507) |

(232) |

| EBITDA (2) |

(182) |

– |

(1,616) |

(670) |

| Share Based and Bonus Payments (Non-Cash Event)(3) |

(72) |

(265) |

(233) |

(2,042) |

| Depreciation, Amortisation and P/L on disposal of plant and equipment (3) |

(772) |

(802) |

(1,546) |

(1,721) |

| Operating Profit after non-cash events |

(1,026) |

(1,067) |

(3,395) |

(4,433) |

| Interest Income/Expense (4) |

(1,394) |

(1,564) |

(2,802) |

(2,941) |

| Net Profit before tax |

(2,420) |

(2,631) |

(6,197) |

(7,374) |

| Income tax (5) |

(6) |

(8) |

(10) |

(17) |

| Net Profit |

(2,426) |

(2,639) |

(6,207) |

(7,391) |

(1) – Non GAAP measure

(2) – Included in General and Administrative expenses in financial statements

(3) – Included in General and Administrative expenses and Cost of Sales in financial statements

(4) – Please see Summary of Interest-Bearing Loans and Borrowings notes

(5) – Please see Income Tax notes

Operating and Financial Results

Sales Performance

In Q2 2025, revenue from sales declined by 6%, accompanied by a 21% decrease in the average revenue per ton compared to Q2 2024. Excluding freight expenses (FOB price), the average revenue per ton fell by 17%, primarily driven by the devaluation of the Brazilian Real by 9.2% and a reduction in sales of specialty products, which decreased from 18% to 9% of the sales mix. The shift reflects farmers’ increasing preference for lower value-added products, as many continue to face restricted cash flows.

Verde maintains a rigorous credit approval process for customers purchasing specialty fertilizers, due to the inclusion of third-party raw materials in these products. This more stringent evaluation helps safeguard operational continuity and mitigates risks associated with the fulfillment of purchase agreements.

The Company reported a net loss of -$2.4 million in Q2 2025, compared to a net loss of -$2.6 million in Q2 2024. The result was primarily impacted by interest expenses of -$1.4 million and depreciation of -$0.8 million. The year-over-year improvement of $0.2 million was mainly due to a reduction in non-cash expenses related to stock options granted by the Company, when compared to the same period in the previous year.

Basic loss per share was -$0.04 for Q2 2025, compared to a basic loss per share of -$0.05 for Q2 2024.

Production Costs[14]

The average cost per ton decreased by 24% in Q2 2025, primarily due to renegotiated supplier contracts, a reduction in operational headcount, and an 9.2% devaluation of the Brazilian Real, alongside a lower proportion of specialty product orders compared to regular products.

Production costs include all direct costs from mining, processing, and the addition of other nutrients to the Product, such as sulphur and boron. It also includes the logistics costs from the mine to the plant and related salaries.

Verde’s continued focus on cost reduction has allowed the company to maintain existing gross margins despite inflationary pressures, customer credit restrictions, and commodity price fluctuations.

Loan Renegotiation

Verde’s debt restructuring — renegotiated with over 97.5% of its creditors — has significantly reduced its short-term obligations. Among total debt, 92.2% were classified as debt owed to adherent creditors and 5.3% as debt owed to non-adherent creditors.

Although debt owed to non-adherent creditors only comprised a small portion of total debt, the Company experienced a significant reduction in the principal owed to this group (75%), equating to approximately R$7.0 million. The interest rate on this category of debt was also significantly reduced to the Taxa Referencial (TR)[15], currently around 1.36% per year. The grace period and repayment term for debt associated with non-adherent creditors are 19 months on both principal and interest (starting from the court-approved debt renegotiation date of April 2025) and 108 months following the grace period, respectively.

The terms applied to the majority (92.2%) of total debt, owed to adherent creditors, are as follows:

- Grace Period: 18 months on both principal and interest, starting from October 2024;[16]

- Repayment Term: Debt to be amortized over 108 months; and

- Principal Repayment Schedule:

- 10% repaid between months 19 and 54;

- 30% between months 55 and 90; and

- 60% between months 91 and 126.

Interest accrues at Certificado de Depósito Interbancário (“CDI”) + 1.25% for three years and increases to CDI + 2.5% thereafter.

The current split of short-term and long-term loans are as follows:

| Loans

CAD $’000 |

Before renegotiation |

After renegotiation |

| Short-term loans |

37,953 |

227 |

| Long-term loans |

9,371 |

45,195 |

| Total |

47,324 |

45,472 |

The Company is now well positioned to weather ongoing macroeconomic volatility while preparing for a potential rebound in sector activity in H2 2025.13

Financial Position

As of June 30, 2025, Verde held cash of $2.4 million, compared to $2.7 million at the end of Q2 2024. Short-term receivables recorded during the quarter were $8.2 million. The total cash and short-term receivables were $10.6 million in Q2 2025.

Outlook

During H2 2025, the Company will focus on:

- Product portfolio expansion via the development of new, customer-driven fertilizer formulations, which have been designed to address evolving agronomic needs while enhancing crop productivity and sustainability. By broadening our suite of multi-nutrient solutions, we aim to deepen relationships with existing growers and distributors and, importantly, attract a wider base of new customers.

- Strengthening our commercial reach — leveraging the recently expanded sales team, targeted marketing initiatives, and data-driven agronomic support — to accelerate market penetration in core regions near our production hub.

- Advancing research on the Company’s carbon project (Enhanced Rock Weathering), reinforcing our long-term vision of delivering agronomic performance alongside measurable environmental benefits.

Q2 Results Conference Call

The Company will host a conference call to discuss Q2 2025 results and provide an update. Subscribe using the link below and receive the conference details by email.

The Company’s financial statements and related notes for the period ended June 30, 2025 are available to the public on SEDAR+ at www.sedarplus.ca and the Company’s website at www.investor.verde.ag/.

About Verde AgriTech

Verde AgriTech is dedicated to advancing sustainable agriculture through the innovation of specialty multi-nutrient potassium fertilizers. Our mission is to increase agricultural productivity, enhance soil health, and significantly contribute to environmental sustainability. Utilizing our unique position in Brazil, we harness proprietary technologies to develop solutions that not only meet the immediate needs of farmers but also address global challenges such as food security and climate change. Our commitment to carbon capture and the production of eco-friendly fertilizers underscores our vision for a future where agriculture contributes positively to the health of our planet.

For more information on how we are leading the way towards sustainable agriculture and climate change mitigation in Brazil, visit our website at https://verde.ag/en/home/.

For additional information please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

Cautionary Language and Forward-Looking Statements

All Mineral Reserve and Mineral Resources estimates reported by the Company were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards (May 10, 2014). These standards differ significantly from the requirements of the U.S. Securities and Exchange Commission. Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

This document contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. This information and these statements, referred to herein as “forward-looking statements” are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to:

- the estimated amount and grade of Mineral Resources and Mineral Reserves;

- the estimated amount of CO2 removal potential per ton of rock;

- the PFS representing a viable development option for the Project;

- estimates of the capital costs of constructing mine facilities and bringing a mine into production, of sustaining capital and the duration of financing payback periods;

- the estimated amount of future production, both produced and sold;

- timing of disclosure for the PFS and recommendations from the Special Committee;

- the Company’s competitive position in Brazil and demand for potash;

- estimates of operating costs and total costs, net cash flow, net present value and economic returns from an operating mine.

- the expected terms of the debt restructuring;

- the expected financial impact of the debt restructuring to the Company;

- the timeline for court approval of the debt restructuring; and

- the potential arising from the re-assaying of certain core samples.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “envisages”, “assumes”, “intends”, “strategy”, “goals”, “objectives” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

All forward-looking statements are based on Verde’s or its consultants’ current beliefs as well as various assumptions made by them and information currently available to them. The most significant assumptions are set forth above, but generally these assumptions include, but are not limited to:

- the presence of and continuity of resources and reserves at the Project at estimated grades;

- the estimation of CO2 removal based on the chemical and mineralogical composition of assumed resources and reserves;

- the geotechnical and metallurgical characteristics of rock conforming to sampled results; including the quantities of water and the quality of the water that must be diverted or treated during mining operations;

- the capacities and durability of various machinery and equipment;

- the availability of personnel, machinery and equipment at estimated prices and within the estimated delivery times;

- currency exchange rates;

- Super Greensand® and K Forte® sales prices, market size and exchange rate assumed;

- appropriate discount rates applied to the cash flows in the economic analysis;

- tax rates and royalty rates applicable to the proposed mining operation;

- the availability of acceptable financing under assumed structure and costs;

- anticipated mining losses and dilution;

- reasonable contingency requirements;

- success in realizing proposed operations;

- receipt of permits and other regulatory approvals on acceptable terms; and

- the fulfilment of environmental assessment commitments and arrangements with local

Although management considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. Many forward-looking statements are made assuming the correctness of other forward looking statements, such as statements of net present value and internal rates of return, which are based on most of the other forward-looking statements and assumptions herein. The cost information is also prepared using current values, but the time for incurring the costs will be in the future and it is assumed costs will remain stable over the relevant period.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections, and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements, as a number of important factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions, and intentions expressed in such forward-looking statements. These risk factors may be generally stated as the risk that the assumptions and estimates expressed above do not occur as forecast, but specifically include, without limitation: risks related to the court approval process for the debt restructuring; risks relating to variations in the mineral content within the material identified as Mineral Resources and Mineral Reserves from that predicted; variations in rates of recovery and extraction; the geotechnical characteristics of the rock mined or through which infrastructure is built differing from that predicted, the quantity of water that will need to be diverted or treated during mining operations being different from what is expected to be encountered during mining operations or post-closure, or the rate of flow of the water being different; developments in world metals markets; risks relating to fluctuations in the Brazilian Real relative to the Canadian dollar; increases in the estimated capital and operating costs or unanticipated costs; difficulties attracting the necessary workforce; increases in financing costs or adverse changes to the terms of available financing, if any; tax rates or royalties being greater than assumed; changes in development or mining plans due to changes in logistical, technical, or other factors; changes in project parameters as plans continue to be refined; risks relating to receipt of regulatory approvals; delays in stakeholder negotiations; changes in regulations applying to the development, operation, and closure of mining operations from what currently exists; the effects of competition in the markets in which Verde operates; operational and infrastructure risks and the additional risks described in Verde’s Annual Information Form filed with SEDAR+ in Canada (available at www.sedarplus.com) for the year ended December 31, 2024. Verde cautions that the foregoing list of factors that may affect future results is not exhaustive.

When relying on our forward-looking statements to make decisions with respect to Verde, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Verde does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by Verde or on our behalf, except as required by law.

[1] The carbon capture potential of Verde’s products, through Enhanced Rock Weathering (ERW), is 120 kg CO2e per ton of K Forte®. For further information, see “Verde’s Products Remove Carbon Dioxide From the Air”.

[2] K Forte® is a fertilizer produced in Brazil using national raw materials. Its production process has low energy consumption from renewable sources and, consequently, a low environmental and GHG emissions footprint. Whereas the high carbon footprint of KCl results from a complex production process, involving extraction, concentration, and granulation of KCl, in addition to the long transportation distances to Brazil, given that 95% of the KCl consumed in the country is imported. 12Mt of K Forte® is equivalent to 2Mt of KCl in K2O content. Emissions avoided are calculated as the difference between the weighted average emissions for KCl suppliers to produce, deliver, and apply their product in each customer’s city and the emissions determined according to K Forte®’s Life Cycle Assessment for its production, delivery, and application in each customer’s city.

[3] From 2018 to Q2 2025, the Company has sold 2.3 million tons of Product, which can potentially remove up to 251,734 tons of CO2. Additionally, this amount of Product could potentially avoid up to 63,829 tons of CO2 emissions.

[4] Verde’s Product is a salinity and chloride-free replacement for KCl fertilizers. Potassium chloride is composed of approximately 46% of chloride, which can have biocidal effects when excessively applied to soils. According to Heide Hermary (Effects of some synthetic fertilizers on the soil ecosystem, 2007), applying 1 pound of potassium chloride to the soil is equivalent to applying 1 gallon of Clorox bleach, with regard to killing soil microorganisms. Soil microorganisms play a crucial role in agriculture by capturing and storing carbon in the soil, making a significant contribution to the global fight against climate change.

[5] 1 ton of Product (10% K2O) has 0.1 tons of K2O, which is equivalent to 0.17 tons of potassium chloride (60% K2O), containing 0.08 tons of chloride.

[6] Source: Lack of Credit Challenges Brazil’s Agricultural Inputs Market, AgriBrasilis, July 23, 2025. Available at: https://agribrasilis.com/2025/07/23/credit-access-agricultural-inputs/.

[7] Source: Acerto Limited.

[8] Source: Lavoro Restructures $460 Million Debt to Secure Crop Input Supply, The AgriBiz. Available at: https://www.theagribiz.com/international/lavoro-restructures-460-million-debt-to-secure-crop-input-supply/.

[9] As of June 30, 2025. Source: Brazilian Central Bank

[10] As of June 30, 2025. Source: Brazilian Central Bank

[11] Source: J.P. Morgan, COPOM Preview, Latin America Emerging Markets Research, August 5, 2025.

[12] As of June 30, 2025. Source: Brazilian Central Bank

[13] “US sanctions could cause chaos on Latam farms run on Russian fertilizers,” Reuters, July 21, 2025. Available at: https://www.reuters.com/world/americas/us-sanctions-could-cause-chaos-latam-farms-run-russian-fertilizers-2025-07-21

[14] Verde’s production costs and sales price are based on the following assumptions:

- Micronutrients added to the product increase its production cost, rendering K Forte® less expensive to produce.

- Production costs vary based on packaging type, with bulk being less expensive than Jumbo Bags.

- Plant 1 produces K Forte® Jumbo Bags and Low-Carbon Specialty Fertilizer Products, while Plant 2 exclusively produces K Forte® Bulk. Therefore, Plant 2’s production costs are lower than Plant 1’s costs.

[15] Reference rate.

[16] With the exception of a symbolic monthly payment of R$100,000 from May 2025 onwards.

Singapore. Verde AgriTech Ltd (TSX: “NPK”) (“Verde” or the “Company”) announces its financial results for the full year ended December 31, 2024 (“FY 2024”) and the fourth quarter 2024 (“Q4 2024), as audited by RSM.

“Looking back, 2023/24 will undoubtedly be remembered as one of the most challenging periods for Brazilian agriculture in this century. A historic number of farmers and input suppliers faced insolvency, overwhelmed by an unprecedented combination of economic and climatic challenges. The effects of this crisis have already spilled into the first half of 2025, continuing to present significant obstacles for the sector. Navigating through this ‘perfect storm’ required exceptional resilience, and those who persevered have demonstrated remarkable strength and adaptability,” stated Cristiano Veloso, Founder and CEO of Verde Agritech.

“For H2 2025 deliveries, we are seeing strong market optimism driven not only by favorable geopolitical factors but also by improved commodity prices, better climatic conditions, and a recovering global supply chain. Verde is strategically positioned to capitalize on the resurgence of Brazil’s agricultural profitability, which is bolstered by these favorable dynamics. Our order books for the second half of the year reflect significant growth to date, marking a notable improvement compared to 2024,” Mr. Veloso added.

As previously announced on October 2, 2024[1], the Company successfully renegotiated its loans with its two largest creditors, covering 73% of its total outstanding debt. This deal, which extends the repayment term to 120 months and suspends principal payments for 18 months, is projected to generate R$115 million in cash savings over the next 24 months. Interest payments will also be suspended during this period, with a significantly reduced interest rate to follow. The agreement has proven to be a critical step in strengthening Verde’s financial position.

Further progress was reported on November 11, 2024[2] when Verde secured an agreement with creditors representing over 92% of the company’s total debt, leading to improved financial terms for the company. Non-adherent creditors will face a 75% reduction in their outstanding balance, with the remaining debt subject to a much lower interest rate of 0.82% per year. The agreement, which is pending court approval, is expected to result in the cancellation of R$8.5 million in debt.

Additionally, Verde successfully renegotiated additional loans. This comprehensive effort means that more than 99.8% of the Company’s outstanding debts have now been renegotiated, significantly reducing its short-term obligations for 2025 to R$1.5 million.

“It has been over four months since we entered the final stage of the renegotiation process, and we are now awaiting the homologation of the agreement by the court. We remain confident that the approval is imminent, and its recognition will be finalized soon. This will be a significant milestone for the Company,” stated Cristiano Veloso, Founder and CEO of Verde Agritech.

Fourth Quarter and Full Year 2024 Highlights

Operational and Financial Highlights

- Verde’s sales volume amounted to 319,000 tons; a 25% reduction compared to 2023. Additionally, revenue had a 43% decrease compared to the previous year, with $21.6 million in FY 2024. In 2025, after only 79 days, Verde already has orders and delivered products representing over 60% of all products delivered in 2024.

- Cash held by the Company decreased by $3.5 million, from $6.9 million in FY 2023 to $3.4 million in FY 2024. Additionally, the Company has $6.9 million in short-term receivables. The total Cash and short-term receivables were $10.3 million in FY 2024.

- EBITDA before non-cash events was -$2.5 million in FY 2024, compared to $2.0 million in FY 2023.

- The Company reported a net loss of -$12.6 million in FY 2024, compared to a net loss of -$6.0 million in FY 2023.

- Sales and General Administrative Expenses decreased by $1.6 million, from $11.7 million in 2023 to $10.1 million.

Other Highlights

- The Product sold in FY 2024 has the potential to capture up to 25,429 tons of carbon dioxide (“CO2”) from the atmosphere via Enhanced Rock Weathering (“ERW”).[3] The potential net amount of carbon captured is estimated at 16,255 tons of CO2. In addition to the carbon removal potential, Verde’s FY 2024 sales avoided the emissions of 9,116 tons of CO2e, by substituting potassium chloride (“KCl”) fertilizers.[4]

- Combining the potential carbon removal and carbon emissions avoided by the use our Product since the start of production in 2018, Verde’s total impact stands at 297,782 tons of CO2.[5]

- 16,776 tons of chloride have been prevented from being applied into soils FY 2024, by farmers who used the Product in lieu of KCl fertilizers.[6] A total of 155,935 tons of chloride has been prevented from being applied into soil by Verde’s customers since the Company started production.[7]

2024 Year in Review

Agricultural Market

In 2024, many agricultural businesses have been confronted with severe liquidity challenges, prompting an increasing number to seek insolvency protection as part of efforts to restructure their debts. The scarcity of accessible credit has not only hindered investments but also disrupted the broader agribusiness ecosystem, impacting suppliers and financial institutions alike. This crisis stems from the high commodity prices at the beginning of 2022, which led farmers to expect that both commodity and input prices would remain elevated. However, while input costs stayed high for longer, commodity prices began to drop. As a result, farmers who purchased fertilizers at elevated prices, expecting high commodity prices, were left struggling with mismatched financial conditions. Consequently, 2024 continues to be marked by significant financial strain, as businesses work to manage the debt burdens accumulated in recent years.

Furthermore, economic instability in Brazil further intensified challenges in the agricultural market. High interest rates and fluctuating exchange rates created additional financial strain for farmers, limiting their access to working capital. Amid the record rise in farmer insolvencies, several distributors experienced financial distress, with some seeking credit protection. In response, Verde adopted a cautious approach to farmer financing, prioritizing financial stability over short-term sales growth. The Company chose to limit credit offerings, forgoing potential sales to minimize exposure to default risks, which inevitably had an impact on overall sales performance.

Global market competition

The Brazilian agricultural sector faced significant challenges in 2024, driven by evolving macroeconomic factors. The Selic interest rate, which stood at 12.25% by the end of the year, restricted farmers’ access to credit, limiting their ability to invest in productivity-enhancing input. Projections suggest a gradual increase in the Selic rate in 2025, with estimates indicating 15.00% by the end of 2025, followed by a potential decrease to 12.50% by 2026. Annual inflation forecasts for 2025 and 2026 stand at 5.50% and 4.20%, respectively, which may provide some relief as economic conditions stabilize.[8]

In 2024, Verde’s average cost of debt was 16.2% per annum, reflecting the high-interest environment that has become a defining characteristic of the current economic landscape. Brazilian corporations, particularly those in the agricultural sector, faced significant financial constraints and limited access to working capital, which further hampered their ability to invest in productivity and input purchases. Compared to international players, Verde’s capacity to offer financing with longer tenors is considerably limited, putting the company at a disadvantage in terms of competitive financing options for its customers. Unlike many of its competitors, Verde does not have the ability to shift a significant portion of its debt to US dollar-denominated liabilities at attractive interest rates, further amplifying the impact of local interest rates on its financial flexibility.

Amid these challenging market conditions, Brazilian farmers faced tight working capital during the critical period for purchasing inputs like fertilizers for the upcoming planting season. In response, many farmers sought suppliers offering the most favorable payment terms and interest rates, opting to defer payments until after the harvest, typically between 9 to 12 months later. While this approach is common in the agricultural sector, it increases the risk of non-payment for suppliers, including fertilizer companies, reflecting the heightened financial pressures within the industry.

Currency exchange rate

Canadian dollar valuated by 6.2% versus Brazilian Real in FY 2024 compared to FY 2023[9].

Q4 and FY 2024 Results Conference Call

The Company will host a conference call to discuss Q4 and FY 2024 results and provide an update. Subscribe using the link below and receive the conference details by email.

The questions must be submitted in advance through the following link before the conference call: https://bit.ly/Q4_andFY2024_Questions

The Company’s full year and fourth quarter financial statements and related notes for the period ended December 31, 2024 are available to the public on SEDAR at www.sedar.com and the Company’s website at www.investor.verde.ag/.

Results of Operations

The following table provides information about three and twelve months ended December 31, 2024 as compared to the three and twelve months ended December 31, 2023. All amounts in CAD $’000.

| All amounts in CAD $’000 |

3 months ended

Dec 31, 2024 |

3 months ended

Dec 31, 2023 |

12 months ended

Dec 31, 2024 |

12 months ended

Dec 31, 2023 |

| Tons sold (‘000) |

48 |

104 |

319 |

428 |

| Average revenue per ton sold $ |

60 |

68 |

68 |

89 |

| Average production cost per ton sold $ |

(21) |

(21) |

(20) |

(23) |

| Average gross profit per ton sold $ |

39 |

47 |

48 |

66 |

| Average gross margin |

65% |

68% |

71% |

74% |

| |

|

|

|

|

| Revenue |

2,888 |

7,058 |

21,597 |

37,863 |

| Production costs |

(986) |

(2,230) |

(6,302) |

(9,689) |

| Gross Profit |

1,902 |

4,828 |

15,295 |

28,174 |

| Gross Margin |

65% |

68% |

71% |

74% |

| Sales and marketing expenses |

(842) |

(996) |

(3,686) |

(4,022) |

| Product delivery freight expenses |

(938) |

(3,001) |

(7,705) |

(14,510) |

| General and administrative expenses |

(1,947) |

(2,527) |

(6,432) |

(7,666) |

| EBITDA (1) |

(1,825) |

(1,696) |

(2,528) |

1,976 |

| Share Based, Equity and Bonus Payments (Non-Cash Event) (2) |

13 |

(304) |

(2,133) |

(449) |

| Depreciation and Amortization (3) |

(753) |

(640) |

(3,232) |

(3,716) |

| Operating (Loss) / Profit after non-cash events |

(2,565) |

(2,640) |

(7,893) |

(2,189) |

| Interest Income/Expense (4) |

(262) |

(2,795) |

(4,634) |

(6,381) |

| Net (Loss) / Profit before tax |

(2,827) |

(5,435) |

(12,527) |

(8,570) |

| Income tax (5) |

(4) |

2,787 |

(31) |

2,591 |

| Net (Loss) / Profit |

(2,831) |

(2,648) |

(12,558) |

(5,979) |

(1) – Non GAAP measure

(2) – Included in General and Administrative expenses in financial statements

(3) – Included in General and Administrative expenses and Cost of Sales in financial statements

(4) – Please see Summary of Interest-Bearing Loans and Borrowings notes

(5) – Please see Income Tax notes

External Factors

Revenue and costs are affected by external factors including changes in the exchange rates between the C$ and R$ along with fluctuations in potassium chloride spot CFR Brazil, agricultural commodities prices, interest rates, among other factors. For further details, please refer to the 2024 Year in Review section (page 3).

Financial and operating results

In FY 2024, revenue from sales fell by 43%, accompanied by a 23% reduction in the average revenue per ton. Excluding freight expenses (FOB price), the average revenue per ton decreased by 20%. This decline in average revenue per ton was primarily attributed to a decrease in potassium chloride prices, the provision of additional discounts by the Company to strategic customers to increase market adoption, and a shift in the product mix due to farmers limited working capital. With many farmers facing restricted cash flows, there has been a noticeable shift towards opting for lower-value-added products. Despite these challenges, Verde managed to increase sales of premium products, with Low-Carbon Specialty Fertilizer Products accounting for 13% of total sales in 2024, up from 7% in 2023. However, the share of sales in big bags declined from 20% in FY 2023 to 13% in FY 2024, negatively impacting the average revenue per ton.

The decline in sales price per ton and volume were the key drivers of the Company’s significantly lower results compared to the previous year. Additionally, the Company continues to maintain a high level of Expected Credit Losses (“ECL”), which further impacted EBITDA negatively. The Company is actively negotiating with these clients, and if successful, the provision will be reversed.

The Company generated a net loss of -$12.6 million in FY 2024, compared to a net loss of -$6.0 million in FY 2023.

Basic loss per share was -$0.24 for FY 2024, compared to a basic loss per share of -$0.11 for FY 2023.

Production costs

The average cost per ton fell by 13% in FY 2024, driven by fluctuations in the Brazilian real and a shift towards greater utilization of Plant 2, which operates at a lower cost than Plant 1 due to enhanced operational efficiency. Sales from Plant 2 accounted for 76% of total sales in 2024, further contributing to the reduction in average production costs per ton.

Production costs include all direct costs from mining, processing, and the addition of other nutrients to the Product, such as Sulphur and Boron. It also includes the logistics costs from the mine to the plant and related salaries.

Verde’s production costs and sales price are based on the following assumptions:

- Micronutrients added to the product increase its production cost, rendering K Forte® less expensive to produce.

- Production costs vary based on packaging type, with bulk being less expensive than Jumbo Bags.

- Plant 1 produces K Forte® Jumbo Bags and Low-Carbon Specialty Fertilizer Products, while Plant 2 exclusively produces K Forte® Bulk. Therefore, Plant 2’s production costs are lower than Plant 1’s costs.

Sales, General and Administrative Expenses:

SG&A represents a non-operating segment that includes corporate and administrative functions, essential for supporting the Company’s operating segments.

Sales Expenses

| CAD $’000 |

3 months ended |

3 months ended |

12 months ended |

12 months ended |

| Dec 31, 2024 |

Dec 31, 2023 |

Dec 31, 2024 |

Dec 31, 2023 |

| Sales and marketing expenses |

(740) |

(923) |

(3,246) |

(3,912) |

| Fees paid to independent sales agents |

(102) |

(73) |

(440) |

(110) |

| Total |

(842) |

(996) |

(3,686) |

(4,022) |

Sales and marketing expenses cover salaries for employees, car rentals, domestic travel in Brazil, hotel accommodations, and Product promotion at marketing events.