BELO HORIZONTE, BRAZIL, June 30, 2021 – Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) held its Annual General Meeting (“AGM”) of shareholders on Wednesday, June 30, 2021, in Belo Horizonte, Brazil, and is pleased to announce that its shareholders approved all items put before them.

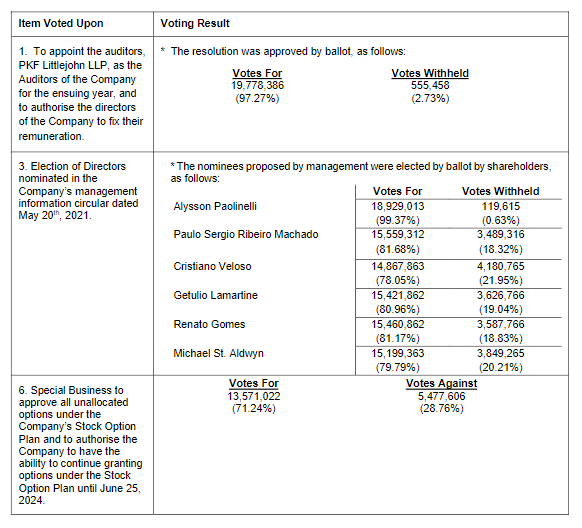

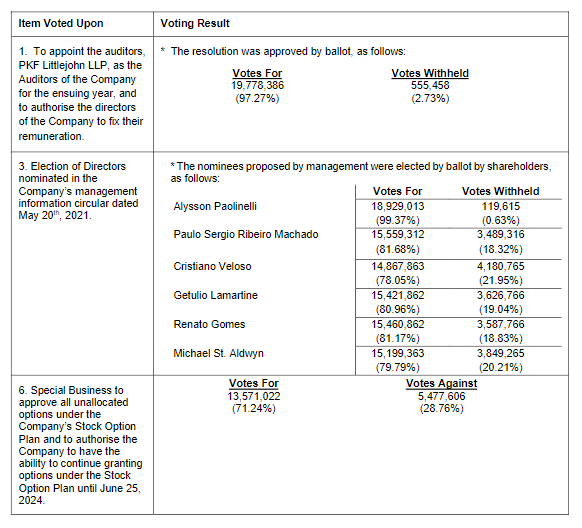

The director nominees were elected as directors of the Company. Shareholders adopted the Directors’ Report, the Audited Statement of Accounts and the Auditors’ Report for the year ended December 31, 2020 and appointed PKF Littlejohn LLP as auditors of the Company for the ensuing year. In addition, shareholders approved the Company’s stock option plan, as it may be amended from time to time, which approval shall remain effective until June 30, 2024. The results were as follows:

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil’s largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President, Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

www.investor.verde.ag | www.verde.ag | www.supergreensand.com

Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to update shareholders on the procedures for its upcoming annual general meeting (the “Meeting”) of Verde’s shareholders, scheduled to take place on June 30, 2021 at 3:00 p.m. (EDT).

In light of concerns about COVID-19, the notice calling the Meeting issued on May 20, 2021 (the “Notice”) indicated that it would be “closed”, without the ability for registered shareholders and duly appointed proxyholders to physically attend the Meeting unless the local rules at the time and place of the Meeting permitted admission of additional persons.

The Notice states: “unless a change in the rules allows a wider attendance (which will be communicated to shareholders) the Meeting will be a closed event”

Current COVID-19 restrictions on gatherings in the City of Belo Horizonte, the location of the Meeting, currently permit physical gatherings subject to certain density limitations. As such, and in accordance with the Notice and the latest local health regulations, the Company advises shareholders that in-person Meeting attendance will now be permitted. Any shareholder or duly appointed proxyholder that attends the Meeting in person will be required to comply with the local restrictions, e.g. social distancing; wearing a mask or other appropriate face covering at all times, among others.

Although the latest restrictions permit limited public gathering, the COVID-19 crisis in Brazil continues to intensify and could result in the implementation of further government restrictions on gatherings. The Company will notify shareholders in the event further restrictions are implemented prior to the Meeting.

GIVEN THE SERIOUSNESS OF THE COVID-19 SITUATION IN BRASIL, SHAREHOLDERS ARE STRONGLY ENCOURAGED NOT TO ATTEND THE MEETING AND TO VOTE BY WAY OF PROXY IN ADVANCE OF THE MEETING.

Commenting, President & CEO, Cristiano Veloso cautioned: “From its onset, we at Verde have taken this pandemic very seriously. To date, we are relieved to say that not a single Verde employee or contractor was among the over 500 thousand hapless Brazilian victims of COVID-19. It is with the same care and attention to health regulation and expert recommendations that I emphasize: in presence attendance at our Meeting is not advisable, for the wellbeing of Verde’s team – some of whom need to be physically in our offices – and of the shareholders – who can all adequately and safely attend remotely.”

Registered shareholders or duly appointed proxyholders who intend to attend the Meeting in person are asked to notify the Company or its transfer agent, TSX Trust Company, in advance of the Meeting, and in any event not less than 24 hours prior to the Meeting, of their intention to attend, to allow the Company time to ensure compliance with local restrictions on gatherings. Registered shareholders and duly appointed proxyholders can provide notification by sending an email to investor@verde.ag or tsxtrustclientsupport@tmx.com.

In order to ensure that any questions shareholders may have regarding the business of the Meeting are received in time to be considered at the Meeting, registered shareholders and duly appointed proxyholders are encourage to send their questions in advance of the meeting through the following link: .

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil’s largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

www.investor.verde.ag | www.supergreensand.com | www.verde.ag

Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to announce the launch of N Keeper®, a proprietary processing technology for glauconitic siltstone that alters its physical-chemical properties to enable ammonia retention for use as a calibrated additive in Nitrogen fertilizers. This combination is responsible for the reduction of Nitrogen volatilization loss, allowing more agronomic efficiency for farmers and contributing to the reduction of the global warming impacts caused by Nitrogen fertilizers manufacturing and application.

Nitrogen Fertilizers Impacts

Nitrogen is part of the NPK triad (Nitrogen, Phosphorus and Potassium) that make up the vital macronutrients for plants. The main source of Nitrogen in Brazilian agriculture is urea, mainly due to its low cost, when compared to other sources.

Traditionally, the production of synthetic Nitrogen fertilizers is a significant source of greenhouse gas (“GHG”) emissions. The GHG are generated from the fossil fuel mining and transportation, the ammonia synthesis and its conversion into various Nitrogen fertilizer products.[1] Moreover, the application of synthetic Nitrogen fertilizers is recognized as the most important factor contributing to direct nitrous oxide (“N2O”) emissions from agricultural soils.[2],[3] Studies report that up to 75% of the total GHG emission in crop production stemmed from the use of Nitrogen fertilizers.[4] This finding is particularly relevant because N2O is a potent GHG, with a 298 higher global warming potential over a 100-year timeframe than carbon dioxide (“CO2”).[5]

Despite the use of urea as the most common Nitrogen source in agriculture, it has low use efficiency under field conditions due to its high susceptibility to losses, mostly caused by the ammonia (“NH3”) volatilization[6].

Verde Introduces N Keeper®

Verde observed an opportunity that led to the development of a technology with the purpose of mitigating reactions and loss processes, thus increasing the agronomic efficiency for the use of urea in agricultural systems and optimizing Nitrogen fertilization: N Keeper®.

The conception of the N Keeper® technology came from studies carried out by the Company, scientifically determining the most efficient outcome. An independent research concluded that the use of Verde’s multinutrient potassium fertilizer, marketed and sold in Brazil under the K Forte® brand and internationally as Super Greensand® (the “Product”), processed with the N Keeper® technology, showed a potential to reduce relative ammonia volatilization between 10% to 27%, depending on the proportion of Product employed, when compared to conventional regular use of urea without any of it.

That is possible due to the proprietary processing technology of the material, which is carried out in Verde’s facilities and allows the enhancement of its feedstock’s natural characteristics. N Keeper® accentuates the negative correlations in the glauconite grains, identified by electron micro spread dispersive energy spectrometer in an electronic microprobe, indicating cationic substitutions giving to the mineral the characteristics of an anion. These unbalanced anions allow cationic exchanges between the potassium present in interlayers of glauconite with ammonium (NH4+) ions present in the soil. Therefore, N Keeper® provides a high capacity of ammonia retention, leading to the reduction of Nitrogen volatilization loss.

“By drastically reducing the volatilized Nitrogen from urea, N Keeper® guarantees an increase in the efficiency of crop fertilization. As importantly, with low environmental impact and low costs for farmers, N Keeper® represents an important advance of agricultural technologies in the fight against climate change and thereby fulfilling Verde’s purpose of improving both the health of people and the Planet”, commented Cristiano Veloso, Verde’s Founder and CEO.

Verde has filed for patent protection for the N Keeper® technology. As a result of its research and development focus, the Company has already filed seven patents.

Next Steps

When Verde’s Products are added to the soil along with other sources of Nitrogen or even before the nutrient’s application, the N Keeper® technology is activated. Thus, both the Company’s customers and the environment can already benefit from the improvements enabled by the technology.

For Plant 2, the Company will be able to add nitrogen to BAKS®, further increasing the benefits for the N Keeper® technology.

Q&A Event:

The Company will host a Q&A session on Wednesday, June 09, 2021 in order to provide further details about the N Keeper® technology. Subscribe using the link below and receive the conference details by email.

| Date: |

Wednesday, June 09, 2021 |

| Time: |

11:00 am Eastern Time (4:00 pm Greenwich Mean Time) |

| Subscription link: |

|

The questions can be submitted in advance through the following link:

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at: http://bit.ly/InvestorsNL-April2021

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil’s largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President, Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

www.investor.verde.ag | www.verde.ag | www.supergreensand.com

[1] Chai, R., Ye, X., Ma, C. et al. Greenhouse gas emissions from synthetic nitrogen manufacture and fertilization for main upland crops in China. Carbon Balance Manage 14, 20 (2019). https://doi.org/10.1186/s13021-019-0133-9.

[2] Bouwman AF. Direct emission of nitrous oxide from agricultural soils. Nutr Cycl Agroecosyst. 1996;46:53–70.

[3] Faradiella Mohd Kusin, Nurul Izzati Mat Akhir, Ferdaus Mohamat-Yusuff, Muhamad Awang. The impact of nitrogen fertilizer use on greenhouse gas emissions in an oil palm plantation associated with land use change. Atmósfera vol.28 no.4 Ciudad de México oct. 2015.

[4] Yahya, N. Urea fertilizer: The global challenges and their impact to our sustainability. Green Energy and Technology (978981). 2018. p. 1-21. http://eprints.utp.edu.my/21254/

[5] IPCC (2007): Climate Change 2007: Synthesis Report. 2007. In: Pachauri R.K., Reisinger A. (eds.): Contribution of Working Groups I, II and III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change. Geneva, Intergovernmental Panel on Climate Change.

[6] Pereira, H. S.; Leão, A. F.; Verginassi, A.; Carneiro, M. A. C. Ammonia volatilization of urea in the out-of-season corn. Revista Brasileira de Ciência do Solo, Viçosa, v. 33, n. 6, p. 1685-1694, 2009.

(All figures are in Canadian dollars, unless stated otherwise. Average exchange rate in Q1 2021: C$1.00 = R$4.33)

Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to announce its financial results for the first quarter, ended on March 31, 2021 (“Q1 2021”).

Q1 2021 Financials

- Sales increased by 63% with 16,558 tonnes sold, compared to 10,170 tonnes sold in the first quarter of 2020 (“Q1 2020”).

- The Company recognised revenue of $831,000, an increase of 63% compared to $510,000 in Q1 2020.

- Brazilian Real (“R$”) revenue increased by 113%, to R$3,599,000 compared to R$1,690,000 in Q1 2020.

- Gross margin increased to 41% in Q1 2021, compared to 35% in Q1 2020.

- In line with the Company’s expectation for Brazil’s rainy season typical of the years’ first quarter, Verde recorded a Q1 2021 net loss of $1,008,000, compared to a net loss of $792,000 in Q1 2020.

- Cash held by the Company increased by 150%, to a total of $2,021,000 in Q1 2021, compared to $806,000 in Q1 2020.

“We are excited with another strong first quarter, especially in light of the triple-digit revenue growth in local currency. We are confident 2021 will be another successful year in our fast-growth trajectory”, said Cristiano Veloso, Verde’s Founder.

2021 Guidance

The Company’s target for 2021 was to achieve R$50 million revenue, as announced in the press release disclosed on November 15, 2020. Verde is pleased to announce a 10% increase in its guidance, totalling a revenue target of R$55 million for 2021, which will represent a 56% growth YoY.

“If we continue to see strong sales in the following months above initial expectations, it is natural that the yearly guidance may be further increased over the next quarterly results”, completed Mr. Veloso.

Selected Annual Financial Information

The following table provides information about three months ended March 31, 2021 as compared to the three months ended March 31, 2020. All amounts in CAD $’000.

| C$’000 |

Q1 2021 |

Q1 2020 |

| Tonnes sold ‘000 |

17 |

10 |

| Revenue per tonne sold $ |

50 |

50 |

| Production cost per tonne sold $ |

(30) |

(32) |

| Gross Profit per tonne sold $ |

20 |

18 |

| Gross Margin |

41% |

35% |

|

|

|

| Revenue |

831 |

510 |

| Production costs |

(490) |

(332) |

| Gross Profit |

341 |

178 |

| Gross Margin |

41% |

35% |

| Sales and product delivery freight expenses |

(531) |

(422) |

| General and administrative expenses |

(697) |

(420) |

| Operating Profit/(Loss) before non-cash events |

(887) |

(664) |

| Share Based Payments (Non-Cash Event) * |

(19) |

(40) |

| Depreciation and Amortisation * |

(5) |

(12) |

| Profit on disposal of plant and equipment * |

9 |

– |

| Operating Profit/(Loss) after non–cash events |

(902) |

(716) |

| Corporation tax** |

(31) |

(18) |

| Interest Income/Expense |

(75) |

(58) |

| Net Profit / (Loss) |

(1,008) |

(792) |

* – Included in General and Administrative expenses in financial statements.

** For further details please refer to Q1 2021 Management’s Discussion and Analysis.

Q1 2021 compared with Q1 2020

For Q1 2021 the Company generated a net loss of $1,008,000, an increase of $216,000 compared to Q1 2020. The loss per share was $0.020, compared to $0.017 for Q1 2020. In line with Brazil’s rainy season typical of the years’ first quarter, sales are lower for Q1 and in 2021 Verde is making more investments than in 2020 in order to continue growing at an accelerated pace while upholding customer satisfaction.

Product Sales

In Q1 2021, the Group sold 16,558 tonnes, an increase of 63% in comparison to Q1 2020. BAKS® accounts for approximately 3.9% of Verde’s sales in Q1 2021, and accounts for 14% of Verde’s total sales orders for 2021 up to March 31, 2021.

Revenue

Revenue from sales for Q1 2021 was $831,000 from the sale of 16,558 tonnes of the Product, at $50 per tonne sold. Average revenue per tonne was consistent with Q1 2020 ($50 per tonne sold). The Product price is based on the current US$ Potassium Chloride price.

Production costs

Production costs include all direct costs from mining, processing, logistics from the mine to the factory and supply chain salaries, which are paid in R$. Production costs for Q1 2021 were $490,000, an increase of $158,000 compared to Q1 2020. Cost per tonne for the quarter was $30 compared to $32 for the same period in 2020. The reduction of 6% was due to the devaluation of the Brazilian Real against the Canadian Dollar in Q1 2021 as compared to Q1 2020.

Sales Expenses

| C$’000 |

Q1 2021 |

Q1 2020 |

| Sales and marketing expenses |

(302) |

(265) |

| Product delivery freight expenses |

(229) |

(157) |

| Total |

(531) |

(422) |

Sales and marketing expenses

Sales and marketing expenses include sales and marketing salaries, the promotion of the Product such as fees paid to sales agents, marketing events, car rentals, travel within Brazil, hotel expenses and Customer Relationship Management (CRM) Software licenses. Expenses increased by $37,000 in Q1 2021 compared to Q1 2020 mainly due to a further expansion of Verde’s sales and marketing team, with professional headcount increased from 29 in Q1 2020 to 43 in Q1 2021. This growth is in line with the Company’s accelerated growth strategy.

Product delivery freight expenses

Product delivery freight expenses were $72,000 higher in Q1 2021 compared to Q1 2020 as the Company has significantly increased the volume sold as CIF (Cost Insurance and Freight), from 3% of total sales in 2020 to 34% in 2021.

General and Administrative Expenses

| C$’000 |

Q1 2021 |

Q1 2020 |

| General administrative expenses |

(478) |

(220) |

| Legal, professional, consultancy and audit costs |

(159) |

(163) |

| IT/Software expenses |

(52) |

(22) |

| Taxes and licenses fees |

(8) |

(15) |

| Total |

(697) |

(420) |

General administrative expenses

These costs include general office expenses, rent, bank fees, insurance, foreign exchange variances and remuneration of the executives and administrative staff in Brazil. The costs have increased by $259,000 in Q1 2021 compared to Q1 2020 as they include an additional 12 administrative employees, with professional headcount increasing from 14 in Q1 2020 to 26 in Q1 2021 to support the Company’s growth and due to incentive compensation.

Legal, professional, consultancy and audit costs

Legal and professional fees include legal, professional, consultancy fees along with accountancy, audit and regulatory costs. Consultancy fees are consultants employed in Brazil, such as accounting services, patent process, lawyer’s fee and regulatory consultants. The costs in Q1 2021 are comparable with Q1 2020.

IT/Software expenses

IT/Software expenses include software licenses such as Microsoft Office and enterprise resource planning (ERP). In Q1 2021 expenses were $52,000, an increase of $30,000 on Q1 2020 due to increased third party computing services provided in Brazil.

Taxes and licences

Taxes and licence expenses include general taxes, product branding and licence costs. In Q1 2021, expenses were $8,000 compared to $15,000 in Q1 2020.

Share Based Payments (Non-Cash Event)

These costs represent the expense associated with stock options granted to employees and directors.

In Q1 2021 expenses were $18,000, compared to $40,000 in Q1 2020. The decrease is a result of less options vesting in the period.

Q1 2021 Results Conference Call

The Company will host a conference call on Thursday, May 20, 2021 at 11:00 am Eastern Time (4:00 pm Greenwich Mean Time), to discuss Q1 2021 results and provide an update. Subscribe using the link below and receive the conference details by email.

The Company’s first quarter financial statements and related notes for the period March 31, 2021

are available to the public on SEDAR at www.sedar.com and the Company’s website at www.investor.verde.ag/.

Technology Launch:

The Company will introduce a new technology to the market on June 02, 2021 and host a Q&A session on June 09, 2021 in order to provide further details about it. Subscribe using the link below and receive the conference details by email.

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at: http://bit.ly/InvestorsNL-April2021

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil’s largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

www.investor.verde.ag | www.supergreensand.com | www.verde.ag

Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to announce that Cristiano Veloso has been appointed Chairman of the Board of Directors (the “Board”) and that Michael St Aldwyn has been appointed Lead Independent Director of the Board.

Mr. Veloso, Verde’s Founder, President and Chief Executive Officer, will serve as the Chairman of the Board. The Board is composed of five independent directors and Mr. Veloso as sole executive director. The position of Chairman had been vacant since December 2013.

“Mr. Veloso has been essential in bringing the Company to its current stage of production and potential expansion, thanks to his vision, competence, and in depth understanding of the agricultural market and mining sector. This was clearly witnessed when Mr Veloso successfully reinvented the Company twice when it faced some of the world’s worst recent crises, both times at a significant financial and personal sacrifice in favour of the Company and its shareholders. Therefore, it stood to reason that all five independent directors would unanimously select Mr. Veloso to serve as Chairman. On a personal note, over my 40 years career, seldom have I witnessed this level of leadership and accomplishment demonstrated by Mr. Veloso when faced with economic adversities.” said Michael St Aldwyn, Lead Independent Director.

Appointment of Lead Independent Director

Michael St Aldwyn was unanimously elected by all other four independent directors to serve as Lead Independent Director. He was selected based on the exceptional breadth of his professional and corporate governance experience, as well as his strong connections in global investment markets and his long success record in Latin America and Brazil. Mr. St Aldwyn has served as a Director on Verde’s Board since 2018.

As Lead Independent Director, Mr. St Aldwyn will assume the duties and responsibilities of that position, appraising the performance of the Board Chair, serving as an intermediary between the Chair, the Board and Verde’s stakeholders. Mr. St. Aldwyn will also oversee the best practices of corporate governance at the corporate and Board level.” I gracefully accept the choice of my fellow independent directors to serve as Lead. I look forward to representing the interests of all stakeholders as our Company moves forward at an ever-accelerating pace”, said Mr. St Aldwyn.

Mr. St Aldwyn worked in Brazil from 1973-1979. Between 1979-1989, he was responsible for Latin American markets when at the New York office of ED&F Man and moving to London from 1989-1994 still with ED&F Man, an agricultural commodities trader with over 7,000 staff spread across 60 countries started in 1783. Mr. St Aldwyn then established his own company, 1994-2010, dedicated to the promotion of hedge funds. He also served as Chairman of the Anglo Brazilian Society from 1996-2002 and as a Director of BlackRock Latin American Investment Trust from 1996-2017. He is currently Chairman of Itacaré Capital Investment Ltd. He is fluent in Portuguese and in 2017 he completed a master’s degree at King’s College London in “Brazil in Global Perspective”.

Mr. Veloso, President and CEO, commented: “On behalf of management and our shareholders, I congratulate the Board on its excellent choice of Mr. St. Aldwyn as Verde’s Lead Independent Director. In this position he will add even further oversight and efficiency to corporate strategy and governance. As for my election as Chairman, it is an honour to continue to serve the Company and its Board in this position. Though it will not carry any added voting power nor remuneration of any sort, I will apply all my competence and best efforts to serve as Chairman and sole member of Verde’s management on its Board.”

Composition of the Board Committees

The Company announces that the Board has updated the composition of the Audit, Compensation, and Corporate Governance and Nominating committees that, in observing the best practices of corporate governance, are solely comprised of independent directors.

The following independent directors have been appointed to the respective Board Committees:

Audit Committee:

- Renato Gomes (Chairman)

- Getúlio Fonseca

- Michael St Aldwyn

Compensation Committee

- Getúlio Fonseca (Chairman)

- Renato Gomes

- Michael St Aldwyn

Corporate Governance and Nominating Committee

- Michael St Aldwyn (Chairman)

- Renato Gomes

- Paulo Sérgio Machado

Composition of the Board of Directors

The Board consists of six members and is committed to applying a robust corporate governance framework, drawing on its collective experience stewarding successful businesses in Brazil and internationally. The Board members are Cristiano Veloso (Chairman), Alysson Paolinelli, Getúlio Fonseca, Michael St Aldwyn, Paulo Sérgio Machado and Renato Gomes.

Cristiano Veloso

Mr. Veloso earned a certificate in Sustainable Business Strategy from Harvard Business School (USA), he holds a Master’s Degree from the University of East Anglia (UK) and a Bachelor of Laws Degree from the Federal University of Minas Gerais (Brazil). Cristiano has nearly two decades of experience and knowledge in the agricultural and mineral sectors. Cristiano leads Verde as an innovative company which seeks to revolutionize global production of food through sustainable technologies.

Alysson Paolinelli

Mr. Paolinelli is the President of the Brazilian Association of Corn Producers (“Abramilho”). Mr. Paolinelli held positions such as the Brazilian Minister of Agriculture, President of the National Confederation of Agriculture, President of Minas Gerais State Bank, Congressman, Secretary of Agriculture for Minas Gerais State, and Professor and Dean of Lavras University. In 2006 he was awarded the World Food Prize. Mr. Paolinelli has been nominated for the 2021 Nobel Peace Prize.

Getúlio Lamartine Fonseca

Mr. Fonseca is a senior economist with over 40 years of government and consulting experience in the Brazilian resource, electrical and power generation sectors. Since 1990, Mr. Fonseca has been employed by GL Consultoria Ltda. as a consultant to the Brazilian resource, electric and power generation industries. In that role, Mr. Fonseca has assisted businesses such as Bank of Montréal, Samarco Mineração S.A., Klabin S.A., Alcoa Inc., KLM Aerocarto B.V., Construtora Norberto Odebrecht S.A., Acesita S.A. and Dow Corning Corporation with major projects in Brazil.

Michael St Aldwyn

Mr. St Aldwyn worked in Brazil from 1973-1979. Between 1979-1989, he was responsible for Latin American markets when at the New York office of ED&F Man and moving to London from 1989-1994 still with ED&F Man, an agricultural commodities trader with over 7,000 staff spread across 60 countries started in 1783. Mr. St Aldwyn then established his own company, 1994-2010, dedicated to the promotion of hedge funds. He also served as Chairman of the Anglo Brazilian Society from 1996-2002 and as a Director of BlackRock Latin American Investment Trust from 1996-2017. He is currently Chairman of Itacaré Capital Investment Ltd. He is fluent in Portuguese and in 2017 he completed a master’s degree at King’s College London in “Brazil in Global Perspective”.

Paulo Sergio Ribeiro Machado

Mr. Machado was a former executive at Vale and has spent his career developing and operating large mining projects. From 1988 to 2002, Mr. Machado was the General Manager of Vale’s Igarapé Bahia Gold Mine, at the time the largest gold producer in Latin America, where he was responsible for implementation, operation and decommissioning. Between 2002 and 2006 Mr. Machado was the Director for all iron ore mines in the central region of Minas Gerais state, overseeing management and operations of mining activities, plants and railway terminals. Mr. Machado was also a director of CEMIG, one of the largest power generators and distributors in Brazil and Subsecretary of Mines and Energy for Minas Gerais state from 2007 to 2014.

Renato Gomes

Mr. Gomes is co-Founder & President of Pix Force, ranked as Brazil’s number one artificial intelligence startup, He is also co-Founder and a Board Director of Graphite Company of the Americas, which is developing a graphite mine and processing plant in Brazil. Mr. Gomes holds a degree in electronics and a law degree both from the Federal University of Minas Gerais (Brazil), a master’s degree from the London School of Economics (U.K.) and a doctorate from Georgetown University (U.S.A.). Mr Gomes is a qualified solicitor in New York, Portugal and Brazil.

Anywhere office policy

Since March 2020, in light of the impending Covid pandemic, all of the Company’s employees that are not directly required for mining and production have been working under an anywhere office policy. The experience has been a success, with average productivity unperturbed by the arrangement and high overall employee satisfaction and engagement. Verde still maintains its physical office, which employees can use at their convenience. Considering this positive experience, the Company has decided to make the shift permanent.

Moreover, with the adoption of the anywhere office policy, the Company has been able to recruit talent from all over Brazil, today already represented by professionals based in over 40 different cities. To maximize its hiring policy, Verde has adopted artificial intelligence based psychological appraisal of candidates to ensure that new professionals are working in the best position for their personality, experience and motivation.

“The long-term commitment to an anywhere office policy has allowed Verde to attract unimaginable talent to the Company and to be competitive when attracting new talent that would usually have favoured other companies. The result was the independent award of Great Place to Work and triple digit growth in the workforce in 2020, both strong endorsements to this work policy. On a personal note, at all levels we can see benefits, in my case, for example, the anywhere policy has allowed me to carry out in day as many video conference calls with customers that it would have taken me a week to meet in person. Declared, President and CEO, Cristiano Veloso.

The anywhere office policy has been implemented across the Company, allowing employees work remotely from anywhere across the globe during the pandemic, but also in a post-Covid scenario.

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

Q4 and FY 2020 Results Conference Call

The Company will host a conference call today, Wednesday, April 7, 2021 at 11:00 pm Eastern Daylight Time (4:00 pm British Summer Time), to discuss Q4 and FY 2020 results and provide an update. Subscribe using the link below and receive the conference details by email.

| Date: |

Wednesday, April 7, 2021 |

| Time: |

11:00 am Eastern Daylight Time (4:00 pm British Summer Time) |

| Subscription link: |

|

The Company’s full year and fourth quarter financial statements and related notes for the period ended December 31, 2020 are available to the public on SEDAR at www.sedar.com and the Company’s website at www.investor.verde.ag/.

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil’s largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

www.investor.verde.ag | www.supergreensand.com