BELO HORIZONTE, Brazil / SINGAPORE – January 26, 2026 – Verde AgriTech Ltd. (TSX: NPK | OTCQX: VNPKF) (“Verde” or the “Company”) is pleased to report additional assay results from its ongoing drilling program at the Minas Americas Global Alliance Project (the “Project”) in Minas Gerais, Brazil.

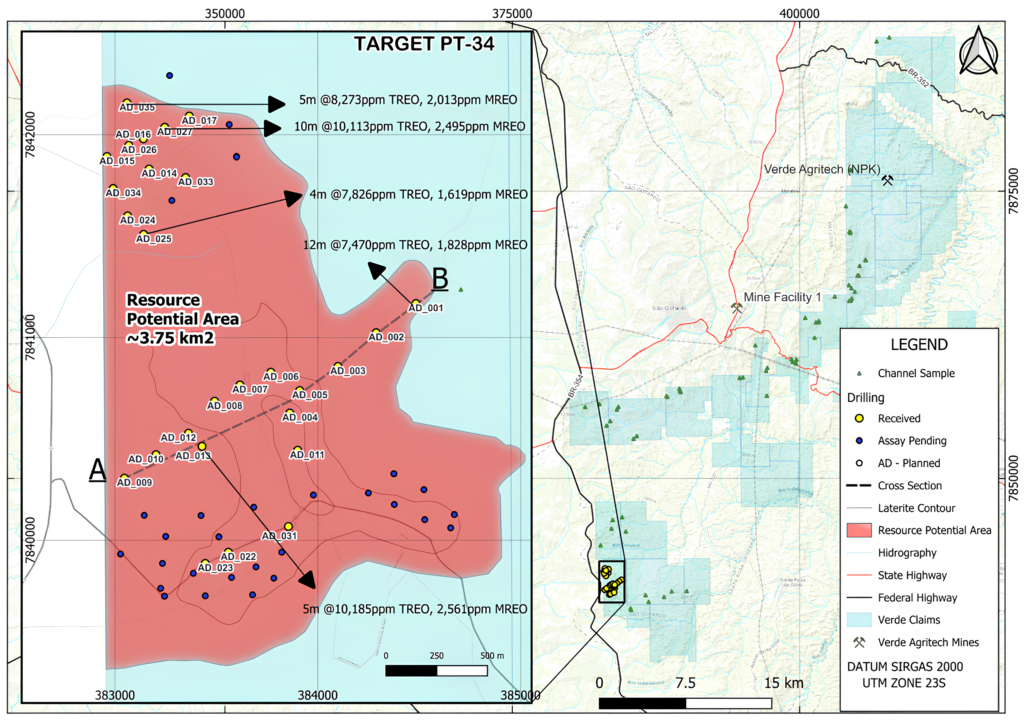

“Our first drilling target (PT-34) is already delivering the combination that matters in rare earth discoveries: shallow thickness, repeated high grades, and a magnet‑rich rare earth basket,” said Cristiano Veloso, Founder and CEO of Verde. “With significant intercepts now extending across PT‑34 and multiple holes finishing in mineralization, we are prioritizing scale capture. Given the strength of results so far, the Board has approved expanding the resource definition footprint and drilling additional metres to better outline the district‑scale potential of the Project. Our objective is to define more tonnes of higher‑quality, magnet‑rich mineralization before finalizing scoping‑level economics.”

“In parallel, the Board has directed the Company to prepare the Project’s technical disclosure under Canadian NI 43‑101 and to develop U.S. SEC Regulation S‑K Subpart 1300 (S‑K 1300) aligned disclosure, including a Technical Report Summary as applicable,” added Mr. Veloso. “This dual‑track approach enhances comparability for global investors and preserves strategic flexibility as we advance the Project.”

This release reports assays from 24 additional holes totaling 244.7 m at the priority PT‑34 target, bringing drilling results reported to date to 27 holes totaling 279.8 m (280 assayed intervals).

Drill Highlights

- New best intercept to date returned 13.0 m (2.0–15.0 m) averaging 8,257 ppm (0.83%) TREO and 2,004 ppm (0.20%) MREO, including 8.0 m (3.0–11.0 m) averaging 10,113 ppm (1.01%) TREO and 2,495 ppm (0.25%) MREO.

- Best 5 m composite to date averaged 10,941 ppm (1.09%) TREO and 2,732 ppm (0.27%) MREO.

- Peak grade + magnet basket: (9.0–10.0 m) returned 13,453 ppm (1.35%) TREO and 3,836 ppm (0.38%) MREO (MREO/TREO = 28.5%; NdPr = 27.8% of TREO).

- Meaningful high‑grade distribution: of 279.8 m drilled at PT‑34 to date, 71.2 m (25.4%) returned ≥0.40% TREO, 46.0 m (16.4%) returned ≥0.60% TREO, 23.0 m (8.2%) returned ≥0.80% TREO and 8.0 m (2.9%) returned ≥1.00% TREO.

- Magnet basket strengthens with grade: in intervals ≥0.40% TREO, MREO (Nd+Pr+Dy+Tb) averages ~23% of TREO, rising to ~26% of TREO in intervals ≥1.00% TREO.

- Heavy magnet REEs present: Dy₂O₃ up to 86 ppm and Tb₄O₇ up to 18 ppm.

- Open at depth: 11 of 27 holes ended in ≥0.20% TREO mineralization, including 6 holes ending ≥0.40% TREO, 4 holes ending ≥0.80% TREO and 2 holes ending ≥1.00% TREO.

- Significant intercepts now span ~1.7 km across PT‑34 (based on maximum collar‑to‑collar distance among holes returning continuous ≥0.40% TREO mineralization over ≥3 m).

Definitions: TREO = total rare earth oxides. MREO = magnetic rare earth oxides (Nd₂O₃ + Pr₆O₁₁ + Dy₂O₃ + Tb₄O₇). 10,000 ppm = 1.0%. Assays are head grades; metallurgical recoveries are determined by separate testwork.

Metallurgy Context (Previously Reported) and Next Steps

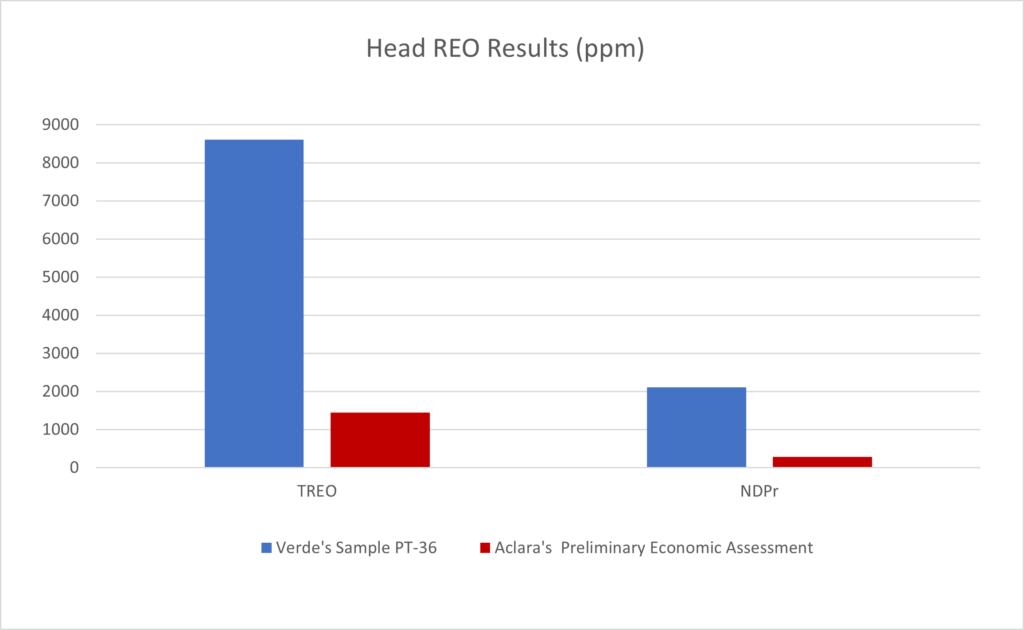

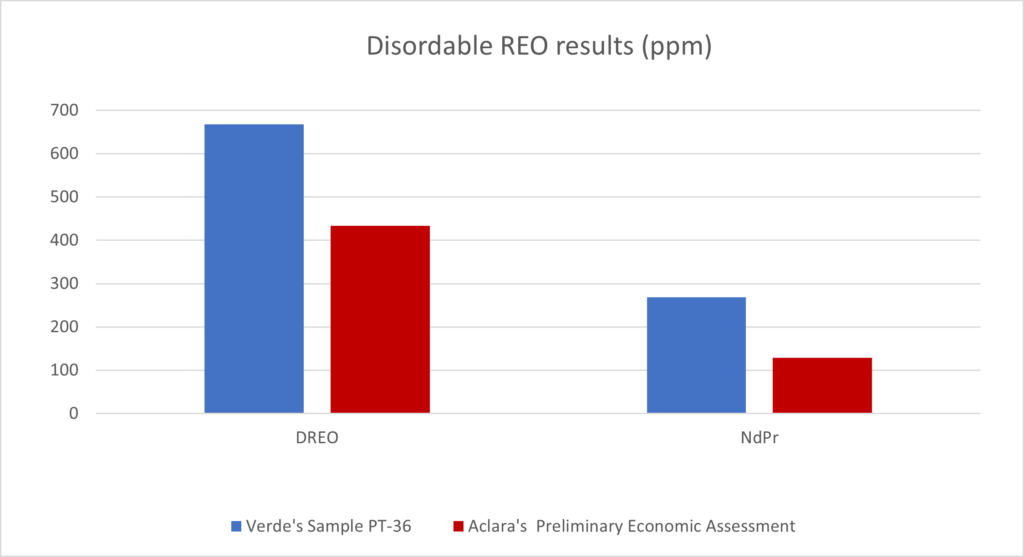

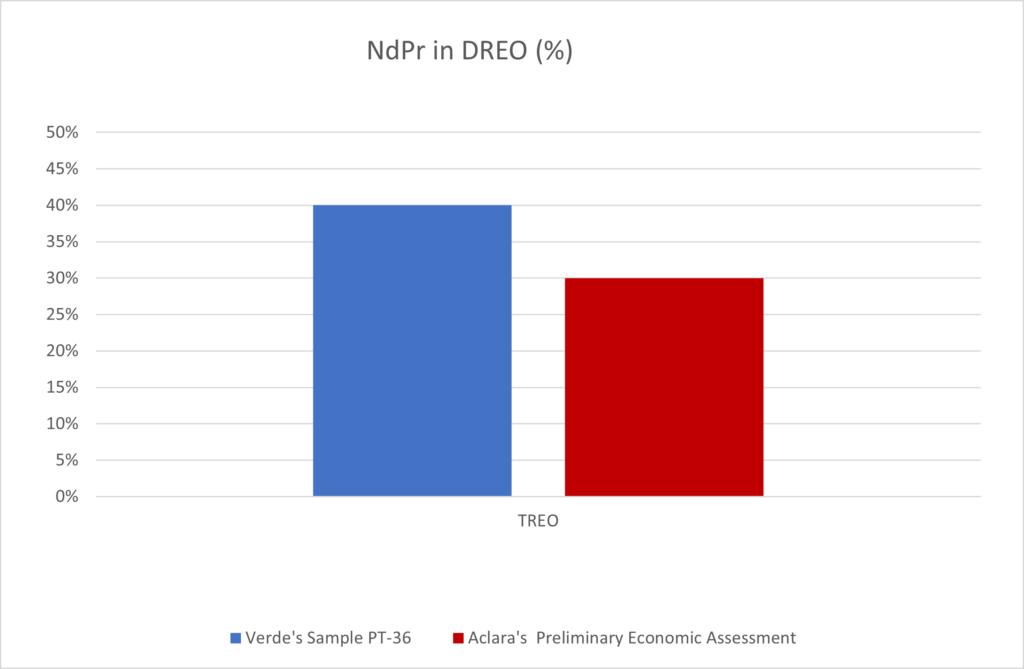

Verde has previously reported ionic adsorption behavior at the Project using mild ammonium‑sulfate leach screening, including the following process indicators in the best trench samples:

- magnet rare earths comprising >40% of dissolved REO in primary leach solutions;

- thorium and uranium reported at or below detection in the best intervals; and

- cerium reporting at low levels in solution relative to head grade — a favorable selectivity signature for downstream upgrading.

Ongoing work includes:

- deeper follow‑up drilling to test below current auger depths where mineralization remains open;

- drill‑based composite metallurgical testing across principal mineralization domains; and

- continued reporting of drill assays and metallurgical results as they become available.

Preliminary Economic Assessment (“PEA”)

With multiple high‑grade centres emerging across PT‑34 and mineralization remaining open at depth, Verde is sequencing its technical work to ensure the first economic study incorporates a broader drill dataset and updated composite metallurgy.

The Company continues to target a maiden NI 43‑101 Mineral Resource Estimate in H1 2026, and now targets completion of a PEA (NI 43‑101) in H2 2026, supported by S‑K 1300‑aligned technical disclosure work as applicable.

Table 1: Selected Significant Intercepts — PT‑34 (Head Grades)

| Hole ID |

Note |

From (m) |

To (m) |

Length (m) |

TREO (ppm) |

TREO (%) |

MREO (ppm) |

MREO (%) |

MREO/TREO (%) |

| MAV_AD_0027 |

from surface |

0.0 |

15.5 |

15.5 |

7,265 |

0.73 |

1,749 |

0.17 |

24.1 |

| MAV_AD_0027 |

|

2.0 |

15.0 |

13.0 |

8,257 |

0.83 |

2,004 |

0.20 |

24.3 |

| MAV_AD_0027 |

incl. |

3.0 |

11.0 |

8.0 |

10,113 |

1.01 |

2,495 |

0.25 |

24.7 |

| MAV_AD_0027 |

5 m comp. |

5.0 |

10.0 |

5.0 |

10,941 |

1.09 |

2,732 |

0.27 |

25.0 |

| MAV_AD_0013 |

|

4.0 |

10.0 |

6.0 |

9,484 |

0.95 |

2,231 |

0.22 |

23.5 |

| MAV_AD_0013 |

incl. |

8.0 |

10.0 |

2.0 |

12,740 |

1.27 |

3,551 |

0.36 |

27.9 |

| MAV_AD_0013 |

incl. peak |

9.0 |

10.0 |

1.0 |

13,453 |

1.35 |

3,836 |

0.38 |

28.5 |

| MAV_AD_0012 |

|

10.0 |

14.0 |

4.0 |

10,143 |

1.01 |

2,475 |

0.25 |

24.4 |

| MAV_AD_0035 |

|

6.0 |

11.0 |

5.0 |

8,273 |

0.83 |

2,013 |

0.20 |

24.3 |

| MAV_AD_0002 |

from surface |

0.0 |

14.2 |

14.2 |

6,801 |

0.68 |

1,659 |

0.17 |

24.4 |

| MAV_AD_0002 |

incl. |

4.0 |

10.0 |

6.0 |

8,013 |

0.80 |

1,941 |

0.19 |

24.2 |

| MAV_AD_0025 |

|

4.0 |

8.0 |

4.0 |

7,826 |

0.78 |

1,619 |

0.16 |

20.7 |

Notes: Intervals are downhole. Drillholes are vertical; based on the current geological model of a gently undulating mineralized horizon, downhole lengths are interpreted to represent approximate true thickness. Weighted averages are calculated by length. Rounding may result in minor differences.

Table 2: PT‑34 Grade Distribution Scoreboard (Assayed Metres Above TREO Cutoffs)

| TREO cutoff |

Cutoff (ppm) |

Metres ≥ cutoff |

% of drilled metres |

Holes hit |

| ≥0.40% TREO |

4,000 |

71.2 m |

25.4% |

11/27 |

| ≥0.60% TREO |

6,000 |

46.0 m |

16.4% |

10/27 |

| ≥0.80% TREO |

8,000 |

23.0 m |

8.2% |

7/27 |

| ≥1.00% TREO |

10,000 |

8.0 m |

2.9% |

4/27 |

Notes: Metres are the summed lengths of assayed drill intervals meeting each cutoff (mostly ~1 m). This table does not represent a mineral resource or reserve estimate and is not a statement of continuity.

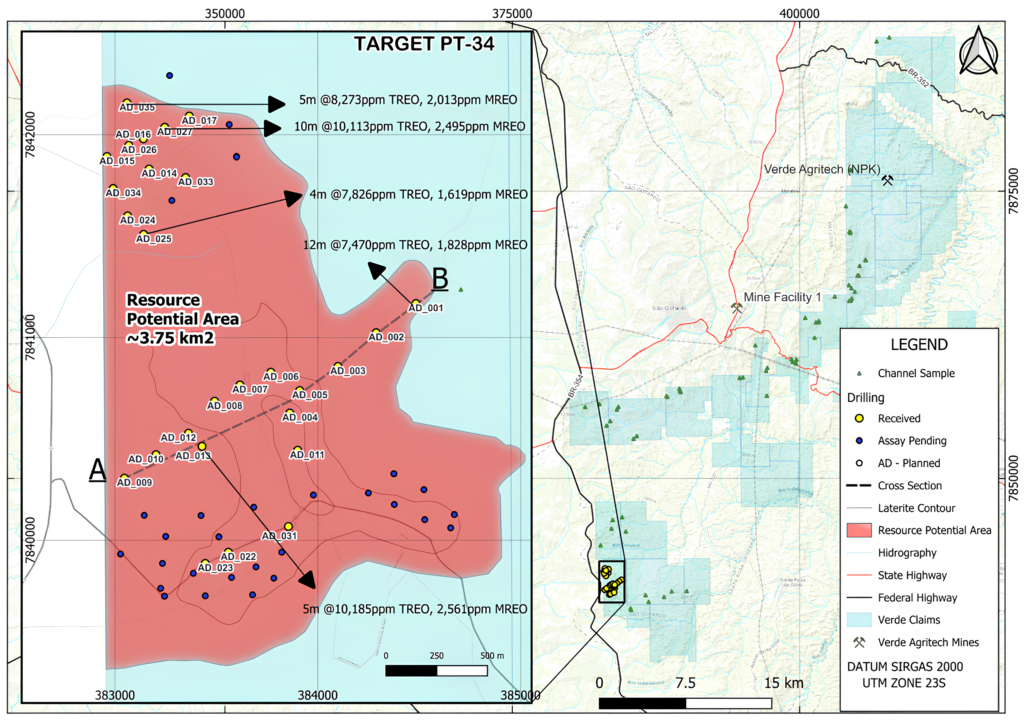

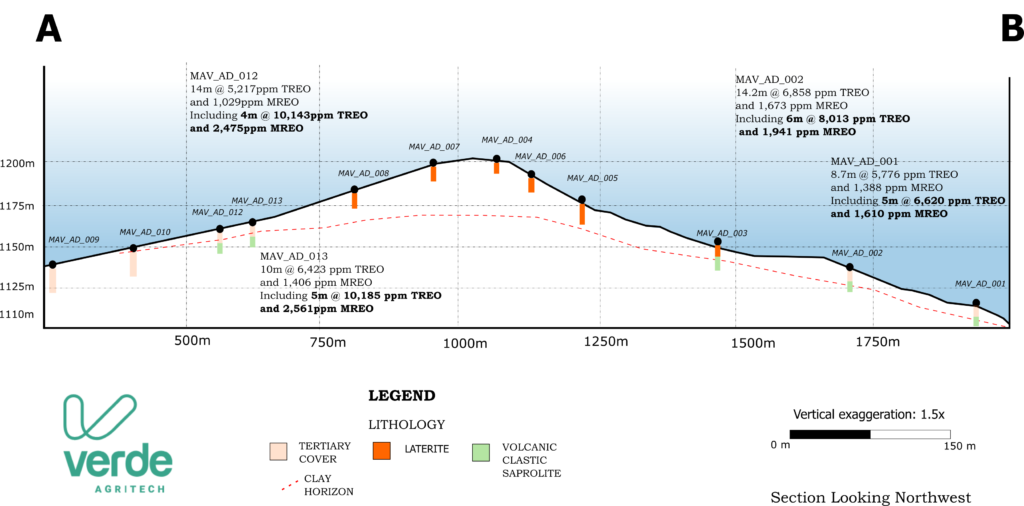

Figure 1: Drill hole plan map showing completed and pending drill hole assays in the resource potential area.

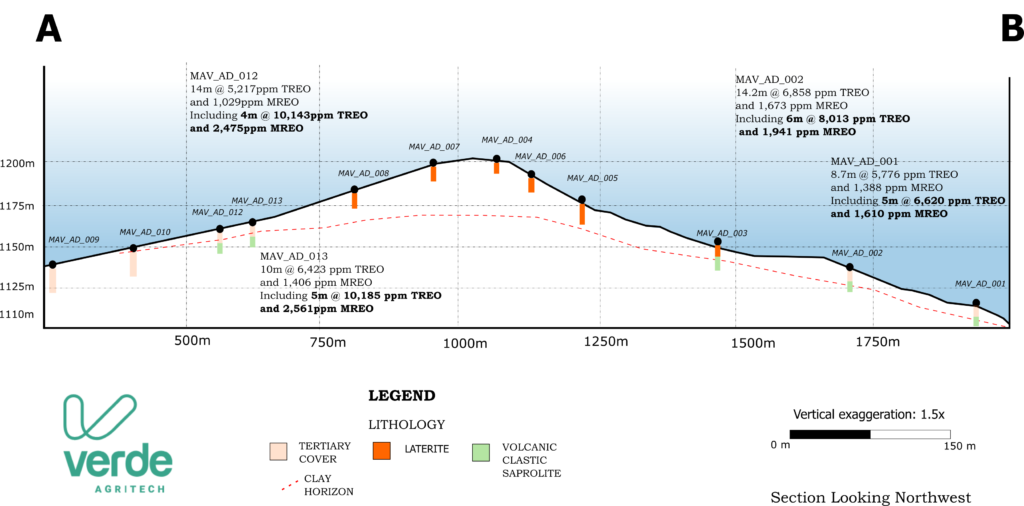

Figure 2: Cross section showing significant drill holes results

Qualified Person and QA/QC

The scientific and technical information contained in this news release has been reviewed and approved by Leonardo Deringer Fraga, P.Geo, Vice‑President of Exploration, who is a Qualified Person as defined by NI 43‑101 – Standards of Disclosure for Mineral Projects. EGBC License No. 61611.

Dril samples were collected at nominal one‑metre intervals. Sample preparation and analysis were carried out by SGS Geosol, an independent, ISO-accredited laboratory in Vespasiano, Minas Gerais, Brazil. Samples were analyzed for major oxides and a full rare earth element suite using industry-standard analytical methods

The Company maintains a quality assurance and quality control (QA/QC) program that includes the insertion of certified reference materials, blanks, and duplicates at regular intervals. QA/QC results were reviewed by the Qualified Person and were found to be within acceptable limits. No material QA/QC issues were identified that would affect the reliability of the reported assay results.

ABOUT VERDE AGRITECH

Verde AgriTech is a Brazil‑focused specialty fertilizer company listed on the TSX and OTCQX. The Company is advancing the Minas Americas Global Alliance rare earth project in Minas Gerais, Brazil, leveraging its operational platform and regional experience to accelerate exploration and technical de‑risking. For more information, visit our website: https://verde.ag/en/home.

Cautionary Language and Forward-Looking Statements

This news release contains “forward‑looking information” within the meaning of applicable Canadian securities legislation, including, but not limited to, statements with respect to: the significance of exploration results; the potential for economic extraction of rare earth elements; future exploration and development plans; the outcome of the Board of Directors’ review; potential partnerships, strategic alternatives, or value‑maximizing structures; the advancement of the Project; and the expected timing of further updates. Forward‑looking information is based on management’s current expectations, assumptions, estimates, projections and interpretations and involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed or implied.

These factors include, without limitation: risks related to exploration‑stage projects; the possibility that future exploration results may not support mineral resource or reserve delineation; uncertainties relating to assay and metallurgical results; operational risks inherent in mining; risks associated with maintaining licenses, permits and mineral rights; changes in laws, regulations and government policies; risks related to capital and operating costs; commodity price volatility; financing risks; and other risks described in the Company’s most recent annual information form and other continuous disclosure filings available under the Company’s profile at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward‑looking information. The Company does not undertake to update or revise any forward‑looking statements, whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

This news release reports exploration results which are preliminary in nature and do not represent mineral resources or mineral reserves as defined under NI 43‑101. There is no certainty that further exploration will result in the delineation of mineral resources or mineral reserves, or that any development decision will be made. Mineralization identified to date is not necessarily indicative of future results.

For additional information please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

APPENDIX

Minas Americas Global Alliance Project (PT-34) — Drill Hole Collar Information and Full Assay Results

Notes: Assays are reported as head grades in parts per million (“ppm”). MREO includes Nd, Pr, Dy and Tb oxides. TREO includes all rare earth oxides. All holes are vertical (90°). Based on current interpretation of a gently undulating mineralized horizon, the reported intervals are interpreted to represent approximate true thickness. Coordinates are reported in SIRGAS 2000 / UTM Zone 23S.

Table 3: Drill hole collar information (PT-34 auger drilling reported to date)

| Hole ID |

Easting (UTM) |

Northing (UTM) |

Elevation m |

Depth EOH m |

Status |

| MAV_AD_0001 |

384,454 |

7,841,206 |

1044.00 |

8.70 |

CONCLUDED |

| MAV_AD_0002 |

384,282 |

7,841,027 |

1149.00 |

14.20 |

CONCLUDED |

| MAV_AD_0003 |

384,092 |

7,840,847 |

1172.00 |

12.20 |

CONCLUDED |

| MAV_AD_0004 |

383,855 |

7,840,627 |

1195.00 |

7.00 |

CONCLUDED |

| MAV_AD_0005 |

383,909 |

7,840,741 |

1181.00 |

15.00 |

CONCLUDED |

| MAV_AD_0006 |

383,736 |

7,840,835 |

1192.00 |

11.00 |

CONCLUDED |

| MAV_AD_0007 |

383,611 |

7,840,764 |

1193.00 |

10.40 |

CONCLUDED |

| MAV_AD_0008 |

383,505 |

7,840,694 |

1182.00 |

11.00 |

CONCLUDED |

| MAV_AD_0009 |

383,356 |

7,840,530 |

1162.00 |

9.00 |

CONCLUDED |

| MAV_AD_0010 |

383,207 |

7,840,421 |

1142.00 |

9.00 |

CONCLUDED |

| MAV_AD_0011 |

383,911 |

7,840,309 |

1133.00 |

7.00 |

CONCLUDED |

| MAV_AD_0012 |

383,362 |

7,840,528 |

1164.29 |

14.00 |

CONCLUDED |

| MAV_AD_0013 |

383,429 |

7,840,463 |

1163.00 |

10.00 |

CONCLUDED |

| MAV_AD_0014 |

383,168 |

7,841,831 |

1167.00 |

6.00 |

CONCLUDED |

| MAV_AD_0015 |

382,960 |

7,841,892 |

1148.00 |

7.00 |

CONCLUDED |

| MAV_AD_0016 |

383,140 |

7,841,980 |

1164.00 |

12.00 |

CONCLUDED |

| MAV_AD_0017 |

383,366 |

7,842,092 |

1130.00 |

12.00 |

CONCLUDED |

| MAV_AD_0022 |

383,559 |

7,839,941 |

1179.00 |

12.00 |

CONCLUDED |

| MAV_AD_0023 |

383,445 |

7,839,886 |

1174.66 |

6.00 |

CONCLUDED |

| MAV_AD_0024 |

383,062 |

7,841,600 |

1149.00 |

10.00 |

CONCLUDED |

| MAV_AD_0025 |

383,141 |

7,841,509 |

1144.00 |

8.00 |

CONCLUDED |

| MAV_AD_0026 |

383,068 |

7,841,948 |

1169.00 |

6.00 |

CONCLUDED |

| MAV_AD_0027 |

383,245 |

7,842,037 |

1139.00 |

15.50 |

CONCLUDED |

| MAV_AD_0031 |

383,855 |

7,840,068 |

1190.00 |

11.00 |

CONCLUDED |

| MAV_AD_0033 |

383,348 |

7,841,789 |

1175.00 |

12.80 |

CONCLUDED |

| MAV_AD_0034 |

382,991 |

7,841,735 |

1150.00 |

12.00 |

CONCLUDED |

| MAV_AD_0035 |

383,059 |

7,842,157 |

1150.00 |

11.00 |

CONCLUDED |

*EOH = end of hole.

Table 4: Full drilling results for PT-34 auger holes (all assayed intervals)

| Hole ID |

From

(m) |

To

(m) |

Length

(m) |

CeO2

(ppm) |

Dy2O3

(ppm) |

Er2O3

(ppm) |

Eu2O3

(ppm) |

Gd2O3

(ppm) |

Ho2O3

(ppm) |

La2O3

(ppm) |

Lu2O3

(ppm) |

Nd2O3

(ppm) |

Pr6O11

(ppm) |

Sm2O3

(ppm) |

Tb4O7

(ppm) |

Tm2O3

(ppm) |

Y2O3

(ppm) |

Yb2O3

(ppm) |

TREO

(ppm) |

MREO

(ppm) |

NdPr

(%TREO) |

| MAV_AD_0001 |

0.0 |

1.0 |

1.0 |

2968 |

34 |

9 |

33 |

77 |

4 |

1331 |

1 |

1039 |

299 |

139 |

8 |

1 |

104 |

5 |

6052 |

1380 |

22% |

| MAV_AD_0001 |

1.0 |

2.0 |

1.0 |

3857 |

49 |

13 |

51 |

117 |

6 |

2042 |

1 |

1617 |

490 |

210 |

12 |

1 |

152 |

6 |

8623 |

2168 |

24% |

| MAV_AD_0001 |

2.0 |

3.0 |

1.0 |

3132 |

44 |

13 |

42 |

101 |

6 |

1663 |

1 |

1299 |

394 |

172 |

10 |

1 |

170 |

7 |

7054 |

1747 |

24% |

| MAV_AD_0001 |

3.0 |

4.0 |

1.0 |

2730 |

40 |

11 |

37 |

90 |

6 |

1326 |

1 |

1098 |

311 |

151 |

9 |

1 |

140 |

6 |

5957 |

1458 |

24% |

| MAV_AD_0001 |

4.0 |

5.0 |

1.0 |

2580 |

31 |

8 |

32 |

73 |

4 |

1191 |

0 |

977 |

281 |

131 |

7 |

1 |

93 |

4 |

5411 |

1296 |

23% |

| MAV_AD_0001 |

5.0 |

6.0 |

1.0 |

2455 |

29 |

7 |

30 |

69 |

4 |

1151 |

0 |

912 |

265 |

124 |

7 |

1 |

85 |

3 |

5143 |

1213 |

23% |

| MAV_AD_0001 |

6.0 |

7.0 |

1.0 |

2341 |

30 |

9 |

29 |

70 |

4 |

1086 |

1 |

872 |

250 |

119 |

7 |

1 |

108 |

4 |

4932 |

1159 |

23% |

| MAV_AD_0001 |

7.0 |

8.0 |

1.0 |

2347 |

29 |

8 |

28 |

66 |

4 |

1108 |

0 |

873 |

250 |

117 |

7 |

1 |

96 |

4 |

4938 |

1159 |

23% |

| MAV_AD_0001 |

8.0 |

8.7 |

0.7 |

1828 |

23 |

6 |

22 |

52 |

3 |

880 |

0 |

690 |

199 |

92 |

5 |

1 |

75 |

3 |

3880 |

917 |

23% |

| MAV_AD_0002 |

0.0 |

1.0 |

1.0 |

3484 |

43 |

12 |

44 |

103 |

6 |

1748 |

1 |

1381 |

417 |

184 |

10 |

1 |

129 |

6 |

7568 |

1851 |

24% |

| MAV_AD_0002 |

1.0 |

2.0 |

1.0 |

3102 |

52 |

14 |

47 |

115 |

7 |

1751 |

1 |

1356 |

406 |

187 |

12 |

1 |

158 |

7 |

7217 |

1826 |

24% |

| MAV_AD_0002 |

2.0 |

3.0 |

1.0 |

3181 |

58 |

15 |

52 |

130 |

8 |

1854 |

1 |

1491 |

446 |

209 |

13 |

2 |

173 |

8 |

7640 |

2008 |

25% |

| MAV_AD_0002 |

3.0 |

4.0 |

1.0 |

2740 |

35 |

10 |

36 |

83 |

4 |

1351 |

1 |

1109 |

325 |

148 |

8 |

1 |

113 |

5 |

5970 |

1477 |

24% |

| MAV_AD_0002 |

4.0 |

5.0 |

1.0 |

3055 |

39 |

11 |

39 |

91 |

5 |

1484 |

1 |

1210 |

353 |

164 |

9 |

1 |

131 |

6 |

6599 |

1611 |

24% |

| MAV_AD_0002 |

5.0 |

6.0 |

1.0 |

3334 |

42 |

12 |

42 |

96 |

6 |

1642 |

1 |

1293 |

394 |

172 |

10 |

1 |

146 |

6 |

7197 |

1739 |

23% |

| MAV_AD_0002 |

6.0 |

7.0 |

1.0 |

3716 |

43 |

12 |

44 |

101 |

6 |

1767 |

1 |

1403 |

430 |

184 |

10 |

1 |

145 |

6 |

7869 |

1886 |

23% |

| MAV_AD_0002 |

7.0 |

8.0 |

1.0 |

4523 |

47 |

11 |

53 |

116 |

6 |

2128 |

1 |

1742 |

522 |

221 |

11 |

1 |

135 |

5 |

9520 |

2321 |

24% |

| MAV_AD_0002 |

8.0 |

9.0 |

1.0 |

4241 |

59 |

17 |

58 |

136 |

8 |

2047 |

1 |

1720 |

513 |

234 |

14 |

2 |

204 |

9 |

9262 |

2305 |

24% |

| MAV_AD_0002 |

9.0 |

10.0 |

1.0 |

3219 |

86 |

40 |

50 |

147 |

16 |

1546 |

4 |

1319 |

364 |

188 |

17 |

5 |

606 |

27 |

7632 |

1787 |

22% |

| MAV_AD_0002 |

10.0 |

11.0 |

1.0 |

3105 |

54 |

23 |

42 |

110 |

9 |

1503 |

2 |

1229 |

361 |

167 |

11 |

3 |

353 |

14 |

6987 |

1656 |

23% |

| MAV_AD_0002 |

11.0 |

12.0 |

1.0 |

2916 |

37 |

11 |

36 |

85 |

5 |

1367 |

1 |

1100 |

321 |

149 |

8 |

1 |

141 |

6 |

6183 |

1467 |

23% |

| MAV_AD_0002 |

12.0 |

13.0 |

1.0 |

1712 |

21 |

6 |

20 |

49 |

3 |

817 |

0 |

637 |

183 |

85 |

5 |

1 |

78 |

3 |

3621 |

847 |

23% |

| MAV_AD_0002 |

13.0 |

14.2 |

1.2 |

1308 |

16 |

4 |

16 |

36 |

2 |

625 |

0 |

484 |

141 |

65 |

4 |

0 |

53 |

3 |

2757 |

644 |

23% |

| MAV_AD_0003 |

0.0 |

1.0 |

1.0 |

221 |

3 |

2 |

1 |

4 |

1 |

86 |

0 |

46 |

14 |

7 |

1 |

0 |

20 |

2 |

410 |

64 |

15% |

| MAV_AD_0003 |

1.0 |

2.0 |

1.0 |

134 |

3 |

2 |

1 |

3 |

1 |

74 |

0 |

24 |

9 |

3 |

0 |

0 |

21 |

3 |

279 |

37 |

12% |

| MAV_AD_0003 |

2.0 |

3.0 |

1.0 |

163 |

5 |

3 |

1 |

5 |

1 |

87 |

1 |

43 |

14 |

6 |

1 |

1 |

28 |

4 |

361 |

62 |

16% |

| MAV_AD_0003 |

3.0 |

4.0 |

1.0 |

200 |

3 |

2 |

1 |

3 |

0 |

93 |

0 |

38 |

13 |

5 |

0 |

0 |

16 |

2 |

377 |

54 |

13% |

| MAV_AD_0003 |

4.0 |

5.0 |

1.0 |

443 |

4 |

2 |

2 |

6 |

1 |

235 |

0 |

75 |

26 |

9 |

1 |

0 |

22 |

2 |

829 |

106 |

12% |

| MAV_AD_0003 |

5.0 |

6.0 |

1.0 |

638 |

7 |

3 |

5 |

12 |

1 |

304 |

0 |

164 |

52 |

22 |

1 |

0 |

26 |

3 |

1239 |

225 |

17% |

| MAV_AD_0003 |

6.0 |

7.0 |

1.0 |

1898 |

23 |

11 |

15 |

37 |

4 |

903 |

1 |

439 |

136 |

64 |

5 |

1 |

93 |

11 |

3640 |

603 |

16% |

| MAV_AD_0003 |

7.0 |

8.0 |

1.0 |

2108 |

21 |

11 |

11 |

30 |

4 |

582 |

1 |

295 |

92 |

43 |

4 |

2 |

101 |

10 |

3314 |

411 |

12% |

| MAV_AD_0003 |

8.0 |

9.0 |

1.0 |

2588 |

18 |

6 |

14 |

33 |

3 |

555 |

1 |

400 |

120 |

58 |

4 |

1 |

62 |

5 |

3865 |

541 |

13% |

| MAV_AD_0003 |

9.0 |

10.0 |

1.0 |

3498 |

36 |

10 |

34 |

78 |

5 |

1214 |

1 |

1043 |

303 |

152 |

8 |

1 |

105 |

6 |

6494 |

1390 |

21% |

| MAV_AD_0003 |

10.0 |

11.0 |

1.0 |

2381 |

41 |

14 |

32 |

82 |

6 |

1247 |

1 |

912 |

263 |

131 |

9 |

1 |

147 |

9 |

5276 |

1225 |

22% |

| MAV_AD_0003 |

11.0 |

12.2 |

1.2 |

2132 |

42 |

14 |

30 |

80 |

6 |

1035 |

1 |

811 |

227 |

121 |

9 |

2 |

150 |

10 |

4671 |

1089 |

22% |

| MAV_AD_0004 |

0.0 |

1.0 |

1.0 |

260 |

7 |

4 |

2 |

7 |

1 |

112 |

1 |

78 |

24 |

11 |

1 |

1 |

38 |

5 |

551 |

109 |

18% |

| MAV_AD_0004 |

1.0 |

2.0 |

1.0 |

324 |

7 |

4 |

2 |

7 |

1 |

108 |

1 |

73 |

22 |

10 |

1 |

1 |

40 |

5 |

606 |

104 |

16% |

| MAV_AD_0004 |

2.0 |

3.0 |

1.0 |

355 |

7 |

4 |

3 |

8 |

1 |

174 |

1 |

127 |

38 |

17 |

1 |

1 |

37 |

4 |

778 |

173 |

21% |

| MAV_AD_0004 |

3.0 |

4.0 |

1.0 |

255 |

6 |

4 |

1 |

5 |

1 |

63 |

1 |

40 |

12 |

6 |

1 |

1 |

41 |

5 |

444 |

60 |

12% |

| MAV_AD_0004 |

4.0 |

5.0 |

1.0 |

236 |

6 |

4 |

1 |

5 |

1 |

65 |

1 |

42 |

13 |

6 |

1 |

1 |

40 |

5 |

429 |

63 |

13% |

| MAV_AD_0004 |

5.0 |

6.0 |

1.0 |

251 |

7 |

4 |

2 |

7 |

1 |

92 |

1 |

63 |

19 |

9 |

1 |

1 |

41 |

5 |

503 |

90 |

16% |

| MAV_AD_0004 |

6.0 |

7.0 |

1.0 |

218 |

6 |

4 |

2 |

6 |

1 |

97 |

1 |

63 |

19 |

9 |

1 |

1 |

38 |

4 |

469 |

89 |

17% |

| MAV_AD_0005 |

0.0 |

1.0 |

1.0 |

383 |

7 |

4 |

4 |

9 |

1 |

201 |

1 |

151 |

44 |

19 |

1 |

1 |

37 |

4 |

867 |

204 |

23% |

| MAV_AD_0005 |

1.0 |

2.0 |

1.0 |

340 |

6 |

4 |

3 |

8 |

1 |

193 |

1 |

143 |

43 |

18 |

1 |

1 |

33 |

4 |

800 |

194 |

23% |

| MAV_AD_0005 |

2.0 |

3.0 |

1.0 |

330 |

6 |

4 |

3 |

8 |

1 |

207 |

1 |

152 |

45 |

19 |

1 |

1 |

31 |

4 |

813 |

205 |

24% |

| MAV_AD_0005 |

3.0 |

4.0 |

1.0 |

329 |

6 |

3 |

3 |

7 |

1 |

209 |

1 |

151 |

46 |

18 |

1 |

1 |

31 |

4 |

811 |

203 |

24% |

| MAV_AD_0005 |

4.0 |

5.0 |

1.0 |

295 |

5 |

3 |

3 |

7 |

1 |

196 |

1 |

138 |

43 |

16 |

1 |

1 |

28 |

4 |

740 |

186 |

24% |

| MAV_AD_0005 |

5.0 |

6.0 |

1.0 |

253 |

4 |

3 |

3 |

6 |

1 |

171 |

1 |

119 |

36 |

14 |

1 |

0 |

23 |

3 |

638 |

160 |

24% |

| MAV_AD_0005 |

6.0 |

7.0 |

1.0 |

257 |

4 |

2 |

2 |

5 |

1 |

154 |

0 |

99 |

32 |

11 |

1 |

0 |

20 |

3 |

591 |

135 |

22% |

| MAV_AD_0005 |

7.0 |

8.0 |

1.0 |

175 |

3 |

2 |

1 |

3 |

1 |

100 |

0 |

60 |

20 |

7 |

0 |

0 |

14 |

2 |

388 |

83 |

21% |

| MAV_AD_0005 |

8.0 |

9.0 |

1.0 |

156 |

3 |

2 |

1 |

3 |

1 |

90 |

0 |

54 |

17 |

6 |

0 |

0 |

15 |

2 |

350 |

74 |

20% |

| MAV_AD_0005 |

9.0 |

10.0 |

1.0 |

183 |

3 |

2 |

1 |

3 |

1 |

101 |

0 |

57 |

19 |

6 |

0 |

0 |

15 |

2 |

392 |

79 |

19% |

| MAV_AD_0005 |

10.0 |

11.0 |

1.0 |

258 |

3 |

2 |

2 |

4 |

1 |

140 |

0 |

70 |

24 |

8 |

1 |

0 |

16 |

2 |

530 |

98 |

18% |

| MAV_AD_0005 |

11.0 |

12.0 |

1.0 |

301 |

3 |

2 |

1 |

4 |

1 |

165 |

0 |

66 |

24 |

7 |

0 |

0 |

14 |

2 |

590 |

93 |

15% |

| MAV_AD_0005 |

12.0 |

13.0 |

1.0 |

329 |

4 |

2 |

2 |

5 |

1 |

200 |

0 |

67 |

25 |

8 |

1 |

0 |

21 |

2 |

667 |

96 |

14% |

| MAV_AD_0005 |

13.0 |

14.0 |

1.0 |

304 |

4 |

3 |

1 |

4 |

1 |

174 |

0 |

47 |

18 |

5 |

1 |

0 |

21 |

3 |

586 |

69 |

11% |

| MAV_AD_0005 |

14.0 |

15.0 |

1.0 |

325 |

5 |

3 |

1 |

5 |

1 |

186 |

1 |

50 |

19 |

6 |

1 |

1 |

25 |

4 |

631 |

74 |

11% |

| MAV_AD_0006 |

0.0 |

1.0 |

1.0 |

279 |

6 |

4 |

2 |

6 |

1 |

93 |

1 |

65 |

20 |

9 |

1 |

1 |

37 |

4 |

529 |

91 |

16% |

| MAV_AD_0006 |

1.0 |

2.0 |

1.0 |

291 |

6 |

4 |

2 |

6 |

1 |

96 |

1 |

66 |

20 |

9 |

1 |

1 |

37 |

4 |

545 |

93 |

16% |

| MAV_AD_0006 |

2.0 |

3.0 |

1.0 |

280 |

6 |

4 |

2 |

6 |

1 |

91 |

1 |

61 |

19 |

9 |

1 |

1 |

37 |

4 |

522 |

87 |

15% |

| MAV_AD_0006 |

3.0 |

4.0 |

1.0 |

352 |

7 |

4 |

2 |

6 |

1 |

101 |

1 |

67 |

21 |

9 |

1 |

1 |

39 |

5 |

617 |

95 |

14% |

| MAV_AD_0006 |

4.0 |

5.0 |

1.0 |

356 |

6 |

4 |

2 |

6 |

1 |

107 |

1 |

74 |

22 |

10 |

1 |

1 |

36 |

5 |

633 |

104 |

15% |

| MAV_AD_0006 |

5.0 |

6.0 |

1.0 |

363 |

7 |

4 |

3 |

8 |

1 |

141 |

1 |

96 |

30 |

13 |

1 |

1 |

37 |

4 |

708 |

133 |

18% |

| MAV_AD_0006 |

6.0 |

7.0 |

1.0 |

372 |

7 |

4 |

3 |

9 |

1 |

162 |

1 |

116 |

35 |

16 |

1 |

1 |

36 |

4 |

767 |

159 |

20% |

| MAV_AD_0006 |

7.0 |

8.0 |

1.0 |

413 |

7 |

4 |

4 |

10 |

1 |

194 |

1 |

141 |

43 |

19 |

1 |

1 |

37 |

4 |

880 |

192 |

21% |

| MAV_AD_0006 |

8.0 |

9.0 |

1.0 |

431 |

8 |

4 |

4 |

11 |

1 |

210 |

1 |

158 |

47 |

22 |

1 |

1 |

37 |

4 |

940 |

214 |

22% |

| MAV_AD_0006 |

9.0 |

10.0 |

1.0 |

427 |

8 |

4 |

4 |

11 |

1 |

214 |

1 |

166 |

49 |

23 |

1 |

1 |

37 |

4 |

953 |

225 |

23% |

| MAV_AD_0006 |

10.0 |

11.0 |

1.0 |

410 |

7 |

4 |

4 |

10 |

1 |

203 |

1 |

159 |

47 |

22 |

1 |

1 |

36 |

4 |

910 |

214 |

23% |

| MAV_AD_0007 |

0.0 |

1.0 |

1.0 |

298 |

6 |

4 |

2 |

6 |

1 |

103 |

1 |

71 |

22 |

10 |

1 |

1 |

37 |

5 |

568 |

100 |

16% |

| MAV_AD_0007 |

1.0 |

2.0 |

1.0 |

536 |

7 |

4 |

3 |

8 |

1 |

194 |

1 |

107 |

36 |

14 |

1 |

1 |

36 |

4 |

952 |

151 |

15% |

| MAV_AD_0007 |

2.0 |

3.0 |

1.0 |

326 |

7 |

5 |

2 |

7 |

1 |

104 |

1 |

68 |

21 |

10 |

1 |

1 |

41 |

5 |

597 |

96 |

15% |

| MAV_AD_0007 |

3.0 |

4.0 |

1.0 |

338 |

6 |

4 |

2 |

6 |

1 |

99 |

1 |

67 |

21 |

9 |

1 |

1 |

37 |

5 |

598 |

95 |

15% |

| MAV_AD_0007 |

4.0 |

5.0 |

1.0 |

333 |

6 |

4 |

2 |

7 |

1 |

119 |

1 |

83 |

25 |

12 |

1 |

1 |

37 |

4 |

636 |

116 |

17% |

| MAV_AD_0007 |

5.0 |

6.0 |

1.0 |

351 |

7 |

4 |

2 |

8 |

1 |

140 |

1 |

96 |

29 |

12 |

1 |

1 |

38 |

5 |

696 |

133 |

18% |

| MAV_AD_0007 |

6.0 |

7.0 |

1.0 |

341 |

7 |

4 |

3 |

8 |

1 |

147 |

1 |

103 |

32 |

14 |

1 |

1 |

38 |

4 |

704 |

143 |

19% |

| MAV_AD_0007 |

7.0 |

8.0 |

1.0 |

335 |

6 |

4 |

3 |

8 |

1 |

156 |

1 |

110 |

33 |

15 |

1 |

1 |

36 |

4 |

714 |

150 |

20% |

| MAV_AD_0007 |

8.0 |

9.0 |

1.0 |

353 |

7 |

4 |

3 |

9 |

1 |

171 |

1 |

124 |

37 |

16 |

1 |

1 |

36 |

4 |

768 |

169 |

21% |

| MAV_AD_0007 |

9.0 |

10.4 |

1.4 |

358 |

7 |

4 |

3 |

9 |

1 |

178 |

1 |

130 |

39 |

18 |

1 |

1 |

35 |

4 |

789 |

177 |

21% |

| MAV_AD_0008 |

0.0 |

1.0 |

1.0 |

310 |

6 |

4 |

2 |

7 |

1 |

122 |

1 |

86 |

26 |

12 |

1 |

1 |

34 |

4 |

616 |

119 |

18% |

| MAV_AD_0008 |

1.0 |

2.0 |

1.0 |

286 |

6 |

4 |

2 |

6 |

1 |

114 |

1 |

80 |

24 |

11 |

1 |

1 |

35 |

4 |

577 |

111 |

18% |

| MAV_AD_0008 |

2.0 |

3.0 |

1.0 |

334 |

6 |

4 |

2 |

7 |

1 |

119 |

1 |

82 |

25 |

12 |

1 |

1 |

37 |

4 |

637 |

115 |

17% |

| MAV_AD_0008 |

3.0 |

4.0 |

1.0 |

371 |

6 |

4 |

3 |

7 |

1 |

133 |

1 |

93 |

28 |

13 |

1 |

1 |

38 |

5 |

704 |

129 |

17% |

| MAV_AD_0008 |

4.0 |

5.0 |

1.0 |

376 |

7 |

4 |

3 |

8 |

1 |

153 |

1 |

106 |

32 |

14 |

1 |

1 |

37 |

5 |

749 |

146 |

18% |

| MAV_AD_0008 |

5.0 |

6.0 |

1.0 |

378 |

6 |

4 |

3 |

8 |

1 |

165 |

1 |

120 |

36 |

16 |

1 |

1 |

35 |

4 |

780 |

163 |

20% |

| MAV_AD_0008 |

6.0 |

7.0 |

1.0 |

356 |

6 |

4 |

3 |

8 |

1 |

169 |

1 |

123 |

37 |

17 |

1 |

1 |

32 |

4 |

762 |

168 |

21% |

| MAV_AD_0008 |

7.0 |

8.0 |

1.0 |

189 |

3 |

2 |

2 |

4 |

1 |

106 |

0 |

75 |

23 |

10 |

1 |

0 |

15 |

2 |

432 |

101 |

23% |

| MAV_AD_0008 |

8.0 |

9.0 |

1.0 |

213 |

3 |

2 |

2 |

5 |

1 |

112 |

0 |

77 |

24 |

10 |

1 |

0 |

16 |

2 |

468 |

105 |

22% |

| MAV_AD_0008 |

9.0 |

10.0 |

1.0 |

256 |

3 |

2 |

2 |

5 |

1 |

128 |

0 |

80 |

26 |

10 |

1 |

0 |

18 |

2 |

534 |

110 |

20% |

| MAV_AD_0008 |

10.0 |

11.0 |

1.0 |

289 |

4 |

2 |

2 |

5 |

1 |

140 |

0 |

88 |

28 |

10 |

1 |

0 |

18 |

2 |

591 |

120 |

20% |

| MAV_AD_0009 |

0.0 |

1.0 |

1.0 |

736 |

7 |

3 |

3 |

10 |

1 |

192 |

1 |

109 |

35 |

15 |

1 |

1 |

34 |

4 |

1151 |

152 |

12% |

| MAV_AD_0009 |

1.0 |

2.0 |

1.0 |

1089 |

8 |

4 |

4 |

11 |

1 |

255 |

1 |

136 |

46 |

18 |

1 |

1 |

37 |

4 |

1617 |

191 |

11% |

| MAV_AD_0009 |

2.0 |

3.0 |

1.0 |

961 |

8 |

4 |

4 |

11 |

1 |

263 |

1 |

137 |

46 |

19 |

1 |

1 |

37 |

4 |

1497 |

192 |

12% |

| MAV_AD_0009 |

3.0 |

4.0 |

1.0 |

550 |

6 |

3 |

3 |

8 |

1 |

195 |

0 |

96 |

31 |

13 |

1 |

0 |

29 |

3 |

940 |

135 |

14% |

| MAV_AD_0009 |

4.0 |

5.0 |

1.0 |

577 |

6 |

3 |

3 |

8 |

1 |

206 |

0 |

98 |

33 |

13 |

1 |

0 |

30 |

3 |

984 |

138 |

13% |

| MAV_AD_0009 |

5.0 |

6.0 |

1.0 |

566 |

6 |

3 |

3 |

8 |

1 |

204 |

0 |

100 |

34 |

13 |

1 |

0 |

31 |

3 |

975 |

141 |

14% |

| MAV_AD_0009 |

6.0 |

7.0 |

1.0 |

753 |

6 |

3 |

3 |

8 |

1 |

214 |

1 |

111 |

37 |

14 |

1 |

1 |

33 |

4 |

1190 |

155 |

12% |

| MAV_AD_0009 |

7.0 |

8.0 |

1.0 |

747 |

6 |

3 |

3 |

8 |

1 |

212 |

0 |

108 |

36 |

14 |

1 |

0 |

30 |

3 |

1172 |

151 |

12% |

| MAV_AD_0009 |

8.0 |

9.0 |

1.0 |

658 |

7 |

4 |

3 |

8 |

1 |

193 |

1 |

100 |

33 |

13 |

1 |

1 |

34 |

4 |

1060 |

141 |

13% |

| MAV_AD_0010 |

0.0 |

1.0 |

1.0 |

321 |

6 |

4 |

2 |

7 |

1 |

129 |

1 |

76 |

24 |

11 |

1 |

1 |

36 |

4 |

623 |

108 |

16% |

| MAV_AD_0010 |

1.0 |

2.0 |

1.0 |

654 |

7 |

4 |

3 |

8 |

1 |

180 |

1 |

95 |

32 |

12 |

1 |

1 |

39 |

4 |

1042 |

134 |

12% |

| MAV_AD_0010 |

2.0 |

3.0 |

1.0 |

1057 |

8 |

4 |

3 |

9 |

1 |

243 |

1 |

121 |

42 |

15 |

1 |

1 |

38 |

4 |

1548 |

171 |

10% |

| MAV_AD_0010 |

3.0 |

4.0 |

1.0 |

617 |

7 |

3 |

4 |

11 |

1 |

265 |

0 |

142 |

46 |

18 |

1 |

0 |

35 |

3 |

1156 |

197 |

16% |

| MAV_AD_0010 |

4.0 |

5.0 |

1.0 |

578 |

8 |

4 |

4 |

10 |

1 |

252 |

1 |

151 |

48 |

19 |

1 |

1 |

40 |

4 |

1123 |

208 |

18% |

| MAV_AD_0010 |

5.0 |

6.0 |

1.0 |

429 |

8 |

5 |

3 |

8 |

2 |

183 |

1 |

124 |

39 |

15 |

1 |

1 |

44 |

5 |

868 |

172 |

19% |

| MAV_AD_0010 |

6.0 |

7.0 |

1.0 |

358 |

7 |

5 |

3 |

7 |

1 |

156 |

1 |

112 |

33 |

14 |

1 |

1 |

42 |

5 |

745 |

154 |

20% |

| MAV_AD_0010 |

7.0 |

8.0 |

1.0 |

349 |

7 |

4 |

3 |

8 |

1 |

151 |

1 |

119 |

35 |

15 |

1 |

1 |

41 |

5 |

741 |

163 |

21% |

| MAV_AD_0010 |

8.0 |

9.0 |

1.0 |

301 |

8 |

5 |

3 |

8 |

2 |

142 |

1 |

115 |

33 |

15 |

1 |

1 |

47 |

5 |

686 |

156 |

21% |

| MAV_AD_0011 |

0.0 |

1.0 |

1.0 |

193 |

6 |

4 |

1 |

5 |

1 |

67 |

1 |

43 |

13 |

7 |

1 |

1 |

40 |

5 |

389 |

63 |

14% |

| MAV_AD_0011 |

1.0 |

2.0 |

1.0 |

193 |

7 |

4 |

1 |

5 |

1 |

67 |

1 |

42 |

13 |

7 |

1 |

1 |

43 |

5 |

391 |

62 |

14% |

| MAV_AD_0011 |

2.0 |

3.0 |

1.0 |

222 |

7 |

5 |

1 |

5 |

1 |

63 |

1 |

39 |

12 |

6 |

1 |

1 |

44 |

5 |

412 |

58 |

12% |

| MAV_AD_0011 |

3.0 |

4.0 |

1.0 |

244 |

7 |

4 |

1 |

5 |

1 |

66 |

1 |

41 |

13 |

6 |

1 |

1 |

41 |

5 |

436 |

61 |

12% |

| MAV_AD_0011 |

4.0 |

5.0 |

1.0 |

205 |

6 |

4 |

1 |

5 |

1 |

64 |

1 |

40 |

12 |

6 |

1 |

1 |

38 |

4 |

389 |

59 |

14% |

| MAV_AD_0011 |

5.0 |

6.0 |

1.0 |

200 |

6 |

4 |

1 |

5 |

1 |

72 |

1 |

46 |

14 |

7 |

1 |

1 |

37 |

4 |

400 |

67 |

15% |

| MAV_AD_0011 |

6.0 |

7.0 |

1.0 |

193 |

6 |

4 |

2 |

5 |

1 |

80 |

1 |

52 |

16 |

8 |

1 |

1 |

36 |

4 |

409 |

75 |

17% |

| MAV_AD_0012 |

0.0 |

1.0 |

1.0 |

432 |

7 |

4 |

2 |

7 |

1 |

140 |

1 |

69 |

23 |

9 |

1 |

1 |

36 |

4 |

736 |

99 |

12% |

| MAV_AD_0012 |

1.0 |

2.0 |

1.0 |

505 |

7 |

4 |

3 |

8 |

1 |

167 |

1 |

82 |

27 |

12 |

1 |

1 |

35 |

4 |

858 |

118 |

13% |

| MAV_AD_0012 |

2.0 |

3.0 |

1.0 |

562 |

7 |

4 |

3 |

8 |

1 |

183 |

1 |

88 |

29 |

12 |

1 |

1 |

40 |

4 |

946 |

126 |

12% |

| MAV_AD_0012 |

3.0 |

4.0 |

1.0 |

920 |

11 |

5 |

7 |

17 |

2 |

355 |

1 |

199 |

64 |

26 |

2 |

1 |

48 |

5 |

1662 |

276 |

16% |

| MAV_AD_0012 |

4.0 |

5.0 |

1.0 |

1494 |

15 |

5 |

10 |

26 |

2 |

611 |

1 |

279 |

94 |

37 |

3 |

1 |

66 |

4 |

2647 |

391 |

14% |

| MAV_AD_0012 |

5.0 |

6.0 |

1.0 |

2303 |

14 |

5 |

9 |

23 |

2 |

696 |

0 |

276 |

97 |

36 |

3 |

1 |

59 |

4 |

3526 |

389 |

11% |

| MAV_AD_0012 |

6.0 |

7.0 |

1.0 |

5014 |

14 |

5 |

9 |

24 |

2 |

760 |

1 |

286 |

101 |

37 |

3 |

1 |

60 |

4 |

6319 |

403 |

6% |

| MAV_AD_0012 |

7.0 |

8.0 |

1.0 |

3057 |

30 |

9 |

23 |

63 |

4 |

1147 |

1 |

670 |

201 |

91 |

7 |

1 |

96 |

5 |

5404 |

908 |

16% |

| MAV_AD_0012 |

8.0 |

9.0 |

1.0 |

2448 |

16 |

5 |

13 |

33 |

2 |

625 |

0 |

377 |

116 |

54 |

3 |

0 |

47 |

3 |

3744 |

513 |

13% |

| MAV_AD_0012 |

9.0 |

10.0 |

1.0 |

3065 |

54 |

22 |

34 |

95 |

9 |

1684 |

2 |

930 |

289 |

129 |

11 |

3 |

280 |

14 |

6620 |

1284 |

18% |

| MAV_AD_0012 |

10.0 |

11.0 |

1.0 |

4890 |

50 |

14 |

49 |

110 |

7 |

1835 |

1 |

1513 |

465 |

208 |

11 |

1 |

152 |

7 |

9313 |

2039 |

21% |

| MAV_AD_0012 |

11.0 |

12.0 |

1.0 |

4715 |

52 |

14 |

56 |

121 |

7 |

2096 |

1 |

1747 |

537 |

235 |

12 |

1 |

163 |

8 |

9764 |

2348 |

23% |

| MAV_AD_0012 |

12.0 |

13.0 |

1.0 |

4879 |

69 |

22 |

64 |

149 |

10 |

2347 |

2 |

1973 |

590 |

264 |

15 |

2 |

256 |

13 |

10654 |

2647 |

24% |

| MAV_AD_0012 |

13.0 |

14.0 |

1.0 |

4762 |

72 |

21 |

71 |

162 |

9 |

2417 |

1 |

2151 |

625 |

290 |

16 |

2 |

229 |

11 |

10840 |

2864 |

26% |

| MAV_AD_0013 |

0.0 |

1.0 |

1.0 |

664 |

7 |

4 |

4 |

10 |

1 |

207 |

0 |

117 |

37 |

16 |

1 |

1 |

34 |

3 |

1106 |

162 |

14% |

| MAV_AD_0013 |

1.0 |

2.0 |

1.0 |

903 |

6 |

3 |

3 |

9 |

1 |

206 |

0 |

98 |

33 |

13 |

1 |

0 |

31 |

3 |

1312 |

138 |

10% |

| MAV_AD_0013 |

2.0 |

3.0 |

1.0 |

1107 |

7 |

3 |

4 |

10 |

1 |

260 |

0 |

111 |

38 |

14 |

1 |

0 |

35 |

3 |

1596 |

158 |

9% |

| MAV_AD_0013 |

3.0 |

4.0 |

1.0 |

2623 |

9 |

4 |

5 |

15 |

1 |

379 |

0 |

156 |

52 |

21 |

2 |

0 |

38 |

3 |

3307 |

219 |

6% |

| MAV_AD_0013 |

4.0 |

5.0 |

1.0 |

4381 |

20 |

6 |

14 |

38 |

3 |

835 |

1 |

420 |

133 |

56 |

4 |

1 |

68 |

4 |

5984 |

576 |

9% |

| MAV_AD_0013 |

5.0 |

6.0 |

1.0 |

4772 |

37 |

10 |

34 |

80 |

5 |

1601 |

1 |

1023 |

312 |

137 |

8 |

1 |

100 |

5 |

8127 |

1380 |

16% |

| MAV_AD_0013 |

6.0 |

7.0 |

1.0 |

4334 |

60 |

17 |

59 |

137 |

8 |

2249 |

1 |

1856 |

571 |

249 |

14 |

2 |

204 |

9 |

9770 |

2501 |

25% |

| MAV_AD_0013 |

7.0 |

8.0 |

1.0 |

3463 |

43 |

12 |

43 |

100 |

6 |

1771 |

1 |

1349 |

422 |

180 |

10 |

1 |

138 |

6 |

7546 |

1824 |

23% |

| MAV_AD_0013 |

8.0 |

9.0 |

1.0 |

4831 |

52 |

13 |

67 |

138 |

6 |

3261 |

1 |

2431 |

770 |

295 |

13 |

1 |

141 |

7 |

12027 |

3266 |

27% |

| MAV_AD_0013 |

9.0 |

10.0 |

1.0 |

5510 |

78 |

23 |

86 |

180 |

10 |

3132 |

2 |

2882 |

858 |

372 |

18 |

3 |

284 |

13 |

13453 |

3836 |

28% |

| MAV_AD_0014 |

0.0 |

1.0 |

1.0 |

330 |

7 |

4 |

2 |

7 |

1 |

109 |

1 |

74 |

23 |

10 |

1 |

1 |

43 |

4 |

618 |

105 |

16% |

| MAV_AD_0014 |

1.0 |

2.0 |

1.0 |

359 |

7 |

5 |

2 |

8 |

1 |

117 |

1 |

79 |

25 |

11 |

1 |

1 |

46 |

5 |

667 |

112 |

15% |

| MAV_AD_0014 |

2.0 |

3.0 |

1.0 |

315 |

7 |

5 |

2 |

6 |

1 |

102 |

1 |

66 |

21 |

9 |

1 |

1 |

45 |

5 |

587 |

95 |

15% |

| MAV_AD_0014 |

3.0 |

4.0 |

1.0 |

413 |

8 |

5 |

3 |

8 |

2 |

127 |

1 |

87 |

27 |

12 |

1 |

1 |

49 |

5 |

747 |

123 |

15% |

| MAV_AD_0014 |

4.0 |

5.0 |

1.0 |

371 |

7 |

4 |

2 |

6 |

1 |

106 |

1 |

68 |

21 |

9 |

1 |

1 |

44 |

5 |

648 |

97 |

14% |

| MAV_AD_0014 |

5.0 |

6.0 |

1.0 |

375 |

7 |

5 |

2 |

7 |

1 |

115 |

1 |

78 |

24 |

11 |

1 |

1 |

45 |

5 |

679 |

111 |

15% |

| MAV_AD_0015 |

0.0 |

1.0 |

1.0 |

511 |

7 |

4 |

2 |

8 |

1 |

154 |

1 |

80 |

26 |

11 |

1 |

1 |

39 |

4 |

850 |

114 |

12% |

| MAV_AD_0015 |

1.0 |

2.0 |

1.0 |

519 |

7 |

4 |

3 |

8 |

1 |

156 |

1 |

78 |

26 |

11 |

1 |

1 |

38 |

4 |

857 |

112 |

12% |

| MAV_AD_0015 |

2.0 |

3.0 |

1.0 |

531 |

7 |

4 |

3 |

7 |

1 |

170 |

1 |

82 |

27 |

11 |

1 |

1 |

36 |

4 |

885 |

117 |

12% |

| MAV_AD_0015 |

3.0 |

4.0 |

1.0 |

595 |

7 |

4 |

3 |

9 |

1 |

195 |

1 |

99 |

32 |

14 |

1 |

1 |

39 |

4 |

1006 |

140 |

13% |

| MAV_AD_0015 |

4.0 |

5.0 |

1.0 |

602 |

7 |

4 |

3 |

8 |

1 |

194 |

1 |

90 |

30 |

12 |

1 |

1 |

39 |

4 |

998 |

129 |

12% |

| MAV_AD_0015 |

5.0 |

6.0 |

1.0 |

655 |

7 |

3 |

3 |

8 |

1 |

241 |

0 |

94 |

33 |

12 |

1 |

1 |

35 |

4 |

1097 |

135 |

12% |

| MAV_AD_0015 |

6.0 |

7.0 |

1.0 |

682 |

7 |

4 |

3 |

8 |

1 |

239 |

1 |

96 |

34 |

13 |

1 |

1 |

35 |

4 |

1130 |

138 |

11% |

| MAV_AD_0016 |

0.0 |

1.0 |

1.0 |

440 |

7 |

4 |

3 |

8 |

1 |

171 |

1 |

116 |

36 |

16 |

1 |

1 |

41 |

5 |

850 |

160 |

18% |

| MAV_AD_0016 |

1.0 |

2.0 |

1.0 |

428 |

7 |

4 |

3 |

8 |

1 |

163 |

1 |

108 |

33 |

14 |

1 |

1 |

41 |

4 |

815 |

149 |

17% |

| MAV_AD_0016 |

2.0 |

3.0 |

1.0 |

455 |

7 |

4 |

3 |

9 |

1 |

182 |

1 |

122 |

38 |

16 |

1 |

1 |

41 |

5 |

884 |

168 |

18% |

| MAV_AD_0016 |

3.0 |

4.0 |

1.0 |

391 |

7 |

4 |

3 |

9 |

1 |

193 |

1 |

140 |

43 |

18 |

1 |

1 |

35 |

4 |

850 |

190 |

22% |

| MAV_AD_0016 |

4.0 |

5.0 |

1.0 |

407 |

7 |

4 |

4 |

10 |

1 |

219 |

1 |

157 |

47 |

19 |

1 |

1 |

38 |

4 |

920 |

213 |

22% |

| MAV_AD_0016 |

5.0 |

6.0 |

1.0 |

427 |

7 |

4 |

4 |

10 |

1 |

214 |

1 |

153 |

47 |

19 |

1 |

1 |

40 |

4 |

933 |

208 |

21% |

| MAV_AD_0016 |

6.0 |

7.0 |

1.0 |

356 |

6 |

3 |

3 |

9 |

1 |

198 |

1 |

146 |

44 |

18 |

1 |

0 |

32 |

3 |

820 |

197 |

23% |

| MAV_AD_0016 |

7.0 |

8.0 |

1.0 |

336 |

5 |

3 |

3 |

8 |

1 |

193 |

1 |

138 |

43 |

16 |

1 |

0 |

29 |

3 |

782 |

187 |

23% |

| MAV_AD_0016 |

8.0 |

9.0 |

1.0 |

317 |

5 |

3 |

3 |

8 |

1 |

179 |

0 |

127 |

39 |

15 |

1 |

0 |

29 |

3 |

731 |

172 |

23% |

| MAV_AD_0016 |

9.0 |

10.0 |

1.0 |

187 |

3 |

2 |

1 |

4 |

1 |

101 |

0 |

65 |

21 |

7 |

0 |

0 |

16 |

2 |

411 |

90 |

21% |

| MAV_AD_0016 |

10.0 |

11.0 |

1.0 |

192 |

3 |

2 |

1 |

3 |

0 |

101 |

0 |

64 |

21 |

7 |

0 |

0 |

14 |

2 |

411 |

89 |

21% |

| MAV_AD_0016 |

11.0 |

12.0 |

1.0 |

144 |

2 |

1 |

1 |

3 |

0 |

79 |

0 |

53 |

16 |

6 |

0 |

0 |

13 |

1 |

322 |

72 |

22% |

| MAV_AD_0017 |

0.0 |

1.0 |

1.0 |

2134 |

28 |

9 |

25 |

60 |

4 |

981 |

1 |

757 |

220 |

105 |

6 |

1 |

99 |

6 |

4437 |

1011 |

22% |

| MAV_AD_0017 |

1.0 |

2.0 |

1.0 |

2873 |

41 |

12 |

38 |

92 |

6 |

1332 |

1 |

1087 |

311 |

151 |

9 |

1 |

137 |

6 |

6097 |

1448 |

23% |

| MAV_AD_0017 |

2.0 |

3.0 |

1.0 |

2105 |

40 |

12 |

35 |

87 |

6 |

1192 |

1 |

996 |

277 |

138 |

9 |

1 |

154 |

6 |

5059 |

1321 |

25% |

| MAV_AD_0017 |

3.0 |

4.0 |

1.0 |

2408 |

37 |

13 |

31 |

73 |

5 |

1090 |

1 |

871 |

249 |

121 |

8 |

1 |

148 |

7 |

5063 |

1165 |

22% |

| MAV_AD_0017 |

4.0 |

5.0 |

1.0 |

1938 |

28 |

9 |

26 |

60 |

4 |

889 |

1 |

709 |

203 |

98 |

6 |

1 |

119 |

6 |

4097 |

947 |

22% |

| MAV_AD_0017 |

5.0 |

6.0 |

1.0 |

2069 |

28 |

9 |

27 |

62 |

4 |

968 |

1 |

765 |

219 |

106 |

6 |

1 |

105 |

4 |

4373 |

1019 |

23% |

| MAV_AD_0017 |

6.0 |

7.0 |

1.0 |

2102 |

27 |

8 |

27 |

64 |

4 |

995 |

1 |

785 |

225 |

109 |

6 |

1 |

104 |

4 |

4463 |

1044 |

23% |

| MAV_AD_0017 |

7.0 |

8.0 |

1.0 |

2240 |

27 |

7 |

27 |

64 |

4 |

1022 |

0 |

808 |

232 |

111 |

6 |

1 |

89 |

4 |

4642 |

1073 |

22% |

| MAV_AD_0017 |

8.0 |

9.0 |

1.0 |

2011 |

25 |

7 |

25 |

59 |

3 |

939 |

0 |

739 |

212 |

101 |

6 |

1 |

83 |

3 |

4215 |

982 |

23% |

| MAV_AD_0017 |

9.0 |

10.0 |

1.0 |

1978 |

24 |

7 |

25 |

56 |

3 |

914 |

0 |

721 |

208 |

99 |

6 |

1 |

78 |

4 |

4123 |

959 |

23% |

| MAV_AD_0017 |

10.0 |

11.0 |

1.0 |

1813 |

23 |

6 |

23 |

52 |

3 |

840 |

0 |

663 |

190 |

91 |

5 |

1 |

73 |

3 |

3786 |

881 |

23% |

| MAV_AD_0017 |

11.0 |

12.0 |

1.0 |

1760 |

22 |

6 |

22 |

51 |

3 |

805 |

0 |

638 |

182 |

88 |

5 |

1 |

73 |

3 |

3659 |

847 |

22% |

| MAV_AD_0022 |

0.0 |

1.0 |

1.0 |

247 |

4 |

3 |

1 |

4 |

1 |

84 |

0 |

52 |

17 |

7 |

1 |

0 |

26 |

3 |

451 |

74 |

15% |

| MAV_AD_0022 |

1.0 |

2.0 |

1.0 |

291 |

4 |

3 |

2 |

4 |

1 |

99 |

0 |

58 |

19 |

8 |

1 |

0 |

27 |

3 |

519 |

82 |

15% |

| MAV_AD_0022 |

2.0 |

3.0 |

1.0 |

303 |

4 |

3 |

2 |

5 |

1 |

103 |

0 |

62 |

20 |

8 |

1 |

0 |

26 |

3 |

539 |

87 |

15% |

| MAV_AD_0022 |

3.0 |

4.0 |

1.0 |

344 |

4 |

3 |

2 |

5 |

1 |

120 |

0 |

73 |

23 |

9 |

1 |

0 |

25 |

3 |

612 |

101 |

16% |

| MAV_AD_0022 |

4.0 |

5.0 |

1.0 |

286 |

4 |

2 |

2 |

4 |

1 |

116 |

0 |

67 |

22 |

8 |

1 |

0 |

22 |

3 |

537 |

93 |

17% |

| MAV_AD_0022 |

5.0 |

6.0 |

1.0 |

224 |

3 |

2 |

1 |

3 |

1 |

107 |

0 |

58 |

19 |

6 |

0 |

0 |

17 |

2 |

445 |

81 |

17% |

| MAV_AD_0022 |

6.0 |

7.0 |

1.0 |

231 |

3 |

2 |

1 |

4 |

1 |

106 |

0 |

60 |

20 |

7 |

0 |

0 |

19 |

2 |

457 |

84 |

18% |

| MAV_AD_0022 |

7.0 |

8.0 |

1.0 |

284 |

4 |

2 |

2 |

4 |

1 |

130 |

0 |

68 |

23 |

8 |

1 |

0 |

20 |

3 |

549 |

96 |

17% |

| MAV_AD_0022 |

8.0 |

9.0 |

1.0 |

251 |

4 |

2 |

1 |

4 |

1 |

129 |

0 |

67 |

22 |

8 |

1 |

0 |

22 |

3 |

515 |

93 |

17% |

| MAV_AD_0022 |

9.0 |

10.0 |

1.0 |

206 |

3 |

2 |

1 |

3 |

1 |

123 |

0 |

49 |

16 |

6 |

1 |

0 |

19 |

2 |

432 |

68 |

15% |

| MAV_AD_0022 |

10.0 |

11.0 |

1.0 |

185 |

4 |

3 |

1 |

3 |

1 |

94 |

0 |

38 |

13 |

5 |

1 |

0 |

25 |

3 |

375 |

55 |

14% |

| MAV_AD_0022 |

11.0 |

12.0 |

1.0 |

209 |

4 |

3 |

1 |

4 |

1 |

128 |

0 |

54 |

18 |

7 |

1 |

0 |

25 |

3 |

458 |

77 |

16% |

| MAV_AD_0023 |

0.0 |

1.0 |

1.0 |

232 |

4 |

2 |

1 |

4 |

1 |

79 |

0 |

48 |

15 |

6 |

1 |

0 |

22 |

3 |

419 |

68 |

15% |

| MAV_AD_0023 |

1.0 |

2.0 |

1.0 |

249 |

4 |

3 |

1 |

4 |

1 |

81 |

0 |

47 |

15 |

6 |

1 |

0 |

25 |

3 |

439 |

66 |

14% |

| MAV_AD_0023 |

2.0 |

3.0 |

1.0 |

284 |

4 |

3 |

1 |

4 |

1 |

86 |

0 |

50 |

16 |

6 |

1 |

0 |

26 |

3 |

486 |

71 |

14% |

| MAV_AD_0023 |

3.0 |

4.0 |

1.0 |

349 |

4 |

2 |

1 |

4 |

1 |

91 |

0 |

52 |

17 |

6 |

1 |

0 |

23 |

3 |

555 |

73 |

12% |

| MAV_AD_0023 |

4.0 |

5.0 |

1.0 |

329 |

4 |

2 |

1 |

4 |

1 |

88 |

0 |

51 |

16 |

6 |

1 |

0 |

25 |

3 |

531 |

71 |

13% |

| MAV_AD_0023 |

5.0 |

6.0 |

1.0 |

272 |

3 |

2 |

1 |

3 |

1 |

83 |

0 |

47 |

15 |

6 |

1 |

0 |

19 |

2 |

455 |

65 |

14% |

| MAV_AD_0024 |

0.0 |

1.0 |

1.0 |

582 |

9 |

5 |

4 |

10 |

2 |

186 |

1 |

107 |

35 |

15 |

1 |

1 |

44 |

5 |

1005 |

152 |

14% |

| MAV_AD_0024 |

1.0 |

2.0 |

1.0 |

595 |

8 |

4 |

4 |

10 |

1 |

178 |

1 |

109 |

35 |

15 |

1 |

1 |

41 |

5 |

1008 |

153 |

14% |

| MAV_AD_0024 |

2.0 |

3.0 |

1.0 |

626 |

8 |

4 |

3 |

10 |

1 |

170 |

1 |

111 |

34 |

15 |

1 |

1 |

38 |

4 |

1027 |

154 |

14% |

| MAV_AD_0024 |

3.0 |

4.0 |

1.0 |

376 |

5 |

3 |

2 |

6 |

1 |

112 |

0 |

62 |

20 |

9 |

1 |

0 |

27 |

3 |

628 |

88 |

13% |

| MAV_AD_0024 |

4.0 |

5.0 |

1.0 |

479 |

7 |

4 |

3 |

8 |

1 |

143 |

1 |

77 |

26 |

11 |

1 |

1 |

41 |

4 |

807 |

112 |

13% |

| MAV_AD_0024 |

5.0 |

6.0 |

1.0 |

277 |

6 |

4 |

2 |

6 |

1 |

110 |

1 |

52 |

18 |

7 |

1 |

1 |

38 |

4 |

526 |

77 |

13% |

| MAV_AD_0024 |

6.0 |

7.0 |

1.0 |

482 |

10 |

6 |

3 |

9 |

2 |

225 |

1 |

84 |

32 |

10 |

1 |

1 |

62 |

6 |

934 |

127 |

12% |

| MAV_AD_0024 |

7.0 |

8.0 |

1.0 |

3163 |

37 |

14 |

27 |

70 |

6 |

1608 |

1 |

836 |

271 |

107 |

7 |

2 |

141 |

11 |

6301 |

1152 |

18% |

| MAV_AD_0024 |

8.0 |

9.0 |

1.0 |

1831 |

24 |

8 |

14 |

38 |

3 |

915 |

1 |

424 |

144 |

55 |

4 |

1 |

76 |

6 |

3543 |

596 |

16% |

| MAV_AD_0024 |

9.0 |

10.0 |

1.0 |

1302 |

18 |

7 |

11 |

30 |

3 |

575 |

1 |

315 |

102 |

43 |

3 |

1 |

73 |

5 |

2490 |

439 |

17% |

| MAV_AD_0025 |

0.0 |

1.0 |

1.0 |

863 |

7 |

4 |

3 |

9 |

1 |

224 |

1 |

105 |

36 |

13 |

1 |

1 |

38 |

4 |

1310 |

149 |

11% |

| MAV_AD_0025 |

1.0 |

2.0 |

1.0 |

932 |

7 |

4 |

3 |

9 |

1 |

228 |

0 |

110 |

37 |

14 |

1 |

1 |

36 |

4 |

1389 |

156 |

11% |

| MAV_AD_0025 |

2.0 |

3.0 |

1.0 |

1113 |

7 |

4 |

3 |

10 |

1 |

272 |

0 |

120 |

41 |

14 |

1 |

0 |

37 |

3 |

1628 |

170 |

10% |

| MAV_AD_0025 |

3.0 |

4.0 |

1.0 |

1736 |

9 |

4 |

6 |

16 |

2 |

474 |

0 |

198 |

68 |

24 |

2 |

0 |

41 |

3 |

2583 |

278 |

10% |

| MAV_AD_0025 |

4.0 |

5.0 |

1.0 |

3662 |

31 |

9 |

25 |

64 |

4 |

1279 |

1 |

805 |

249 |

104 |

7 |

1 |

105 |

5 |

6349 |

1091 |

17% |

| MAV_AD_0025 |

5.0 |

6.0 |

1.0 |

4739 |

34 |

9 |

33 |

78 |

4 |

1579 |

1 |

1106 |

350 |

140 |

8 |

1 |

96 |

5 |

8181 |

1497 |

18% |

| MAV_AD_0025 |

6.0 |

7.0 |

1.0 |

3596 |

35 |

9 |

32 |

77 |

5 |

1557 |

1 |

1070 |

333 |

132 |

8 |

1 |

104 |

5 |

6966 |

1446 |

20% |

| MAV_AD_0025 |

7.0 |

8.0 |

1.0 |

4251 |

58 |

14 |

53 |

138 |

7 |

2508 |

1 |

1823 |

546 |

224 |

13 |

1 |

162 |

8 |

9808 |

2440 |

24% |

| MAV_AD_0026 |

0.0 |

1.0 |

1.0 |

343 |

7 |

4 |

2 |

7 |

1 |

118 |

1 |

73 |

23 |

10 |

1 |

1 |

47 |

5 |

641 |

104 |

15% |

| MAV_AD_0026 |

1.0 |

2.0 |

1.0 |

335 |

6 |

4 |

2 |

6 |

1 |

111 |

1 |

69 |

22 |

9 |

1 |

1 |

36 |

4 |

607 |

98 |

15% |

| MAV_AD_0026 |

2.0 |

3.0 |

1.0 |

365 |

6 |

4 |

2 |

6 |

1 |

113 |

1 |

70 |

22 |

10 |

1 |

1 |

39 |

4 |

644 |

100 |

14% |

| MAV_AD_0026 |

3.0 |

4.0 |

1.0 |

381 |

6 |

4 |

2 |

6 |

1 |

115 |

1 |

71 |

22 |

10 |

1 |

1 |

38 |

4 |

663 |

100 |

14% |

| MAV_AD_0026 |

4.0 |

5.0 |

1.0 |

405 |

6 |

4 |

2 |

6 |

1 |

117 |

1 |

72 |

23 |

10 |

1 |

1 |

39 |

5 |

692 |

102 |

14% |

| MAV_AD_0026 |

5.0 |

6.0 |

1.0 |

435 |

7 |

4 |

2 |

7 |

1 |

143 |

1 |

93 |

30 |

12 |

1 |

1 |

43 |

5 |

785 |

131 |

16% |

| MAV_AD_0027 |

0.0 |

1.0 |

1.0 |

991 |

9 |

5 |

6 |

15 |

2 |

333 |

1 |

201 |

64 |

28 |

2 |

1 |

40 |

4 |

1700 |

276 |

16% |

| MAV_AD_0027 |

1.0 |

2.0 |

1.0 |

812 |

10 |

4 |

7 |

17 |

2 |

376 |

1 |

232 |

74 |

32 |

2 |

1 |

39 |

4 |

1611 |

317 |

19% |

| MAV_AD_0027 |

2.0 |

3.0 |

1.0 |

2337 |

27 |

8 |

26 |

57 |

3 |

1011 |

1 |

772 |

229 |

110 |

6 |

1 |

81 |

5 |

4674 |

1034 |

21% |

| MAV_AD_0027 |

3.0 |

4.0 |

1.0 |

3981 |

53 |

16 |

52 |

116 |

7 |

1849 |

1 |

1465 |

443 |

211 |

12 |

2 |

177 |

9 |

8393 |

1972 |

23% |

| MAV_AD_0027 |

4.0 |

5.0 |

1.0 |

4470 |

54 |

14 |

61 |

129 |

7 |

2184 |

1 |

1770 |

542 |

256 |

13 |

1 |

150 |

7 |

9659 |

2379 |

24% |

| MAV_AD_0027 |

5.0 |

6.0 |

1.0 |

5276 |

59 |

13 |

72 |

149 |

7 |

2657 |

1 |

2204 |

665 |

301 |

14 |

1 |

135 |

6 |

11561 |

2942 |

25% |

| MAV_AD_0027 |

6.0 |

7.0 |

1.0 |

4543 |

47 |

11 |

59 |

122 |

6 |

2153 |

1 |

1740 |

539 |

248 |

11 |

1 |

111 |

5 |

9595 |

2337 |

24% |

| MAV_AD_0027 |

7.0 |

8.0 |

1.0 |

5366 |

75 |

17 |

81 |

185 |

9 |

2598 |

1 |

2295 |

662 |

330 |

18 |

2 |

181 |

8 |

11827 |

3050 |

25% |

| MAV_AD_0027 |

8.0 |

9.0 |

1.0 |

5485 |

78 |

20 |

79 |

182 |

10 |

2565 |

1 |

2215 |

642 |

316 |

18 |

2 |

198 |

9 |

11819 |

2953 |

24% |

| MAV_AD_0027 |

9.0 |

10.0 |

1.0 |

4642 |

65 |

17 |

63 |

146 |

9 |

2195 |

1 |

1761 |

536 |

253 |

14 |

2 |

194 |

8 |

9905 |

2376 |

23% |

| MAV_AD_0027 |

10.0 |

11.0 |

1.0 |

3800 |

51 |

14 |

52 |

116 |

7 |

1817 |

1 |

1449 |

441 |

210 |

12 |

1 |

169 |

7 |

8148 |

1954 |

23% |

| MAV_AD_0027 |

11.0 |

12.0 |

1.0 |

2483 |

36 |

11 |

32 |

76 |

5 |

1236 |

1 |

900 |

265 |

132 |

8 |

1 |

136 |

6 |

5327 |

1209 |

22% |

| MAV_AD_0027 |

12.0 |

13.0 |

1.0 |

3059 |

40 |

11 |

41 |

93 |

5 |

1469 |

1 |

1154 |

337 |

169 |

9 |

1 |

117 |

5 |

6511 |

1540 |

23% |

| MAV_AD_0027 |

13.0 |

14.0 |

1.0 |

2548 |

36 |

10 |

35 |

80 |

5 |

1207 |

1 |

944 |

274 |

140 |

8 |

1 |

114 |

5 |

5409 |

1263 |

23% |

| MAV_AD_0027 |

14.0 |

15.0 |

1.0 |

2118 |

29 |

9 |

28 |

64 |

4 |

1029 |

1 |

785 |

229 |

115 |

7 |

1 |

94 |

5 |

4516 |

1050 |

22% |

| MAV_AD_0027 |

15.0 |

15.5 |

0.5 |

1820 |

27 |

8 |

25 |

56 |

4 |

894 |

1 |

686 |

198 |

100 |

6 |

1 |

85 |

4 |

3914 |

917 |

23% |