(All figures are in Canadian dollars, unless stated otherwise. Average exchange rate in Q3 2021: C$1.00 = R$4.26)

Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to announce its financial results for the third quarter, ended on September 30, 2021 (“Q3 2021”).

Q3 2021 Financials

- Revenue increased by 169%, to $10,651,000 compared to $3,956,000 in the third quarter of 2020 (“Q3 2020”).

- Revenue in Brazilian Real (“R$”) increased by 206%, to R$45,409,000 compared to R$14,815,000 in Q3 2020.

- Gross margin increased to 77% in Q3 2021, compared to 67% in Q3 2020.

- Operating profit before non-cash events increased by 124%, to $3,665,000 compared to $1,635,000 in Q3 2020.

- Trade and other receivables increased by 141%, to $8,238,000 compared to $3,415,000 in Q3 2020.

- Sales by volume increased by 45%, to 153,674 tonnes sold compared to 105,769 tonnes sold in Q3 2020.

- Net profit increased by 192% in Q3 2021, to $3,183,000, compared to $1,090,000 in Q3 2020.

“Our hard work over the years is yielding consistent growth since production started in 2017. In Q3 2021 the effort was relentless as we sought to meet our heightened target, which was achieved thanks to the high quality and commitment of our team. We will endeavour to maintain an exponential growth expansion for the foreseeable future”, said Cristiano Veloso, Verde’s Founder and CEO.

Subsequent Events

- In October 2021, the Company has secured $3.75 million (R$16 million) in loan agreements to fully cover the capital expenditure for the construction of Plant 2. The first $1.17 million (R$5 million) was released to the Company by Santander. The remaining $2.58 million (R$11 million) was approved in the same month by Santander and Bradesco, to be drawn down according to the project requirements. The total construction cost of Plant 2 is expected to be $5.16 million (R$22 million) with $1.41 million (R$6 million) invested through internally generated cashflow.

“From September onwards, market demand has outstripped Plant 1’s operational capacity. Therefore, after having invested over C$66 million to reach our current rate of production, we are proud to finance the tripling of current capacity based on debt and cashflow alone. Many shareholders have continuously supported Verde over the years – it is therefore gratifying to reciprocate by growing through a shareholder-friendly dilution-free strategy”, declared Mr. Veloso.

2021 Guidance

The Company is pleased to announce another increase in its 2021 guidance. The new target is set at R$110 million of revenue for 2021, which would represent an increase of 120% to the Company’s original guidance of R$50 million. If achieved, this new target will represent a 212% growth Year-on-Year (“YoY”).

Selected Annual Financial Information

The table below summarizes Q3 2021 financial results compared to Q3 2020 and provides information about 2021 and 2020 year-to-date (“YTD”). All amounts in CAD $’000.

| CAD $’000 |

Q3 2021 |

Q3 2020 |

YTD 2021 |

YTD 2020 |

| Tonnes sold ‘000 |

154 |

106 |

266 |

187 |

| Revenue per tonne sold $ |

69 |

37 |

63 |

37 |

| Production cost per tonne sold $ |

(16) |

(12) |

(17) |

(14) |

| Gross Profit per tonne sold $ |

53 |

25 |

47 |

23 |

| Gross Margin |

77% |

67% |

74% |

63% |

|

|

|

|

|

| Revenue |

10,651 |

3,956 |

16,858 |

6,957 |

| Production costs |

(2,452) |

(1,316) |

(4,440) |

(2,602) |

| Gross Profit |

8,199 |

2,640 |

12,418 |

4,355 |

| Gross Margin |

77% |

67% |

74% |

63% |

| Sales and product delivery freight expenses |

(4,022) |

(570) |

(6,789) |

(1,596) |

| General and administrative expenses |

(512) |

(435) |

(1,631) |

(1,203) |

| Operating Profit before non-cash events |

3,665 |

1,635 |

3,998 |

1,556 |

| Share Based and Bonus Payments (Non-Cash Event) (1) |

(13) |

(339) |

(1,528) |

(407) |

| Depreciation and Amortisation |

(20) |

(3) |

(35) |

(18) |

| Profit on disposal of plant and equipment |

– |

(18) |

9 |

(18) |

| Operating Profit after non–cash events |

3,632 |

1,275 |

2,444 |

1,113 |

| Income tax |

(352) |

(136) |

(571) |

(252) |

| Interest Income/Expense |

(98) |

(49) |

(229) |

(119) |

| Net Profit |

3,182 |

1,090 |

1,644 |

742 |

(1) – Included in General and Administrative expenses in financial statements.

Q3 2021 compared with Q3 2020

For Q3 2021 the Company generated a net profit of $3,182,000, an increase of $2,093,000 compared to Q3 2020. The earnings per share was $0.06, compared to $0.02 for Q3 2020.

Product Sales

In Q3 2021, the Company sold 153,674 tonnes, an increase of 45% in comparison to Q3 2020. BAKS® accounted for approximately 10% of Verde’s sales in Q3 2021.

Revenue

Revenue from sales for Q3 2021 was $10,651,000 from the sale of 153,674 tonnes of the Product, at $69 per tonne sold. Despite the 14% Brazilian Real devaluation against the Canadian Dollar, revenue per tonne was higher than Q3 2020 ($37 per tonne sold) mainly due to three factors:

- Product volume sold as CIF (Cost Insurance and Freight) increased from 14% of total sales in Q3 2020 to 50% in Q3 2021.

- Potassium Chloride CIF (Minas Gerais) price increased from US$290-US$310 per tonne in Q3 2020 to US$515-790 per tonne in Q3 2021 (as reported by Acerto Limited, a market intelligence firm).

- BAKS has a higher sales price per tonne than the Product, it was launched in Q4 2020 and in Q3 2021 it accounted for 10.5% of the total volume sold.

Production costs

Production costs in R$ include all direct costs from mining, processing, and the addition of the other nutrients such as Sulfur and Boron, the logistics from the mine to the factory and related salaries. Production costs for Q3 2021 were $2,452,000, an increase of $1,136,000 compared to Q3 2020. Cost per tonne for the quarter was $16 compared to $12 for the same period in 2020. This increase was due in large part to higher fuel prices, which increased 80% in Q3 2021 compared to Q3 2020, and due to the production of BAKS, which has a higher cost per tonne because its feedstock includes other nutrients that Verde purchases from third parties.

Sales Expenses

| CAD $’000 |

Q3 2021 |

Q3 2020 |

YTD 2021 |

YTD 2020 |

| Sales and marketing expenses |

(601) |

(294) |

(1,241) |

(796) |

| Fees paid to independent sales agents |

(188) |

(12) |

(260) |

(145) |

| Product delivery freight expenses |

(3,233) |

(264) |

(5,288) |

(655) |

| Total |

(4,022) |

(570) |

(6,789) |

(1,596) |

Sales and marketing expenses

Sales and marketing expenses include employees’ salaries, car rentals, travel within Brazil, hotel expenses, customer relationship management (CRM) software licenses, and the promotion of the Product in marketing events. Expenses increased by $483,000 in Q3 2021 compared to Q3 2020 mainly due to a further expansion of Verde’s sales and marketing team, with professional headcount increasing from 32 in Q3 2020 to 57 in Q3 2021. This increase is in line with the Company’s accelerated growth strategy. The Company’s sales and marketing team had 50 employees in Q2 2021.

Fees paid to independent sales agents

As part of Verde’s marketing and sales strategy, the Company pays out commissions to its independent sales agents. Fees paid to sales independent agents increased by $176,000 in Q3 2021 compared to Q3 2020. This was mainly due to an overestimated provision of $80,000 for Q1 and Q2 2020, which left a surplus that was therefore deducted from the Q3 2020 costs. Taking into account the surplus, the expenses increased by $96,000 for Q3 2021, due to increased sales success.

Product delivery freight expenses

Product delivery freight expenses were $2,969,000 higher in Q3 2021 compared to Q3 2020 as the Company has significantly increased the volume sold as CIF (Cost Insurance and Freight), up from 14% of total sales in 2020 to 50% in 2021 and due to higher fuel prices, which increased 80% in Q32021 compared to Q3 2020.

General and Administrative Expenses

| CAD $’000 |

Q3 2021 |

Q3 2020 |

YTD 2021 |

YTD 2020 |

| General administrative expenses |

(291) |

(240) |

(1,009) |

(656) |

| Legal, professional, consultancy and audit costs |

(134) |

(160) |

(399) |

(444) |

| IT/Software expenses |

(82) |

(26) |

(204) |

(75) |

| Taxes and licenses fees |

(5) |

(9) |

(19) |

(28) |

| Total |

(512) |

(435) |

(1,631) |

(1,203) |

General administrative expenses

These costs include general office expenses, rent, bank fees, insurance, foreign exchange variances and remuneration of executive and administrative staff in Brazil. The costs have increased by $51,000 in Q3 2021 compared to Q3 2020 as they include an additional 36 administrative employees, with professional headcount increasing from 20 in Q3 2020 to 56 in Q3 2021 to support the Company’s growth and due to incentive compensation. The Company had 47 administrative employees in Q2 2021.

Legal, professional, consultancy and audit costs

Legal and professional fees include legal, professional, consultancy fees along with accountancy, audit and regulatory costs. Consultancy fees are consultants employed in Brazil, such as accounting services, patent process, lawyer’s fees and regulatory consultants. The costs in Q3 2021 are $26,000 lower than Q3 2020 mainly due to audit cost reduction and Brazilian Real devaluation against Canadian dollar.

IT/Software expenses

IT/Software expenses include software licenses such as Microsoft Office, CRM and enterprise resource planning (ERP). In Q3 2021 expenses were $82,000, an increase of $56,000 on Q3 2020 due to an increase in the number of software licenses used by the Company.

Taxes and licences

Taxes and licence expenses include general taxes, product branding and licence costs. In Q3 2021, expenses were $5,000 compared to $9,000 in Q3 2020.

Share Based and Bonus Payments (Non-Cash Event)

These costs represent the expense associated with stock options granted to employees and directors and non-cash bonuses paid to key management.

Share Based Payments costs in Q3 2021 represent the expense associated with stock options granted to employees as part of the Company’s long-term incentive programme. These are measured under the Black-Scholes Model.

Q3 2021 Results Conference Call

The Company will host a conference call on Wednesday, November 24, 2021 at 09:00 am Eastern Time, to discuss Q3 2021 results and provide an update. Subscribe using the link below and receive the conference details by email.

The questions can be submitted in advance through the following link: https://bit.ly/Q3-2021-QuestionForm

The Company’s first quarter financial statements and related notes for the period September 30, 2021

are available to the public on SEDAR at www.sedar.com and the Company’s website at www.investor.verde.ag/.

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The most recent edition of the newsletter can be accessed at: https://bit.ly/InvestorNL-October2021

About Verde AgriTech

Verde is an agricultural technology company that develops and produces fertilizers. Rooting our solutions in nature, we make agriculture healthier, more productive, and profitable for farmers. We work to improve the health of all people and the planet.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.investor.verde.ag | www.supergreensand.com | www.verde.ag

Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to announce an increase in its 2021 revenue guidance to R$90 million and to provide an update regarding sales and the construction of its second production facility (“Plant 2”).

As disclosed in the press release published on November 16, 2020, the construction of Plant 2 was scheduled to begin in the second half of 2021. Groundbreaking took place in August 2021, and Plant 2 is expected to reach commercial production by Q3 2022.

Plant 2 will have an operational capacity of 1,200,000 tonnes per year (“tpy”). The new plant will raise Verde’s overall production capacity to 1,800,000 tpy.

“The Company is sold out until mid-November 2021, with new orders being pushed for delivery thereafter. Plant 2 will ensure a 200% increase in production and will be essential to help meet the market’s growing demand for Verde’s products. We are proud to be able to fund its construction through cash flow and debt, therefore avoiding the issuance of new shares”, declared Cristiano Veloso, Verde’s Founder and CEO.

Capital Expenditure

Plant 2 capital expenditure totals 22 million Brazilian Reais (“R$”), with R$6 million to be invested through internally generated cash flow and R$16 million to be debt-financed. The Company is in advanced negotiations with a number of financial institutions and expects the loan agreements will be concluded by Q4 2021.

2021 Guidance

Verde is pleased to increase its 2021 revenue target to R$90 million. This represents an 80% increase to its original guidance of R$50 million revenue. If achieved, the new target will represent a 155 growth Year-on-Year (“YoY”).

“Blitzscaling is never an easy endeavour, but I’m confident we have built the right team to continue succeeding at this challenge. It is still day 1 at Verde”, concluded Mr. Veloso.

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

About Verde AgriTech

Verde is an agricultural technology company that develops and produces fertilizers. Rooting our solutions in nature, we make agriculture healthier, more productive, and profitable for farmers. We work to improve the health of all people and the planet.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President, Founder & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.investor.verde.ag | www.verde.ag | www.supergreensand.com

(All figures are in Canadian dollars, unless stated otherwise. Average exchange rate in Q2 2021: C$1.00 = R$4.32) Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to announce its financial results for the second quarter, ended on June 30, 2021 (“Q2 2021”), and the upwards revision of its target revenue for 2021.

Q2 2021 Financials

- Revenue increased by 116%, to $5,376,000 compared to $2,492,000 in the second quarter of 2020 (“Q2 2020”).

- Revenue in Brazilian Real (“R$”) increased by 159%, to R$23,215,000 compared to R$8,965,000 in Q2 2020.

- Gross margin increased to 72% in Q2 2021, compared to 62% in Q2 2020.

- Operating profit before non-cash events increased by 109%, to $1,220,000 compared to $584,000 in Q2 2020.

- Trade and other receivables increased 259%, to $6,020,000 compared to $1,675,000 in Q2 2020.

- Sales by volume increased by 35%, to 96,233 tonnes sold compared to 71,183 tonnes sold in Q2 2020.

- Verde recorded a net profit of $79,000, compared to a net profit of $444,000 in Q2 2020. A $887,000 non-cash charge from Verde’s long-term incentive programme for 58 employees was the main reason for the reduction in net profit for the period.

- Cash held by the Company increased by 214%, to $1,908,000, compared to $ 607,000 in Q2 2020.

“We are proud to see that Verde achieved triple-digit growth in revenue for the second quarter, especially in light of the considerable improvement in gross margin. This consistent growth in the first half of the year made it possible for us to, once more, increase our revenue target for 2021”, said Cristiano Veloso, Verde’s Founder.

2021 Guidance

Originally, the Company’s target for 2021 was to achieve R$50 million revenue, as announced in the press release disclosed on November 15, 2020. On May 17, 2021, however, Verde announced a 10% increase in its guidance, aiming for a new a revenue target of R$55 million for 2021. In light of the results of Q2, the Company is pleased to announce a second 10% increase in its 2021 guidance, now aiming for a total revenue target of R$60.5 million, which if achieved would represent a 72% growth Year-on-Year (“YoY”). “The pride we have in the Company’s achievements to date have only boosted our efforts to continue the hard work to meet our latest guidance. Beyond the next two quarters, the Verde team is also heavily engaged with the Company’s expansion plans to increase our production capacity for the year of 2022”, completed Mr. Veloso.

Selected Annual Financial Information

The table below summarizes Q2 2021 financial results compared to Q2 2020 and provides information about 2021 and 2020 year-to-date (“YTD”). All amounts in CAD $’000.

| CAD $’000 |

Q2 2021 |

Q2 2020 |

YTD 2021 |

YTD 2020 |

| Tonnes sold ‘000 |

96 |

71 |

113 |

81 |

| Revenue per tonne sold $ |

56 |

35 |

55 |

37 |

| Production cost per tonne sold $ |

(16) |

(13) |

(18) |

(16) |

| Gross Profit per tonne sold $ |

40 |

22 |

37 |

21 |

| Gross Margin |

72% |

62% |

68% |

57% |

| |

|

|

|

|

| Revenue |

5,376 |

2,492 |

6,207 |

3,001 |

| Production costs |

(1,498) |

(955) |

(1,988) |

(1,286) |

| Gross Profit |

3,878 |

1,537 |

4,219 |

1,715 |

| Gross Margin |

72% |

62% |

68% |

57% |

| Sales and product delivery freight expenses |

(2,236) |

(604) |

(2,767) |

(1,026) |

| General and administrative expenses |

(422) |

(349) |

(1,119) |

(768) |

| Operating Profit/(Loss) before non-cash events |

1,220 |

584 |

333 |

(79) |

| Share Based Payments (Non-Cash Event)1,2 |

(887) |

(28) |

(905) |

(68) |

| Depreciation and Amortisation2 |

(10) |

(3) |

(16) |

(15) |

| Profit on disposal of plant and equipment 2 |

– |

– |

9 |

– |

| Operating Profit/(Loss) after non-cash events |

323 |

553 |

(579) |

(162) |

| Corporation tax3 |

(188) |

(98) |

(219) |

(116) |

| Interest Income/Expense |

(56) |

(11) |

(131) |

(70) |

| Net Profit / (Loss) |

79 |

444 |

(929) |

(348) |

1 – One time, non-cash charge from Verde’s long-term incentive programme regarding the vesting of stock options granted to 58 employees. 2 – Included in General and Administrative expenses in the Financial Statements. 3 – For further details please refer to Q2 2021 Management’s Discussion and Analysis.

Q2 2021 compared with Q2 2020

For Q2 2021 the Company generated a net profit of $79,000, a decrease of $365,000 compared to Q2 2020. The earnings per share was $0.001, compared to $0.009 for Q2 2020. This reduction was due to a $887,000 non-cash charge from a long-term incentive programme regarding the vesting of stock options granted to 58 employees.

Product Sales

In Q2 2021, the Company sold 96,233 tonnes, an increase of 35% in comparison to Q2 2020. BAKS® accounted for approximately 13% of Verde’s sales in Q2 2021.

Revenue

Revenue from sales for Q2 2021 was $5,376,000 from the sale of 96,233 tonnes of the Product, at $56 per tonne sold. Despite the 20% Brazilian Real devaluation against the Canadian Dollar, revenue per tonne was higher than Q2 2020 ($35 per tonne sold) mainly due to three factors:

- Product volume sold as CIF (Cost Insurance and Freight) increased from 6% of total sales in Q2 2020 to 43% in Q2 2021.

- Potassium Chloride CIF (Minas Gerais) price increased from US$287-US$303 per tonne in Q2 2020 to US$395-535 per tonne in Q2 2021 (as per Acerto Limited report).

- BAKS® has a higher sales price per tonne than the Product, it was launched on Q4 2020 and in Q2 2021 it has accounted for 13% of the total volume sold.

Production costs

Production costs include all direct costs from mining, processing, and the addition of the other nutrients such as Sulfur and Boron, logistics from the mine to the factory and supply chain salaries, which are paid in R$. Production costs for Q2 2021 were $1,498,000, an increase of $543,000 compared to Q2 2020. Cost per tonne for the quarter was $16 compared to $13 for the same period in 2020. This increase was due in large part to higher fuel prices, which increased 45% in Q2 2021 compared to Q2 2020, and due to the production of BAKS, which has a higher cost per tonne due to the addition of other nutrients to the Product.

Sales Expenses

| CAD $’000 |

Q2 2021 |

Q2 2020 |

YTD 2021 |

YTD 2020 |

| Sales and marketing expenses |

(410) |

(369) |

(712) |

(634) |

| Product delivery freight expenses |

(1,826) |

(235) |

(2,055) |

(392) |

| Total |

(2,236) |

(604) |

(2,767) |

(1,026) |

General and Administrative Expenses

| CAD $’000 |

Q2 2021 |

Q2 2020 |

YTD 2021 |

YTD 2020 |

| General administrative expenses |

(240) |

(197) |

(718) |

(416) |

| Legal, professional, consultancy and audit costs |

(106) |

(121) |

(265) |

(284) |

| IT/Software expenses |

(70) |

(27) |

(122) |

(49) |

| Taxes and licenses fees |

(6) |

(4) |

(14) |

(19) |

| Total |

(422) |

(349) |

(1,119) |

(768) |

General administrative expenses

These costs include general office expenses, rent, bank fees, insurance, foreign exchange variances and remuneration of the executives and administrative staff in Brazil. The costs have increased by $43,000 in Q2 2021 compared to Q2 2020 as they include an additional 29 administrative employees, with professional headcount increasing from 18 in Q2 2020 to 47 in Q2 2021 to support the Company’s growth and due to incentive compensation. The Company had 26 administrative employees in Q1 2021.

Legal, professional, consultancy and audit costs

Legal and professional fees include legal, professional, consultancy fees along with accountancy, audit and regulatory costs. Consultancy fees are consultants employed in Brazil, such as accounting services, patent process, lawyer’s fee and regulatory consultants. The costs in Q2 2021 are $15,000 lower than Q2 2020 mainly due to audit cost reduction and Brazilian Real devaluation against Canadian dollar.

IT/Software expenses

IT/Software expenses include software licenses such as Microsoft Office, CRM and enterprise resource planning (ERP). In Q2 2021 expenses were $70,000, an increase of $43,000 on Q2 2020 due to an increase in the number of the software licenses used by the Company.

Taxes and licences

Taxes and licence expenses include general taxes, product branding and licence costs. In Q2 2021, expenses were $6,000 compared to $4,000 in Q2 2020.

Share Based Payments (Non-Cash Event)

The directors have not received any shares in lieu of compensation since Q3 2020. Share Based Payments costs in Q2 2021 represent the expense associated with stock options granted to employees as part of the Company’s long-term incentive programme. These are measured under the Black-Scholes Model.

Capital Expenditure

In Q2 2021, the Company invested $515,000 in infrastructure improvements: the grounds of Plant 1 were paved to provide greater operational efficiency; access routes to the mine pits have been enhanced; project developments for Plant 2 were further advanced.

Q2 2021 Results Conference Call

The Company will host a conference call on Wednesday, August 25, 2021 at 11:00 am Eastern Time (4:00 pm Greenwich Mean Time), to discuss Q2 2021 results and provide an update. Subscribe using the link below and receive the conference details by email.

| Date: |

Wednesday, August 25, 2021 |

| Time: |

11:00 am Eastern Time (4:00 pm Greenwich Mean Time) |

| Subscription link: |

|

The Company’s first quarter financial statements and related notes for the period March 31, 2021 are available to the public on SEDAR at www.sedar.com and the Company’s website at www.investor.verde.ag/.

Investors Newsletter

Subscribe to receive the Company’s monthly updates at: http://cloud.marketing.verde.ag/InvestorsSubscription The last edition of the newsletter can be accessed at: https://bit.ly/InvestorNL-July2021

About Verde AgriTech

Verde is an agricultural technology company that develops and produces fertilizers. Rooting our solutions in nature, we make agriculture healthier, more productive, and profitable for farmers. We work to improve the health of all people and the planet.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.investor.verde.ag | www.supergreensand.com | www.verde.ag

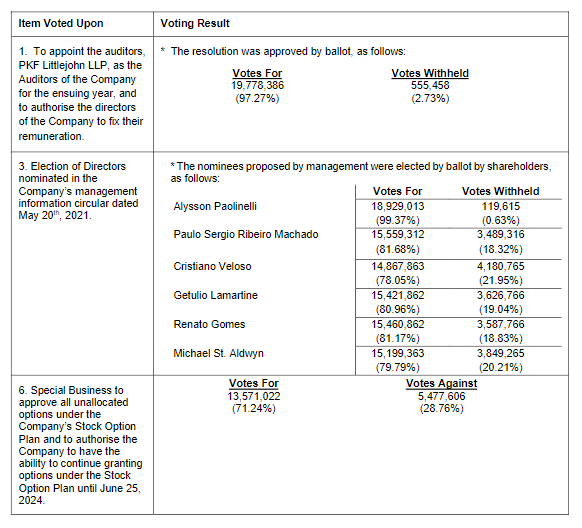

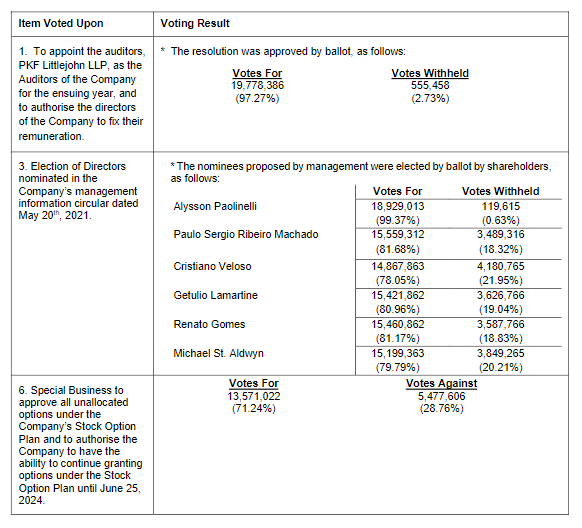

BELO HORIZONTE, BRAZIL, June 30, 2021 – Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) held its Annual General Meeting (“AGM”) of shareholders on Wednesday, June 30, 2021, in Belo Horizonte, Brazil, and is pleased to announce that its shareholders approved all items put before them.

The director nominees were elected as directors of the Company. Shareholders adopted the Directors’ Report, the Audited Statement of Accounts and the Auditors’ Report for the year ended December 31, 2020 and appointed PKF Littlejohn LLP as auditors of the Company for the ensuing year. In addition, shareholders approved the Company’s stock option plan, as it may be amended from time to time, which approval shall remain effective until June 30, 2024. The results were as follows:

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil’s largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President, Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

www.investor.verde.ag | www.verde.ag | www.supergreensand.com

Belo Horizonte, Brazil. Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”) (“Verde” or the “Company”) is pleased to update shareholders on the procedures for its upcoming annual general meeting (the “Meeting”) of Verde’s shareholders, scheduled to take place on June 30, 2021 at 3:00 p.m. (EDT).

In light of concerns about COVID-19, the notice calling the Meeting issued on May 20, 2021 (the “Notice”) indicated that it would be “closed”, without the ability for registered shareholders and duly appointed proxyholders to physically attend the Meeting unless the local rules at the time and place of the Meeting permitted admission of additional persons.

The Notice states: “unless a change in the rules allows a wider attendance (which will be communicated to shareholders) the Meeting will be a closed event”

Current COVID-19 restrictions on gatherings in the City of Belo Horizonte, the location of the Meeting, currently permit physical gatherings subject to certain density limitations. As such, and in accordance with the Notice and the latest local health regulations, the Company advises shareholders that in-person Meeting attendance will now be permitted. Any shareholder or duly appointed proxyholder that attends the Meeting in person will be required to comply with the local restrictions, e.g. social distancing; wearing a mask or other appropriate face covering at all times, among others.

Although the latest restrictions permit limited public gathering, the COVID-19 crisis in Brazil continues to intensify and could result in the implementation of further government restrictions on gatherings. The Company will notify shareholders in the event further restrictions are implemented prior to the Meeting.

GIVEN THE SERIOUSNESS OF THE COVID-19 SITUATION IN BRASIL, SHAREHOLDERS ARE STRONGLY ENCOURAGED NOT TO ATTEND THE MEETING AND TO VOTE BY WAY OF PROXY IN ADVANCE OF THE MEETING.

Commenting, President & CEO, Cristiano Veloso cautioned: “From its onset, we at Verde have taken this pandemic very seriously. To date, we are relieved to say that not a single Verde employee or contractor was among the over 500 thousand hapless Brazilian victims of COVID-19. It is with the same care and attention to health regulation and expert recommendations that I emphasize: in presence attendance at our Meeting is not advisable, for the wellbeing of Verde’s team – some of whom need to be physically in our offices – and of the shareholders – who can all adequately and safely attend remotely.”

Registered shareholders or duly appointed proxyholders who intend to attend the Meeting in person are asked to notify the Company or its transfer agent, TSX Trust Company, in advance of the Meeting, and in any event not less than 24 hours prior to the Meeting, of their intention to attend, to allow the Company time to ensure compliance with local restrictions on gatherings. Registered shareholders and duly appointed proxyholders can provide notification by sending an email to investor@verde.ag or tsxtrustclientsupport@tmx.com.

In order to ensure that any questions shareholders may have regarding the business of the Meeting are received in time to be considered at the Meeting, registered shareholders and duly appointed proxyholders are encourage to send their questions in advance of the meeting through the following link: .

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture through the development of its Cerrado Verde Project. Cerrado Verde, located in the heart of Brazil’s largest agricultural market, is the source of a potassium-rich deposit from which the Company intends to produce solutions for crop nutrition, crop protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. The Cautionary Language and Forward-Looking Statements can be accessed at this link.

For additional information please contact:

Cristiano Veloso, President & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

www.investor.verde.ag | www.supergreensand.com | www.verde.ag