LONDON, UK – November 17, 2025 – Verde AgriTech Ltd. (TSX: NPK | OTCQX: VNPKF) (“Verde” or the “Company”), is pleased to announce the signing of an exclusive agreement with UNDO Carbon Ltd. (“UNDO”), a UK-based carbon dioxide (“CO₂”) removal innovator specializing in enhanced rock weathering, forming a collaborative framework to explore a commercial partnership focused on the creation, delivery, and sale of durable, high-quality carbon removal credits (“CDR Credits”) from Verde’s Enhanced Rock Weathering (“ERW”) activities in Brazil, leveraging the potential of the Company’s glauconitic siltstone mineral. Successful execution of this partnership has the potential to remove hundreds of thousands of tonnes of CO2 from the atmosphere.

“The signing of this agreement with Verde demonstrates the potential of UNDO’s end-to-end platform in activating Enhanced Rock Weathering projects globally at pace. By combining Verde’s exceptional mineral resources and operational capacity in Brazil with UNDO’s ERW measurement and technology expertise, we’re creating a blueprint for scaling durable carbon removal. This collaboration is showing that when you bring together complementary strengths, ERW can scale quickly to deliver the gigatonnes of removal the world urgently needs.”– Jim Mann, CEO and Founder, UNDO Carbon

“Today’s exclusive agreement with UNDO creates a clear path to turn Verde’s Enhanced Rock Weathering activities into a scalable revenue stream,” commented Cristiano Veloso, Founder and CEO. “By combining our glauconitic siltstone products and established operations in Brazil with UNDO’s award‑winning expertise in measurement, reporting, and verification, we aim to originate and deliver durable, high‑quality carbon removal credits aligned with global best practices, including leading Enhanced Rock Weathering methodologies.”

This exclusive agreement represents Verde’s first step into the carbon credit market, establishing a clear framework to monetize Enhanced Rock Weathering, which aims to deliver on the Company’s objective of clearly outlining a new product and business stream through its ERW activities. For UNDO, its objective focuses on securing a reliable source of high-quality ERW feedstock and a pathway to scalable CDR from Verde’s ERW activities in Brazil.

UNDO is a world-leading carbon dioxide removal project developer pioneering ERW to remove CO₂ from the atmosphere. They spread crushed silicate rock on agricultural land, accelerating the natural weathering process and enriching soil health.

In April 2025, UNDO was named one of four global winners of the $100 million XPRIZE Carbon Removal competition (funded by the Musk Foundation), which aims to accelerate carbon dioxide removal technologies to address climate change at scale.1

To date, UNDO has spread over 313,800 tonnes of silicate rock, enriching 54,400 acres of agricultural land across 398 farms, which is set to permanently remove approximately 69,000 tonnes of CO₂ across three continents. With the backing of leading brands such as Microsoft, Barclays, British Airways and McLaren, UNDO is well-positioned to spread millions of tonnes of mineral-rich silicate rock annually, an important step towards the billion-tonne scale needed to meet the urgent climate challenge.

Partnership Benefits

By combining complementary expertise and resources, the agreement supports Verde and UNDO in capturing market share and strengthening their competitive advantage, thereby supporting innovation and project execution, opening the door to scalable solutions that deliver benefits to both parties.

Notable benefits to Verde include:

- UNDO’s experience in designing and implementing Enhanced Rock Weathering projects;

- UNDO technology platform to collect and organize operational and measurement data;

- Access to UNDO’s proprietary and patent-pending measurement protocols for reliable MRV (Measurement, Reporting, and Verification) of carbon removal through ERW;

- UNDO’s established relationships with carbon removal buyers; and

- UNDO’s expertise in quantifying and certifying carbon removal credits, with the ability to package projects for verification.

Notable benefits to UNDO include:

- Access to Verde’s substantial ERW feedstock;

- Access to Verde’s agricultural network in Brazil for ERW activities, where ERW feedstock is applied;

- Local operational deployment capacity, including mineral processing/crushing, haulage, spreading, and field operations, including but not limited to soil sampling; and

- Verde’s local knowledge of the agricultural landscape, agronomic conditions, and climate records in Brazil.

In mid-2023, Verde announced its plan to sell carbon credits to major international companies seeking to offset their carbon emissions (see press release dated July 27, 2023). This initiative builds on Verde’s existing fertilizer operations and introduces a complementary revenue stream based on the sale of verified, durable carbon removal credits generated through Enhanced Rock Weathering (ERW) using Verde’s glauconite-rich silicate rock.

Warrant Grant

In connection with this agreement, Verde will grant UNDO up to 1.7 million common share purchase warrants (the “Warrants”), allocated as:

- Initial Warrants: 100,000;

- Additional Warrants: 1,000,0000; and

- Incremental Success-Based Warrants: 600,000.

The exercise price (“Exercise Price”) of each Warrant will be 120% of Market Price2 and, in any event, not less than the minimum price permitted by TSX policies at the time of grant.

Each Warrant will be exercisable for a period of three (3) years from the Grant Date,3 subject to earlier expiry under §10. Warrants Shares are subject to a 12-month contractual lock up from the date of issuance, in addition to any statutory or TSX hold periods and legends. Unvested Warrants are non transferable. Vested Warrants may be transferred only with the Company’s consent (not to be unreasonably withheld), except transfers to the Holder’s Affiliates are permitted with notice; in all cases, transfers remain subject to securities law and TSX restrictions.

Initial Warrants vest pro rata as and when the Company receives cash consideration under Qualified Offtakes4 priced at a Weighted Average Price ≥ US$350/tCO₂, up to a Dollar Target of US$1,000,000. Fractional vesting is permitted; vesting in this tranche completes once its Dollar Target is fully satisfied.

Additional Warrants after Initial Warrants conditions are fully satisfied, this tranche vests pro rata as and when the Company receives additional Cash Consideration under Qualified Offtakes priced at a Weighted Average Price ≥ US$300/tCO₂, up to a Dollar Target of US$39,000,000.

Incremental Success Based Warrants after Additional Warrants conditions are fully satisfied, this tranche vests pro rata as and when the Company receives additional Cash Consideration under Qualified Offtakes priced at a Weighted Average Price ≥ US$250/tCO₂, up to a Dollar Target of US$60,000,000.

The Company reserves the right to accelerate the expiry of vested Warrants only (unvested Warrants will remain unaffected) to a date 30 days following written notice, provided that the 20-day volume-weighted average trading price (“VWAP”) of the Company’s shares on the TSX equals or exceeds C$2.00 at any time after the Grant Date and TSX acceptance. The notice will specify the calculation period and the revised expiry date.

– ENDS –

ABOUT VERDE AGRITECH

Verde AgriTech is dedicated to advancing sustainable agriculture through the innovation of specialty multi nutrient potassium fertilizers. Our mission is to increase agricultural productivity, enhance soil health, and significantly contribute to environmental sustainability. Utilizing our unique position in Brazil, we harness proprietary technologies to develop solutions that not only meet the immediate needs of farmers but also address global challenges such as food security and climate change. Our commitment to carbon capture and the production of eco-friendly fertilizers underscores our vision for a future where agriculture contributes positively to the health of our planet. For more information on how we are leading the way towards sustainable agriculture and climate change mitigation in Brazil, visit our website: https://verde.ag/en/home.

Because Verde’s existing mining, processing, and distribution infrastructure can be leveraged for ERW deployment, the initiative requires minimal incremental capex and allows for rapid scaling to high-margin carbon revenues.

ABOUT UNDO

UNDO is a pioneering nature-based carbon dioxide removal company with an ambition to remove over one billion tonnes of atmospheric CO₂ in accessible, affordable, nature-friendly ways. Since 2022, UNDO has worked at the cutting edge of science alongside experts in the climate, carbon and agricultural sectors to develop an enhanced rock weathering technology which accelerates natural weathering processes to remove carbon from the atmosphere while bringing soil and crop benefits to agricultural communities. The UNDO operational, scientific and technical model leverages existing infrastructure, with a carbon efficiency of greater than 90 percent, allowing UNDO to quickly scale operations whilst offering carbon removal at competitive prices.

UNDO’s success-based warrants directly link equity participation to verified carbon credit revenue milestones, ensuring strict value alignment with Verde shareholders.

ABOUT ENHANCED ROCK WEATHERING

Enhanced rock weathering is the acceleration of natural rock weathering, whereby the CO₂ in rainwater interacts with silicate rocks (e.g. basalt, wollastonite), mineralizes and is safely stored as solid carbon for hundreds of thousands of years. To speed up this natural geological process, UNDO spreads crushed rock, sourced from the mining and quarrying industry, on agricultural land. As this mineral-rich rock breaks down, it releases nutrients, stabilizes soil pH, and increases crop yield. The IPCC 2022 Mitigation of Climate Change report suggests that enhanced rock weathering, if scaled, could remove up to 4 billion tonnes of CO₂ per year – equivalent to 40% of global CO₂ removal targets.

CAUTIONARY LANGUAGE AND FORWARD-LOOKING STATEMENTS

This document contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. This information and these statements, referred to herein as “forward-looking statements” are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: the Company’s competitive position in Brazil and demand for potash; estimates of operating costs and total costs, net cash flow, net present value and economic returns from an operating mine. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “envisages”, “assumes”, “intends”, “strategy”, “goals”, “objectives” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. All forward-looking statements are based on Verde’s or its consultants’ current beliefs as well as various assumptions made by them and information currently available to them. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections, and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements, as a number of important factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions, and intentions expressed in such forward-looking statements. These risk factors may be generally stated as the risk that the assumptions and estimates expressed above do not occur as forecast, but specifically include, without limitation: risks related to the court approval process for the debt restructuring; risks relating to variations in the mineral content within the material identified as Mineral Resources and Mineral Reserves from that predicted; variations in rates of recovery and extraction; the geotechnical characteristics of the rock mined or through which infrastructure is built differing from that predicted, the quantity of water that will need to be diverted or treated during mining operations being different from what is expected to be encountered during mining operations or post-closure, or the rate of flow of the water being different; developments in world metals markets; risks relating to fluctuations in the Brazilian Real relative to the Canadian dollar; increases in the estimated capital and operating costs or unanticipated costs; difficulties attracting the necessary workforce; increases in financing costs or adverse changes to the terms of available financing, if any; tax rates or royalties being greater than assumed; changes in development or mining plans due to changes in logistical, technical, or other factors; changes in project parameters as plans continue to be refined; risks relating to receipt of regulatory approvals; delays in stakeholder negotiations; changes in regulations applying to the development, operation, and closure of mining operations from what currently exists; the effects of competition in the markets in which Verde operates; operational and infrastructure risks; changes to the potential benefits, applications, and commercial impact of the Company’s patented products and production process, protection and enforcement, and risks regarding the anticipated benefits of the MOU, the timing, scope, and success of Enhanced Rock Weathering (ERW) projects, the generation of carbon credits, and the collaboration between Verde and UNDO; and the additional risks described in Verde’s Annual Information Form filed with SEDAR+ in Canada (available at www.sedarplus.com) for the year ended December 31, 2024. Verde cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to Verde, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Verde does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by Verde or on our behalf, except as required by law.

For additional information, please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

or

Jim Mann, Chief Executive Officer and Founder

Email: hello@un-do.com

www.un-do.com

Singapore, October 21, 2025 – Verde AgriTech Ltd. (TSX: NPK | OTCQX: VNPKF) (“Verde” or the “Company”), is pleased to report ionic-adsorption behaviour confirmed across multiple trenches at the Minas Americas Global Alliance Project (“Minas Americas” or the “Project”) in Minas Gerais, Brazil. Ammonium-sulfate leach tests returned primary leach solutions (“PLS”) with very strong magnet rare earth (neodymium (Nd), praseodymium (Pr), dysprosium (Dy), terbium (Tb)) grades and exceptionally low impurities (thorium/ uranium (Th/U) at, or below, detection).

Highlights

- Best leachates (0.5M (NH₄)₂SO₄, 30 min): up to 667 mg/kg of DREO (total desorbable rare earth oxide (“DREO”) and up to 278 mg/kg of magnetic rare earth oxide (“MREO”) (Nd+Pr+Dy+Tb), showing ionic adsorption behaviour and demonstrating strong magnet-REE proportion in these initial tests.

- NdPr in leachate up to 268 mg/kg (PT‑36), with Dy+Tb up to 9 mg/kg; multiple trenches exceed 150 mg/kg MREO in PLS.

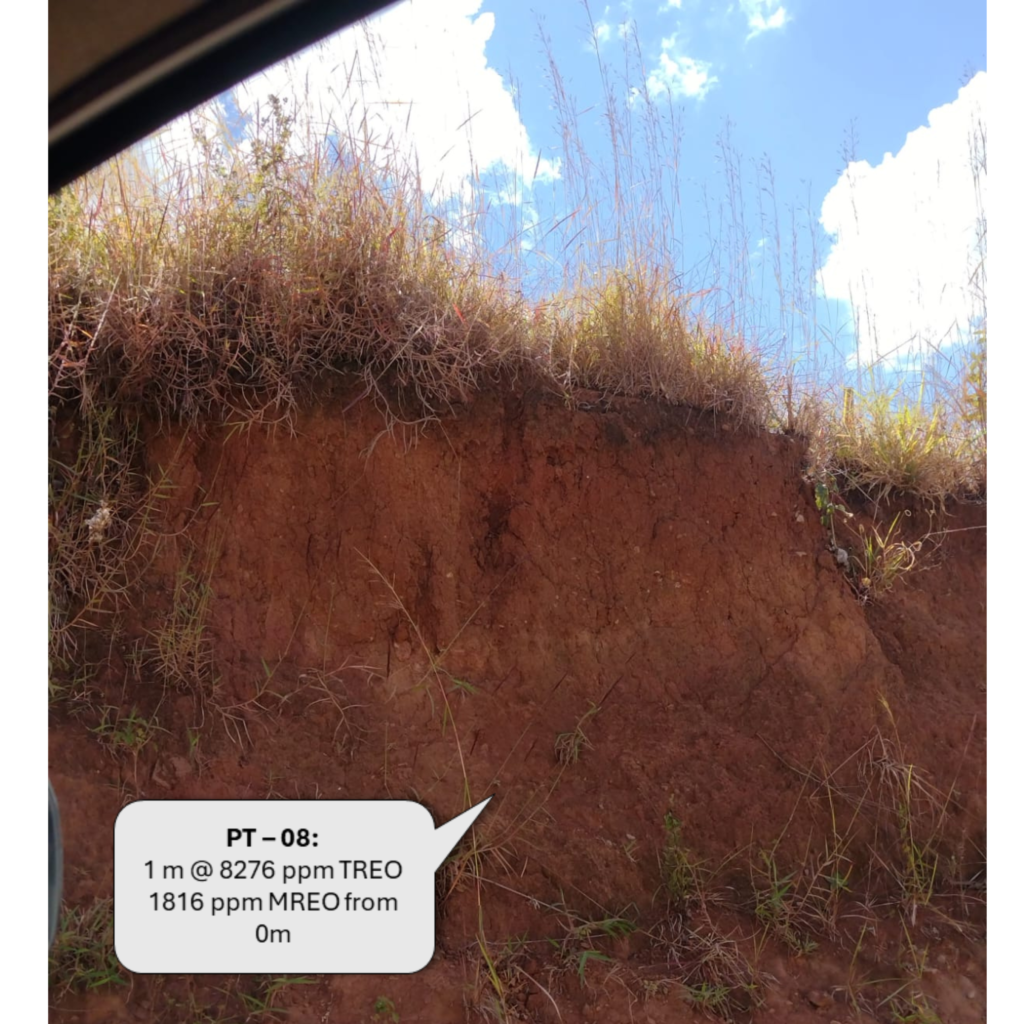

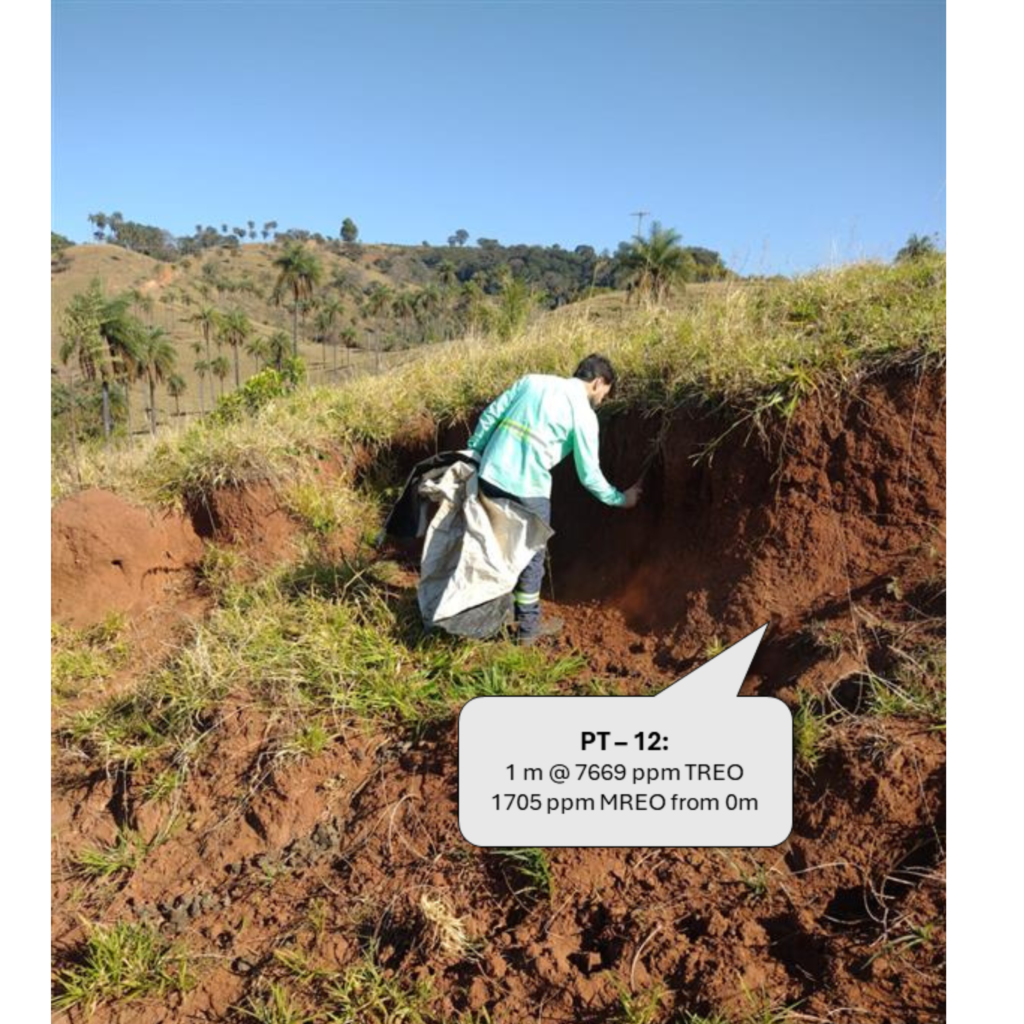

- Head grades are high and laterally continuous: top MREO samples range 1,306–2,182 ppm, within 6,081–8,930 ppm TREO.

- Ultra-low contaminants in PLS: Th and U not detected in the best intervals; Fe and Al minimal, supporting selective ion-exchange.

Top Leachate Intervals and Matching Head Grades

Table 1 – Top Disordable Intervals

| Project/Source |

Basis |

Head TREO (ppm) |

Head MREO (ppm) |

DREO in PLS (mg/kg) |

MREO in PLS (mg/kg) |

Nd₂O₃ (mg/kg) |

Pr₆O₁₁ (mg/kg) |

Dy₂O₃ (mg/kg) |

Tb₄O₇ (mg/kg) |

Key impurity notes |

| PT‑36 |

Trench (0–1 m) |

7,181 |

1,593 |

667 |

278 |

209 |

59 |

7 |

2 |

Th & U ND; Fe ND |

| PT‑34 |

Trench (1–2 m) |

8,615 |

2,182 |

578 |

240 |

187 |

45 |

7 |

2 |

Th & U ND; Fe ND |

| PT‑42 |

Trench (0–1 m) |

4,605 |

1,096 |

383 |

167 |

129 |

33 |

4 |

1 |

Th ND (~3 mg/kg Th max); Fe ND |

Notes: DREO and element grades above are measured directly in the primary leach solution (PLS) from ion-exchange tests; Head grades are from the same trench intervals. ND = not detected.

Magnet REEs dominate the leachate (>40% of dissolved REO). The magnet rare‑earth oxides (MREO = Nd₂O₃ + Pr₆O₁₁ + Dy₂O₃ + Tb₄O₇) constituted over 40% of the dissolved REO in Verde’s best PLS samples—an exceptional selectivity for the value‑driver elements. Quantitatively, PT‑36 returned DREO of ~667 mg/kg with MREO of ~278 mg/kg (≈41.7% MREO; NdPr ~268 mg/kg; Dy+Tb ~9 mg/kg). PT‑34 (1–2 m) showed DREO of ~578 mg/kg and MREO of ~240 mg/kg (≈41.5%), while PT‑42 (0–1 m) reported DREO of ~383 mg/kg and MREO of ~167 mg/kg (≈43.6%). This >40% MREO share—paired with very low Th/U and minimal Fe/Al (iron/aluminium) in solution—indicates high‑value, magnet‑grade enrichment in the leachate and provides a strong technical basis for efficient downstream upgrading to tight‑spec mixed rare earth carbonate (MREC).

Cerium is selectively suppressed in solution. Under the diagnostic 0.5 M ammonium‑sulfate, 30‑minute leach screen, cerium consistently reports at very low concentrations in the primary leach solution (PLS) relative to the head composition—an ionic‑clay hallmark that materially simplifies downstream purification. in Verde’s top intervals, CeO₂ in PLS ranges ~16–91 mg/kg, while the dissolved‑REE (DREO) totals 383–667 mg/kg ; that means cerium represents only ~4–14% of dissolved REO in these best samples. For example, at PT‑36 (0–1 m) the head assay carries ~3,563 ppm CeO₂ within 7,181 ppm TREO, yet the PLS contains ~91 mg/kg CeO₂ against ~667 mg/kg DREO (≈14% Ce in solution). At PT‑34 (0–1 m) and PT‑34 (1–2 m), CeO₂ in PLS is ~16–28 mg/kg versus ~383–578 mg/kg DREO (≈4–5% Ce in solution), further confirming preferential desorption of magnet REEs over cerium under mild conditions. Th and U are at or below detection; iron (Fe) is not detected in the best PLS, reinforcing a clean leach signature.

Ionic‑Clay Rare Earths — Rarer Geology, Higher Strategic Appeal, and Why “Clean” Clays are King

Ionic‑adsorption clays (IACs) are geologically rarer than hard‑rock rare‑earth systems. They form only where REE‑bearing source rocks have been deeply weathered for long periods in warm, humid climates, where the right clay minerals can weakly adsorb REEs and where stable landscapes preserve these horizons close to surface. Those conditions occur in limited belts globally, which is why confirmed IAC districts command outsized strategic interest. Moreover, they are shallow, soft, and tightly aligned to the magnet‑grade demand story powering EVs, robots, and wind.

From a developer’s risk lens, well‑behaved ionic clays can mitigate key execution risks. Their near‑surface, free‑digging nature reduces mining complexity; ambient‑condition desorption allows compact, modular buildouts; and faster test‑iterate cycles are possible if early metallurgy confirms ionic behavior and a “clean” liquor. Cleanliness is king in ionic clays. IAC domains that co‑dissolve fewer contaminants (e.g., Fe/Al/Mn/alkalies) typically need fewer purification stages, consume less reagent, simplify residue handling, and enable a tighter‑spec mixed rare earth carbonate (MREC) that downstream processors prize. The upshot: lower impurity loads can translate into simpler, smaller circuits and materially lower capital intensity than high‑impurity clay variants—accelerating credible pathways to marketable concentrate. The project ultra-low contaminants in PLS are illustrated in Table 2.

Table 2 – Weight Percent (Wt%) of Key Impurities in PLS for Top Disordable Intervals

| Project/Source |

Basis |

Al

(Wt%) |

Ca

(Wt%) |

Fe

(Wt%) |

Ni

(Wt%) |

Th

(Wt%) |

U

(Wt%) |

| PT‑36 |

Trench (0–1 m) |

0,00391 |

0,01508 |

<0,0002 |

0,000266 |

0,000259 |

<0,000004 |

| PT‑34 |

Trench (1–2 m) |

0,00158 |

0,06842 |

<0,0002 |

0,00054 |

<0,00002 |

<0,000004 |

| PT‑42 |

Trench (0–1 m) |

0,00338 |

0,00968 |

<0,0002 |

0,000781 |

0,000292 |

<0,000004 |

Light, Heavy or Magnet?

Rare earth elements are often labeled “light” (La–Gd) and “heavy” (Tb–Lu, plus yttrium), but the market does not split that neatly and definitions vary among authorities. Deposits coproduce a basket of elements, so outputs are governed by geology and processing rather than preference. Many heavy rare earths feed small, highly specialized uses—laser media, medical imaging crystals, specialty optics—where ultra‑tight purity and performance specs drive qualification and price. High unit prices, in other words, reflect specification intensity and tiny volumes, not large underlying markets.

What sets market scale and strategic relevance are the magnetic rare earths. NdPr form the backbone of high‑performance Nd‑Fe‑B magnets, while small additions of dysprosium or terbium (Dy/Tb) enable high‑temperature resilience. These magnets are critical in EV drivetrains, robots, wind turbines, and advanced industrial systems, with few practical substitutes at comparable torque density and efficiency—and supply chains remain geographically concentrated. As a result, magnetic REEs—especially NdPr, with Dy/Tb where needed—are the primary demand drivers and the most strategic focus across the value chain.

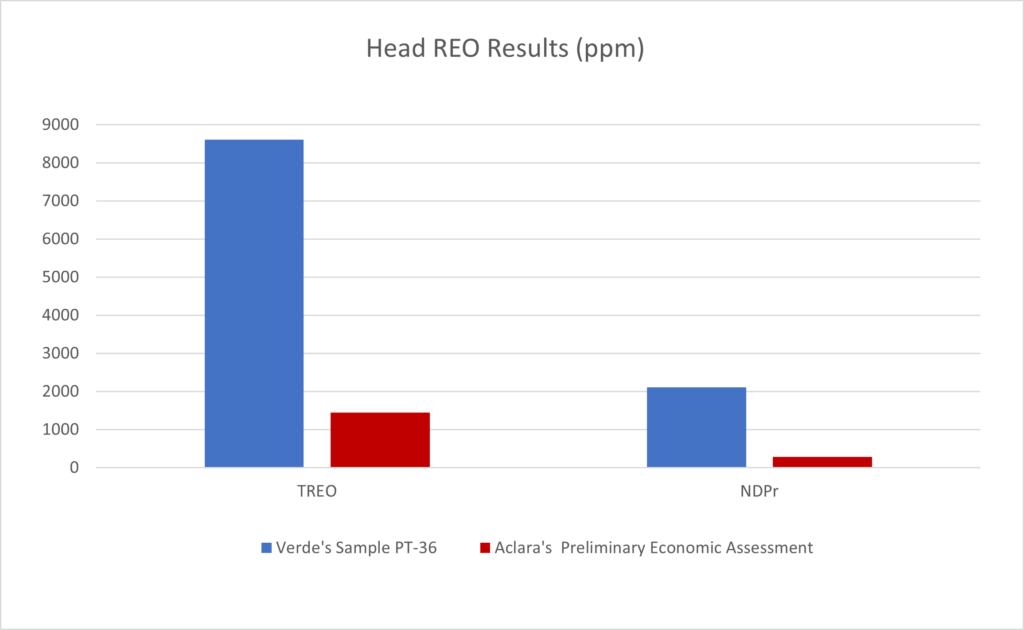

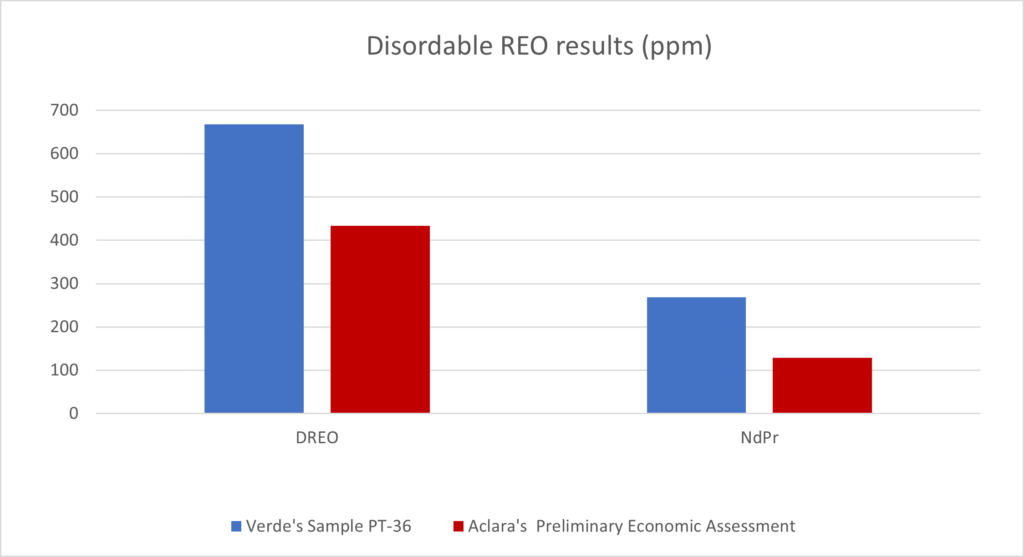

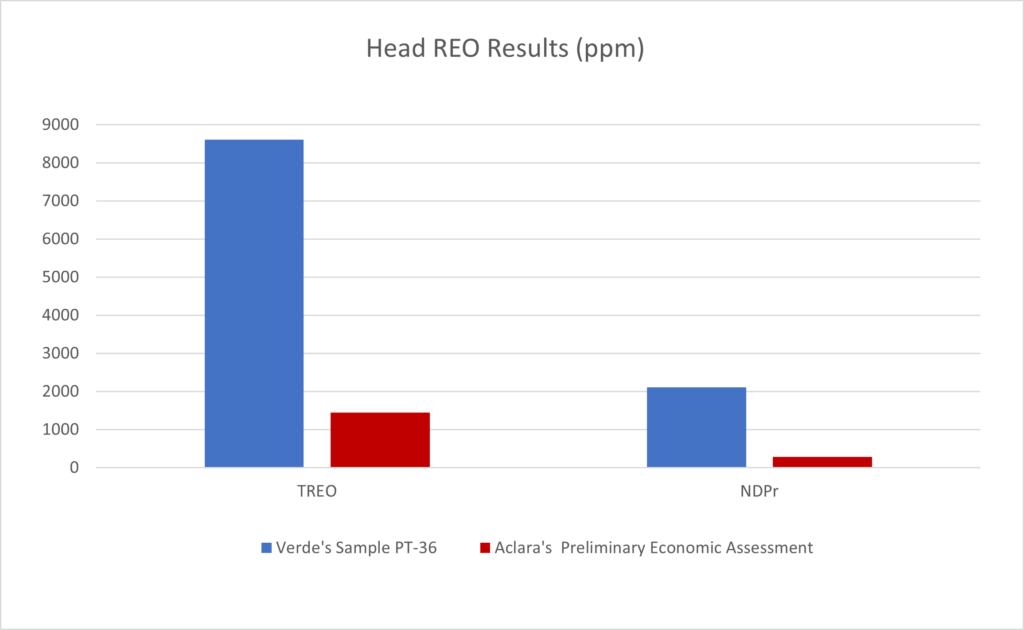

How Minas Americas Compares (Head Grade and Leachate) to Aclara’s Carina Project (Brazil)

Head grade (oxide ppm): Aclara’s Carina Indicated Resource (Grand Total) reports Nd₂O₃ ~221 ppm, Pr₆O₁₁ ~63 ppm, Dy₂O₃ ~38.9 ppm and Tb₄O₇ ~6.4 ppm (~329 ppm MREO) within 1,1452 ppm TREO. The Project selected trench intervals show materially higher head grades (e.g., PT‑34: 2,182 ppm MREO within 8,615 ppm TREO).

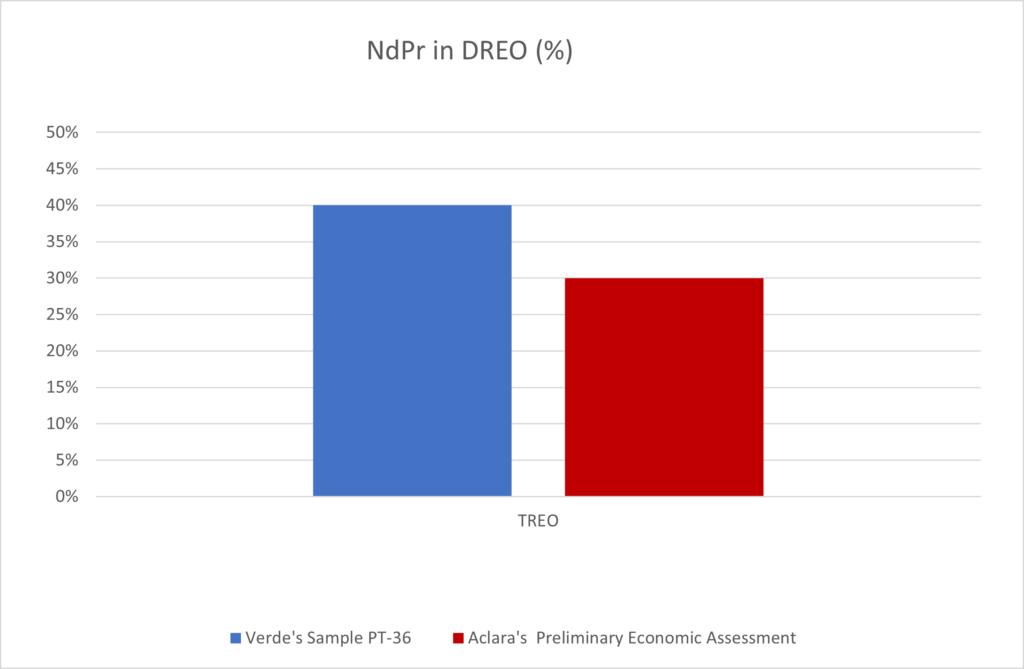

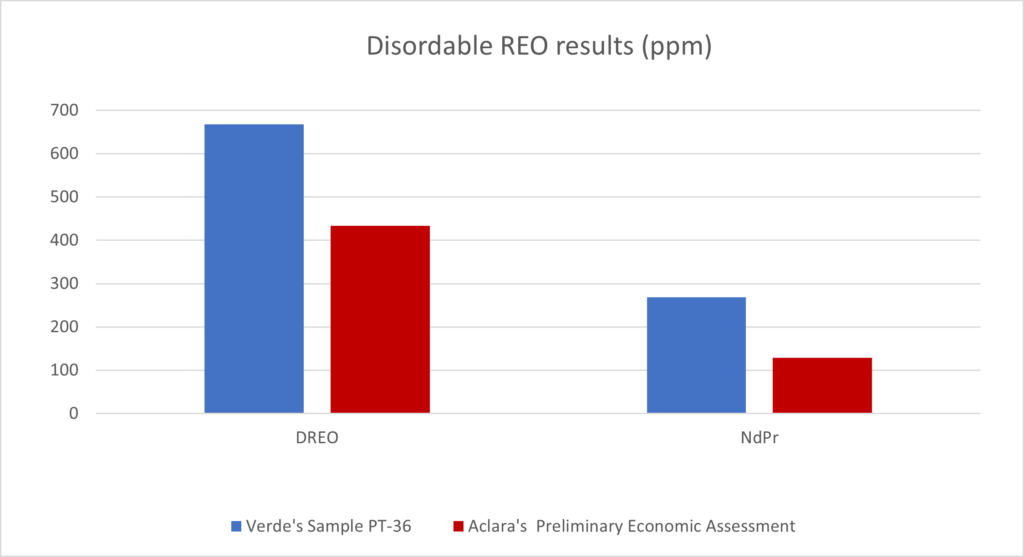

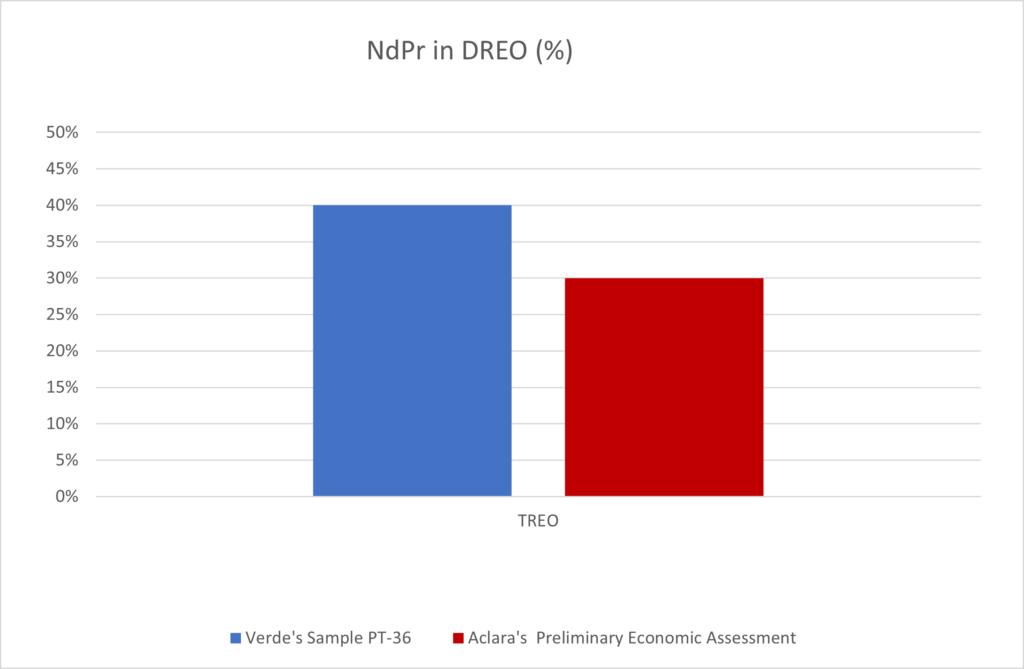

Leachate (PLS) concentrations: Aclara disclosed average high‑grade RC intervals of ~434 mg/kg DREO with ~129 mg/kg NdPr and ~22 mg/kg Dy+Tb (~152 mg/kg MREO). The Project’s best intervals yield up to 667 mg/kg DREO and up to 278 mg/kg MREO (NdPr to 268 mg/kg), exceeding those averages on a strictly apples‑to‑apples basis. This like‑for‑like comparison is summarized in Table 3 and illustrated in Figures 1-3.

Table 3 – Verde – Minas Americas vs.Aclara – Carina

| Project/Source |

Basis |

TREO (ppm) |

MREO (ppm) |

DREO in PLS (mg/kg) |

MREO in PLS (mg/kg) |

NdPr in PLS (mg/kg) |

| PT‑36 |

Trench (0–1 m) |

7,181 |

1,593 |

667 |

278 |

268 |

| PT‑34 |

Trench (1–2 m) |

8,615 |

2,182 |

578 |

240 |

232 |

| PT‑42 |

Trench (0–1 m) |

4,605 |

1,096 |

383 |

167 |

162 |

| Aclara – Carina |

Indicated (avg) / PEA |

1,452 |

~329 |

~434 |

~152 |

~129 |

Figure 1 – Minas Americas vs. Carina – Head REO Results

Figure 2 – Minas Americas vs. Carina – Disordable Results

Figure 3 – Minas Americas vs. Carina – NdPr in DREO Results

Aclara’s head grades above are averaged over a large Indicated Resource; the Project results are early‑stage trench intervals. Nonetheless, on a leachate concentration basis (what goes into the plant), the Project’s best PLS magnet grades are competitive to superior while maintaining exceptionally low impurities.

* Aclara Resources Mineração Ltda.; GE21 Consultoria Mineral. Carina Rare Earth Element Project — Preliminary Economic Assessment Update. GE21 Project No. 240205. May 3, 2024. 322 p.

Metallurgy: Why the First SGS Screen is Conservative and Why Stage Two Testing Lifts Recoveries

All leach results reported today come from an SGS Geosol screening test designed to answer a simple question: Are the rare earths ion adsorbed and therefore readily exchangeable? To keep that diagnostic clean and comparable, the procedure intentionally uses a single, short leach (0.5 M ammonium sulfate, ~30 minutes) on the as received, screened material and then reads the dissolved rare earths in the solution. It does not attempt to maximize extraction. In our program, SGS applied method ICM694 (0.5 M (NH₄)₂SO₄; 30 minute contact) after routine sample prep; results are reported as oxides (REO). This is the right first step for ionic clay projects because it isolates the exchangeable fraction and demonstrates low impurity solubilization. For example, in sample OB56 the leachate contained ~383 mg/kg TREO including ~127 mg/kg Nd₂O₃ and ~29 mg/kg Pr₆O₁₁, with Th and U near detection limits—evidence of selective ion exchange with minimal contaminant carryover under very mild conditions.

Because this diagnostic is purposefully mild, it under reports what a plant level flowsheet can achieve. Several built in limitations suppress extraction: (i) a single short contact rather than multiple counter current stages; (ii) fixed ionic strength (0.5 M) and no pH ramping to keep clays dispersed and prevent readsorption; (iii) no pre conditioning/attrition to expose exchange sites; (iv) no residence time optimization or temperature control; and (v) no recycle/bleed management of the leach liquor. In practice, proper metallurgical testing for ionic clays moves to staged agitated and/or percolation leaching with controlled pH (typically mildly acidic), optimized solid–liquid ratios, higher or stepped salt strengths, dispersants to limit flocculation, and counter current washing. These steps systematically (1) access additional exchange sites, (2) prevent rare earth readsorption as the solution becomes depleted, and (3) concentrate REE in solution while continuing to show low co leaching of Al/Fe/Si. Our initial dataset already points to that selectivity: major gangue oxides are very low in solution, and radioactive/penalty elements are at or near zero—favorable foundations for scaled processing.

What to expect next: Stage two metallurgical work for Verde’s Preliminary Economic Assessment, expected to be released in Q2 2026, will therefore implement multi-stage, counter current leaching and washing sequences (agitated and column), pH/ionic strength profiling, residence time optimization, and dispersion control. The objective is to translate today’s conservative, single pass screen into materially higher extractions of NdPr, Dy and Tb in line with commercial ionic clay practice—while preserving the clean impurity profile indicated by the SGS screen. As those flowsheet elements are introduced, recoveries typically step up materially from the initial screen because we are no longer constrained by a one and done 30-minute contact at fixed strength. We will report those stage two results as they are completed.

QA/QC and Qualified Person

Sample preparation and analytical methods. Samples were analyzed by SGS Geosol Geosol Laboratórios Ltda. (Vespasiano, Brazil), an ISO/IEC 17025:2017-accredited and independent commercial laboratory. For total element concentrations, samples underwent lithium metaborate fusion with ICP-OES/ICP-MS finish (SGS method codes IMS95A/ICP95A). Selective leachates were prepared using a 0.5 M ammonium sulfate leach for 30 minutes (SGS method ICM694) with ICP-MS finish.

QA/QC. The Company inserted certified reference materials, blanks and field/pulp duplicates at ~12% of the sample stream, and monitored laboratory internal controls. The QA/QC results were reviewed by the Qualified Person and were within acceptable limits for this stage of exploration.

Qualified Person. The scientific and technical information in this news release has been reviewed and approved by José Márcio Matta Machado Paixão, FAusIMM, who is a Qualified Person as defined by NI 43-101 and is independent of the Company within the meaning of NI 43-101. Mr. Paixão has verified the data disclosed herein by reviewing laboratory certificates, QA/QC performance (blanks/CRMs/duplicates) and analytical procedures.

About Verde AgriTech

Verde AgriTech is dedicated to advancing sustainable agriculture through the innovation of specialty multi nutrient potassium fertilizers. Our mission is to increase agricultural productivity, enhance soil health, and significantly contribute to environmental sustainability. Utilizing our unique position in Brazil, we harness proprietary technologies to develop solutions that not only meet the immediate needs of farmers but also address global challenges such as food security and climate change. Our commitment to carbon capture and the production of eco-friendly fertilizers underscores our vision for a future where agriculture contributes positively to the health of our planet. For more information on how we are leading the way towards sustainable agriculture and climate change mitigation in Brazil, visit our website: https://verde.ag/en/home.

Cautionary Language and Forward-Looking Statements

This news release contains “forward‑looking information” and “forward‑looking statements” (together, “FLI”) within the meaning of applicable Canadian securities laws. FLI relates to future events or performance and reflects management’s current expectations and assumptions. FLI in this news release includes, but is not limited to, statements regarding: the interpretation and significance of exploration and leach test results; the potential for ionic‑adsorption clay mineralization and for economic extraction of rare earth elements; the selectivity of magnet rare earths in solution and implications for processing; comparisons to other projects; anticipated metallurgical programs and flowsheet development (including staged, counter‑current leaching and washing); the expected timing, scope and outcomes of further testwork and studies (including a potential preliminary economic assessment (PEA)) currently targeted for release in Q2 2026; plans for project advancement; potential strategic initiatives and partnerships; and the timing and content of future updates.

Material assumptions

Material factors and assumptions used in developing the FLI include, without limitation: that trench and leach results are representative of broader mineralized horizons; continuity of ionic‑adsorption behaviour; scalability of laboratory procedures to pilot or commercial settings; availability and performance of reagents and process consumables; the ability to further optimize leaching, washing and impurity control while maintaining selectivity; reasonable access to the Project area, services and infrastructure; the availability of financing on acceptable terms; stable political, regulatory, community and permitting environments; sustained demand and pricing for rare earth products (including Nd, Pr, Dy and Tb); and exchange rates and operating cost inputs consistent with historical ranges.

Material risk factors

FLI is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These include, without limitation: risks inherent to early‑stage exploration projects; that subsequent work may not confirm initial exploration or leach results; metallurgical risks in scaling from bench to pilot/industrial operations; sampling, analytical and interpretive uncertainties; comparisons to peer projects that may not be valid due to differences in geology, scale, test conditions, project stage or assumptions; commodity price and exchange‑rate volatility; access to capital; cost inflation and supply‑chain disruptions; availability of water, power, reagents and skilled labour; environmental, permitting, title, tenure and community risks (including Indigenous engagement); changes in laws, regulations, policies or enforcement; political and country risk; counterparty and offtake risks; and the other risks set out in the Company’s most recent Annual Information Form, MD&A and other continuous disclosure documents available under the Company’s profile at www.sedarplus.ca .

Caution to readers

Although the Company believes the assumptions and expectations reflected in the FLI are reasonable as of the date hereof, no assurance can be given that they will prove correct. Readers are cautioned not to place undue reliance on FLI. The FLI herein is made as of the date of this news release, and the Company does not undertake any obligation to update or revise such FLI except as required by applicable securities laws. The Company’s policy is to update previously disclosed material FLI as required by NI 51‑102 through subsequently filed MD&A or news releases.

Technical and NI 43‑101 Cautionary Statements

The exploration and test results reported are preliminary in nature and do not constitute mineral resources or mineral reserves as defined by National Instrument 43‑101 – Standards of Disclosure for Mineral Projects (NI 43‑101). There is no certainty that further exploration will result in the delineation of mineral resources or reserves, that any economic analysis will be completed, or that any development decision will be made.

Any discussion of a potential PEA relates to a contemplated future study. No PEA results are being disclosed in this news release. If a PEA is completed and disclosed in the future, the Company will include all cautionary language required by NI 43‑101 for any economic analysis that includes or is based on inferred mineral resources.

Reported impurity and radionuclide observations (e.g., thorium/uranium below detection in certain intervals) are limited to the methods, detection limits and sample intervals tested and may not be representative of the property as a whole.

Comparisons to other issuers’ properties and results (including Aclara’s Carina Project) are provided for context only, are based on public disclosures and/or cited technical sources, and are not necessarily indicative of results that may be achieved at the Company’s Project. Differences in geology, testwork, scale, stage of development and assumptions can materially affect outcomes.

The scientific and technical information in this news release has been reviewed and approved by a Qualified Person under NI 43‑101 as disclosed herein. Terms such as TREO, MREO and DREO are used as defined in the news release for clarity and are not CIM‑defined categories.

For additional information please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

Two drill rigs turning, third expected end of October

Ionic clay confirmation and initial drill results expected in Q4 2025

Maiden MRE and PEA targeted in H1 2026

New rare earths project formally named

Singapore, October 14, 2025 – Verde AgriTech Ltd. (TSX: NPK | OTCQX: VNPKF) (“Verde” or the “Company”), is pleased to announce that its Board of Directors has concluded a detailed review of its recent new district-scale rare earths discovery (see press release dated October 6, 2025), alongside a review of ongoing fertilizer operations and feedback from management and shareholders. Following this assessment, the Board has approved an accelerated, cost-efficient development plan for this new project, officially named the Minas Americas Global Alliance rare earths project (the “Project”).

In addition, the Board has identified several project milestones and approved plans to finance near-term exploration plans, without compromising the Company’s low carbon specialty fertilizer business.

Upcoming Milestones for the Project

- Complete mobilization – third drill rig expected at site the week of October 20th

- Confirm ionic clay mineralization with summary of ionic adsorption diagnostics together with full leachate impurity and radiological screening (Q4 2025);

- Provide update on initial drilling (Q4 2025);

- Complete initial drilling and additional trenching; release assay results (Q4 2025);

- Release ANSTO recovery test (Q1 2026);

- Publish maiden NI 43-101 mineral resource estimate (“MRE”)(Q1 2026); and

- Publish preliminary economic assessment (“PEA”) to demonstrate economics (Mid 2026).

“Company owned rigs are now turning, with a third rig mobilizing shortly. Our in-house lab is fast tracking metallurgical testwork while leading external laboratories conduct independent validation,” commented Cristiano Veloso, Founder and CEO. “This is the same team that built and operated two mines and two industrial plants in the same region in Brazil—an execution advantage we intend to leverage. We expect to confirm the Project’s ionic clay mineralization and report initial drilling in Q4 2025, followed by a maiden mineral resource estimate and a Preliminary Economic Assessment in the first half of 2026. These programs are supported by our current liquidity—approximately $11.5 million in cash and receivables—and disciplined capital allocation. We will let the data lead and remain focused on creating value for our shareholders.”

Project Funding

Verde is fully funded to execute the initial Project work program while continuing its fertilizer operations, with approximately C$11.5 million in cash and receivables on hand, as of the date of this release.

Rare Earths Discovery Summary

On October 6, 2025, Verde reported a continuous, clay hosted rare earth mineralized zone spanning approximately 5,500 hectares across 13 mineral rights in Alto Paranaíba, Minas Gerais, Brazil. The zone was delineated through integrated mapping, geochemistry, geophysics and confirmed by trench sampling. Highlight assays include up to 8,930 ppm TREO and up to 2,182 ppm MREO, with 75 surface/trench samples averaging 743 ppm MREO (54/75 ≥ 400 ppm; 22/75 ≥ 1,000 ppm). Samples show a strong NdPr component (averaging ~19% of TREO, up to 24%) and the strong presence of dysprosium and terbium—attributes aligned with high performance magnet applications in EVs, robots and wind power.

About Verde AgriTech

Verde AgriTech is dedicated to advancing sustainable agriculture through the innovation of specialty multi nutrient potassium fertilizers. Our mission is to increase agricultural productivity, enhance soil health, and significantly contribute to environmental sustainability. Utilizing our unique position in Brazil, we harness proprietary technologies to develop solutions that not only meet the immediate needs of farmers but also address global challenges such as food security and climate change. Our commitment to carbon capture and the production of eco-friendly fertilizers underscores our vision for a future where agriculture contributes positively to the health of our planet. For more information on how we are leading the way towards sustainable agriculture and climate change mitigation in Brazil, visit our website: https://verde.ag/en/home.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation, including, but not limited to, statements with respect to: the significance of exploration results; the potential for economic extraction of rare earth elements; future exploration and development plans; the outcome of the Board of Directors’ review; potential partnerships, strategic alternatives, or value-maximizing structures; the advancement of the project; and the expected timing of further updates. Forward-looking information is based on management’s current expectations, assumptions, estimates, projections, and interpretations, and involves known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those expressed or implied. These factors include, without limitation: risks related to exploration stage projects; the possibility that future exploration results may not support mineral resource or reserve delineation; uncertainties relating to assay and metallurgical results; operational risks inherent in mining; risks associated with maintaining licenses, permits and mineral rights; changes in laws, regulations and government policies; risks related to capital and operating costs; commodity price volatility; financing risks; and other risks described in the Company’s most recent annual information form and other continuous disclosure filings available under the Company’s profile at www.sedarplus.ca .

Readers are cautioned not to place undue reliance on forward-looking information. The Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required under applicable securities laws.

This news release reports exploration results which are preliminary in nature and do not represent mineral resources or mineral reserves as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). There is no certainty that further exploration will result in the delineation of mineral resources, mineral reserves, or that any development decision will be made. Mineralization identified to date is not necessarily indicative of future results.

For additional information please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

Second rig arriving at site in two days; third rig mobilizing in ~15 days

Near term focus is defining initial high-quality resources for the fastest viable path to production

Singapore, October 9, 2025 — Verde AgriTech Ltd. (TSX: NPK | OTCQX: VNPKF) (“Verde” or the “Company”) announces that drilling commenced on October 7, 2025 at the Company’s district scale, clay hosted rare earth discovery in Alto Paranaíba, Minas Gerais, Brazil. A second rig is scheduled to arrive on October 11, 2025, with a third rig expected to mobilize on or about October 24, 2025, enabling a three-rig program in the near term.

Program highlights:

- Three drill rig program: Drilling commenced October 7, 2025, second drill rig expected on site October 11, 2025, and last drill rig expected in two weeks.

- Fast track objective: Quickly define highest quality resources to determine the fastest viable path to production; Phase 2 drilling will expand on current drilling to delineate the full potential of the land package.

- Metallurgy: Ionic adsorption confirmation and flowsheet testwork are underway, with confirmation targeted for Q4 2025.

- Next step: Board assessment, including naming of project and expected milestones to be released October 14, 2025.

“Over the past 15 years we’ve established, in this region of Minas Gerais, the right team and equipment, lab capacity, including power and road infrastructure to advance our projects quickly,” commented Cristiano Veloso, Founder and CEO. “Building on the recently announced district scale discovery—characterized by high TREO and magnet grade MREO, with a strong NdPr share and consistent Dy/Tb in the highest-grade samples—we are accelerating this new rare earths project in a disciplined, cash efficient way that does not compromise our low carbon fertilizer business.”

Project Accelerated Timeline

The Project’s mineralized zone lies within concessions that form part of Verde’s long held potash property package, where the Company has operated for over 15 years—a platform that materially reduces start up friction, specifically as it related to:

- People: In house, multidisciplinary teams ready for mapping, sampling and drilling; rapid field to decision cadence.

- Equipment: Drill rigs, vehicles, field equipment and integrated IT systems for fast data capture.

- Laboratory: Verde’s lab supports sample preparation, scout assays and metallurgical screening in parallel with external labs—shortening cycles and de risking flowsheet choices.

- Execution Experience: In the same region, Verde has brought two mines into production and built two large scale industrial plants that are operating today.

- Regional infrastructure: Roads, bridges and high voltage power to site have been significantly upgraded by Verde, avoiding years of typical infrastructure lead time

Next Steps

On October 14, 2025, Verde plans to publish a comprehensive Board assessment that includes the program’s formal name and a clear milestone map.

Rare Earths Discovery

Verde recently reported a continuous, clay hosted rare earth mineralized zone covering ~5,500 hectares across 13 mineral rights, delineated by integrated mapping, geochemistry, geophysics and confirmed by trench sampling (see press release dated October 6, 2025). Highlight assays include up to 8,930 ppm TREO and up to 2,182 ppm MREO; 75 trench/surface samples average 743 ppm MREO (54/75 ≥ 400 ppm; 22/75 ≥ 1,000 ppm). Samples are NdPr rich (averaging ~19% of TREO, peaking 24%) with high grade dysprosium and terbium present—attributes aligned to magnet grade applications in EVs and wind turbines.

Technical Notes, QA/QC and Qualified Person

The scientific and technical information in this release is consistent with Verde’s October 6, 2025 discovery disclosure, including laboratories (SGS Geosol), methods and QA/QC insertion rates (blanks/CRMs/duplicates). The scientific and technical information was reviewed and approved by José Márcio Matta Machado Paixão, Fellow AusIMM, a Qualified Person under NI 43 101.

About Verde AgriTech

Verde AgriTech is dedicated to advancing sustainable agriculture through the innovation of specialty multi nutrient potassium fertilizers. Our mission is to increase agricultural productivity, enhance soil health, and significantly contribute to environmental sustainability. Utilizing our unique position in Brazil, we harness proprietary technologies to develop solutions that not only meet the immediate needs of farmers but also address global challenges such as food security and climate change. Our commitment to carbon capture and the production of eco-friendly fertilizers underscores our vision for a future where agriculture contributes positively to the health of our planet. For more information on how we are leading the way towards sustainable agriculture and climate change mitigation in Brazil, visit our website: https://verde.ag/en/home.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation, including, but not limited to, statements with respect to: the significance of exploration results; the potential for economic extraction of rare earth elements; future exploration and development plans; the outcome of the Board of Directors’ review; potential partnerships, strategic alternatives, or value-maximizing structures; the advancement of the project; and the expected timing of further updates. Forward-looking information is based on management’s current expectations, assumptions, estimates, projections, and interpretations, and involves known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those expressed or implied. These factors include, without limitation: risks related to exploration stage projects; the possibility that future exploration results may not support mineral resource or reserve delineation; uncertainties relating to assay and metallurgical results; operational risks inherent in mining; risks associated with maintaining licenses, permits and mineral rights; changes in laws, regulations and government policies; risks related to capital and operating costs; commodity price volatility; financing risks; and other risks described in the Company’s most recent annual information form and other continuous disclosure filings available under the Company’s profile at www.sedarplus.ca .

Readers are cautioned not to place undue reliance on forward-looking information. The Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required under applicable securities laws.

This news release reports exploration results which are preliminary in nature and do not represent mineral resources or mineral reserves as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). There is no certainty that further exploration will result in the delineation of mineral resources, mineral reserves, or that any development decision will be made. Mineralization identified to date is not necessarily indicative of future results.

For additional information please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

Continuous clay-hosted REE mineralised zone outlined.

High-grade NdPr-rich samples return up to 8,930 ppm TREO and 2,182 ppm MREO.

22 samples return > 1,000 ppm MREO

Singapore, October 6, 2025 – Verde AgriTech Ltd. (TSX: NPK | OTCQX: VNPKF) (“Verde” or the “Company”), announces the delineation of a continuous clay hosted rare earth element (“REE”) mineralized zone (“the Zone”) in Alto Paranaíba, Minas Gerais, Brazil, covering ~5,500 hectares (or ~20 square miles) across 13 mineral rights. The Zone was delineated by integrated geological mapping, geochemistry and spectral/geophysical datasets, and confirmed by trench sampling.

Exploration Highlights:

- High-grade magnet rare earth tenor across a broad sample base: 75 surface/trench samples average magnetic rare earth oxides (“MREO”) 743 ppm, with 54/75 ≥400 ppm, 22/75≥1,000 ppm and 7/75 ≥1,500 ppm MREO.

- Total rare earths at meaningful surface tenor: Total rare earth oxides (“TREO”) averages 3,532ppm, median 3,148, with peak assays up to 8,930 ppm and 2,182 ppm MREO.

- Heavy rare earths confirmed: Top 10 MREO samples carry dysprosium oxide ~35–60 ppm and terbium oxide ~8–13 ppm, reinforcing high coercivity magnet potential alongside NdPr (see Table 1).

- Magnet critical balance: Neodymium and praseodymium (NdPr) typically contribute on average ~19% of TREO within the samples tested, peaking at 24%, with dysprosium and terbium present in higher grade samples — supportive of high coercivity magnet feed.

- Near-term catalyst: Given the significance of the discovery and potential economics, Verde’s Board of Directors is conducting a formal review and will communicate next steps within seven days.

“This discovery demonstrates a rare earth mineralized zone of considerable size and coherence across our mineral rights. The combination of TREO and MREO enrichment highlights a compelling growth opportunity,” commented Cristiano Veloso, Founder and CEO. “We are now preparing to advance the project through a Board review to identify the best path forward to unlocking the project’s full potential.”

Table 1: Top 10 samples by MREO (incl. TREO, Nd, Pr, Dy, Tb)

| Channel |

From |

To |

UTMN |

UTME |

Oxide Total Grade (ppm) |

| TREO |

MREO |

Dy2O3 |

Nd2O3 |

Pr6O11 |

Tb4O7 |

| PT-34 |

1 |

2 |

7841160.46 |

384496.15 |

8615 |

2182 |

60 |

1644 |

464 |

13 |

| PT-34 |

0 |

1 |

7841160.46 |

384496.15 |

8930 |

2118 |

53 |

1592 |

461 |

12 |

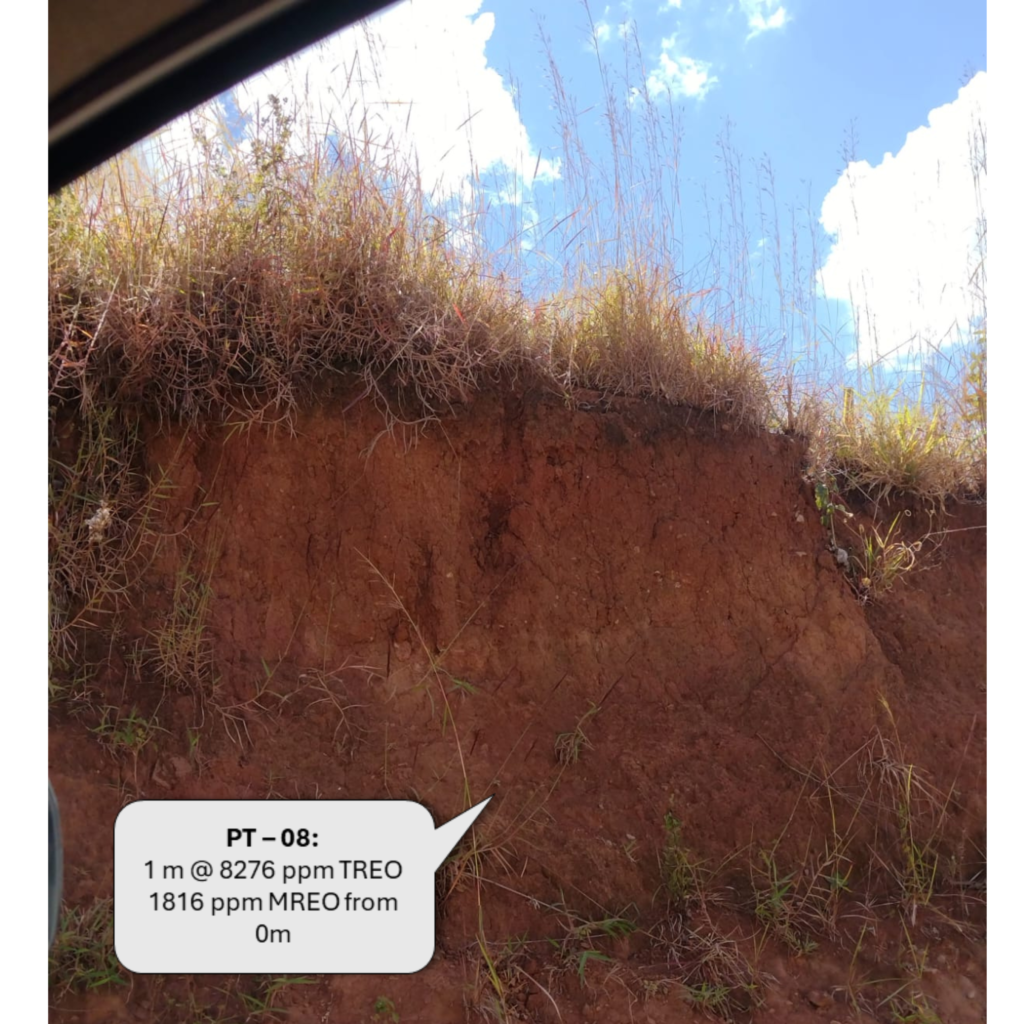

| PT-08 |

0 |

1 |

7863699.87 |

401672.16 |

8276 |

1816 |

48 |

1330 |

428 |

11 |

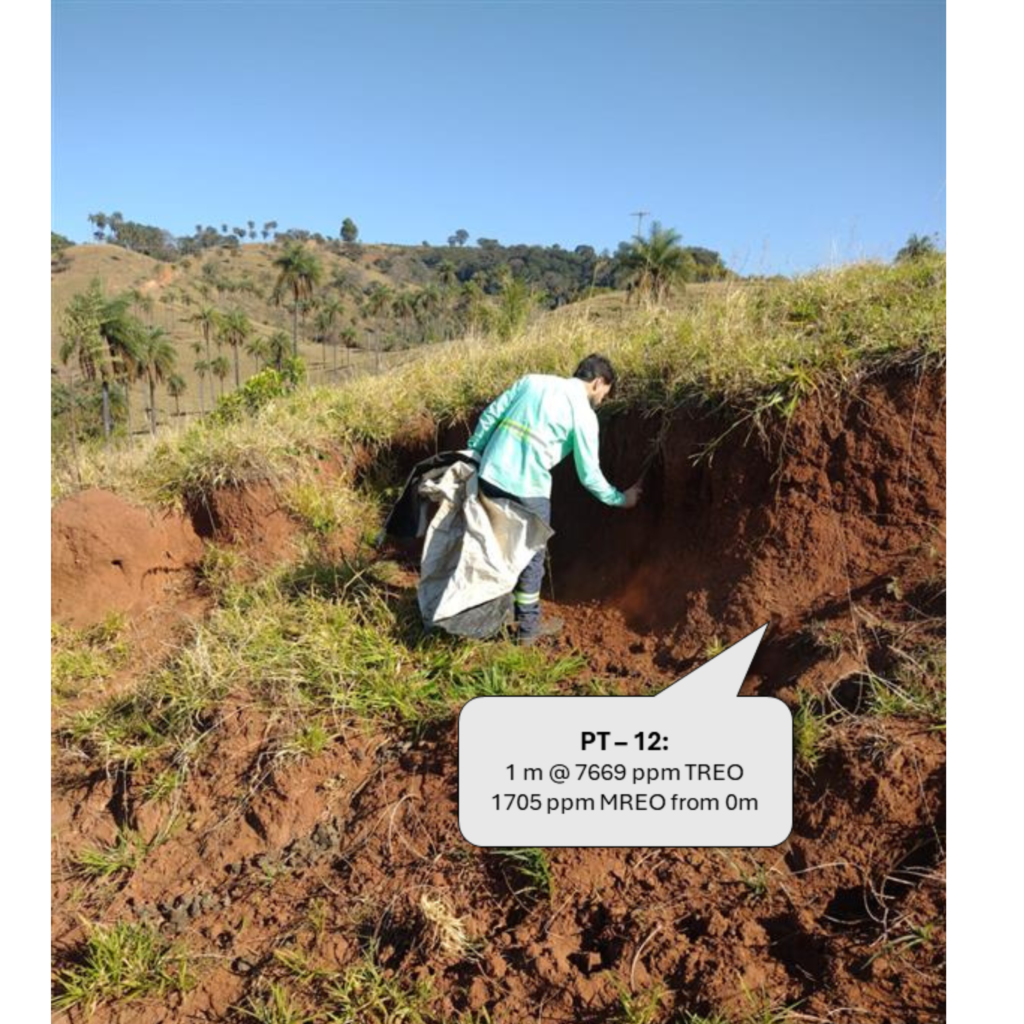

| PT-12 |

0 |

1 |

7871455.52 |

404413.96 |

7669 |

1705 |

46 |

1251 |

398 |

10 |

| PT-18 |

1 |

2 |

7865477.78 |

404446.44 |

7202 |

1676 |

46 |

1231 |

389 |

10 |

| PT-36 |

0 |

1 |

7845380.34 |

384873.08 |

7181 |

1593 |

37 |

1198 |

350 |

9 |

| PT-21 |

1 |

2 |

7867642.38 |

405141.50 |

7250 |

1507 |

49 |

1102 |

347 |

10 |

| PT-45 |

0 |

1 |

7856478.40 |

382570.77 |

6418 |

1372 |

37 |

1026 |

300 |

8 |

| PT-05 |

0 |

1 |

7862246.40 |

401300.48 |

6161 |

1327 |

35 |

972 |

313 |

8 |

MREO—dominated by NdPr, with contributions from Dy and Tb—is the core feedstock for high performance permanent magnets used in EV drivetrains, wind turbines and advanced electronics. A coherent, near surface footprint with consistent NdPr tenor is a key early indicator for scale and relevance in the REE value chain.

Beyond the strong NdPr tenor, Verde’s assays demonstrate consistent enrichment in the heavy rare earths dysprosium (Dy) and terbium (Tb) that underpin high temperature, high coercivity magnets. In the 10 highest grade MREO trench samples (1,306–2,182 ppm MREO; 6,081–8,930 ppm TREO), dysprosium oxide ranges 35–60 ppm and terbium oxide 8–13 ppm, with standout samples at trench PT-34 pairing >2,100 ppm MREO with dysprosium oxide 53–60 ppm and terbium oxide 12–13 ppm. This persistent Dy/Tb presence alongside elevated NdPr strengthens the overall magnet rare earth basket quality.

The 13 mineral claims are held by Verde and overlap with the Company’s potash resources, which have been a part of the portfolio for more than a decade.

Figure 1: Map of the Mineralized Zone

Board Review and Next Steps

Given the significance of this discovery and its potential economics—and mindful of Verde’s primary mission as a fertilizer company—the Board of Directors has initiated a formal review to determine the optimal path forward, balancing disciplined capital allocation with strategic alternatives, including targeted drilling, staged evaluation, partnerships, or other structures that preserve focus on core operations while maximizing value. As part of this process, the Board welcomes shareholder feedback through the Company’s investor relations channels and expects to issue a comprehensive update and go forward plan within the next seven days (on or before October 13, 2025).

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by José Márcio Matta Machado Paixão, Fellow AusIMM, who is a Qualified Person for exploration results under National Instrument 43-101, Standards of Disclosure for Mineral Projects.

QAQC

Analyses were performed by SGS Geosol (Vespasiano, Brazil) using lithium-borate fusion with ICP-MS/OES (IMS95A/ICP95A method). The QA/QC program inserted 3 blanks, 3 certified reference materials (CRMs) and 3 field duplicates among 84 total submissions. Relative to the 75 primary samples (SMP), control insertion equates to 12% (each control type 4% vs. SMP count). Analytical performance was monitored using Ce, Dy, La, Nd, Pr, and Y, consistent with JORC-aligned practice.

This news release presents exploration results and does not constitute a mineral resource or reserve estimate. Forward-looking statements are subject to risks and uncertainties, and actual results may differ materially.

About Verde AgriTech

Verde AgriTech is dedicated to advancing sustainable agriculture through the innovation of specialty multi nutrient potassium fertilizers. Our mission is to increase agricultural productivity, enhance soil health, and significantly contribute to environmental sustainability. Utilizing our unique position in Brazil, we harness proprietary technologies to develop solutions that not only meet the immediate needs of farmers but also address global challenges such as food security and climate change. Our commitment to carbon capture and the production of eco-friendly fertilizers underscores our vision for a future where agriculture contributes positively to the health of our planet. For more information on how we are leading the way towards sustainable agriculture and climate change mitigation in Brazil, visit our website: https://verde.ag/en/home.

Cautionary Language and Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation, including, but not limited to, statements with respect to: the significance of exploration results; the potential for economic extraction of rare earth elements; future exploration and development plans; the outcome of the Board of Directors’ review; potential partnerships, strategic alternatives, or value-maximizing structures; the advancement of the project; and the expected timing of further updates. Forward-looking information is based on management’s current expectations, assumptions, estimates, projections, and interpretations, and involves known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those expressed or implied. These factors include, without limitation: risks related to exploration stage projects; the possibility that future exploration results may not support mineral resource or reserve delineation; uncertainties relating to assay and metallurgical results; operational risks inherent in mining; risks associated with maintaining licenses, permits and mineral rights; changes in laws, regulations and government policies; risks related to capital and operating costs; commodity price volatility; financing risks; and other risks described in the Company’s most recent annual information form and other continuous disclosure filings available under the Company’s profile at www.sedarplus.ca .

Readers are cautioned not to place undue reliance on forward-looking information. The Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required under applicable securities laws.

This news release reports exploration results which are preliminary in nature and do not represent mineral resources or mineral reserves as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). There is no certainty that further exploration will result in the delineation of mineral resources, mineral reserves, or that any development decision will be made. Mineralization identified to date is not necessarily indicative of future results.

For additional information please contact:

Cristiano Veloso, Chief Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email: investor@verde.ag

www.verde.ag | www.investor.verde.ag

Appendix

| Channel |

From |

To |

UTMN |

UTME |

CeO2 |

Dy2O3 |

Er2O3 |

Eu2O3 |

Gd2O3 |

Ho2O3 |

La2O3 |

Lu2O3 |

Nd2O3 |

Pr6O11 |

Sm2O3 |

Tb4O7 |

Tm2O3 |

Y2O3 |

Yb2O3 |

TREO |

MREO |

%NdPr |

| PT-01 |

0 |

1 |

7860136.929 |

399395.0765 |

2260 |

493 |

1139 |

16 |

6 |

13 |

32 |

2 |

451 |

1 |

358 |

115 |

54 |

3 |

1 |

65 |

4 |

21% |

| PT-01 |

1 |

2 |

7860136.929 |

399395.0765 |

2395 |

521 |

1207 |

17 |

6 |

13 |

32 |

2 |

482 |

1 |

378 |

121 |

57 |

4 |

1 |

68 |

5 |

21% |

| PT-01 |

2 |

3 |

7860136.929 |

399395.0765 |

2239 |

479 |

1141 |

16 |

5 |

13 |

30 |

2 |

451 |

1 |

347 |

113 |

53 |

3 |

1 |

60 |

4 |

21% |

| PT-01 |

3 |

4 |

7860136.929 |

399395.0765 |

2231 |

479 |

1137 |

16 |

6 |

13 |

30 |

2 |

447 |

0 |

349 |

112 |

52 |

3 |

1 |

61 |

4 |

21% |

| PT-02 |

0 |

1 |

7860008.239 |

399670.4119 |

2953 |

657 |

1478 |

18 |

6 |

18 |

39 |

3 |

619 |

1 |

491 |

143 |

69 |

4 |

1 |

60 |

4 |

21% |

| PT-02 |

1 |

2 |

7860008.239 |

399670.4119 |

2777 |

653 |

1340 |

19 |

6 |

18 |

41 |

3 |

578 |

1 |

489 |

140 |

71 |

4 |

1 |

63 |

4 |

23% |

| PT-02 |

2 |

3 |

7860008.239 |

399670.4119 |

2116 |

469 |

1063 |

14 |

5 |

12 |

28 |

2 |

435 |

0 |

350 |

102 |

52 |

3 |

1 |

47 |

3 |

21% |

| PT-03 |

0 |

1 |

7860373.942 |

399292.9014 |

1209 |

274 |

574 |

9 |

4 |

7 |

17 |

1 |

260 |

0 |

198 |

65 |

29 |

2 |

0 |

38 |

3 |

22% |

| PT-03 |

1 |

2 |

7860373.942 |

399292.9014 |

1396 |

301 |

699 |

10 |

4 |

8 |

18 |

1 |

293 |

0 |

223 |

66 |

32 |

2 |

0 |

36 |

3 |

21% |

| PT-04 |

0 |

1 |

7860344.159 |

399720.8354 |

2358 |

529 |

1194 |

15 |

5 |

14 |

32 |

2 |

468 |

0 |

387 |

124 |

58 |

3 |

1 |

53 |

3 |

22% |

| PT-04 |

1 |

2 |

7860344.159 |

399720.8354 |

2585 |

577 |

1311 |

16 |

5 |

15 |

35 |

2 |

516 |

0 |

423 |

135 |

61 |

4 |

1 |

57 |

3 |

22% |

| PT-05 |

0 |

1 |

7862246.403 |

401300.476 |

6161 |

1327 |

3015 |

35 |

9 |

36 |

82 |

4 |

1436 |

1 |

972 |

313 |

143 |

8 |

1 |

104 |

5 |

21% |

| PT-06 |

0 |

1 |

7863968.969 |

400492.102 |

4948 |

938 |

2788 |

25 |

7 |

24 |

50 |

3 |

954 |

1 |

681 |

227 |

98 |

5 |

1 |

78 |

6 |

18% |

| PT-07 |

0 |

1 |

7863592.347 |

401682.6914 |

2549 |

541 |

1331 |

16 |

5 |

14 |

32 |

2 |

502 |

0 |

394 |

128 |

57 |

3 |

1 |

58 |

3 |

20% |

| PT-08 |

0 |

1 |

7863699.873 |

401672.1566 |

8276 |

1816 |

4010 |

48 |

14 |

47 |

108 |

6 |

1904 |

1 |

1330 |

428 |

192 |

11 |

1 |

167 |

8 |

21% |

| PT-09 |

0 |

1 |

7863583.943 |

401415.2769 |

2000 |

390 |

1043 |

14 |

6 |

10 |

25 |

2 |

425 |

1 |

286 |

88 |

41 |

3 |

1 |

52 |

4 |

19% |

| PT-10 |

0 |

1 |

7873694.766 |

404024.0238 |

2661 |

488 |

1487 |

12 |

4 |

11 |

24 |

2 |

543 |

1 |

350 |

123 |

47 |

2 |

1 |

50 |

4 |

18% |

| PT-11 |

0 |

1 |

7871366.773 |

404423.6514 |

4704 |

1052 |

2290 |

26 |

8 |

27 |

60 |

4 |

1064 |

1 |

791 |

229 |

110 |

6 |

1 |

83 |

5 |

22% |

| PT-12 |

0 |

1 |

7871455.517 |

404413.9554 |

7669 |

1705 |

3718 |

46 |

14 |

44 |

101 |

6 |

1717 |

1 |

1251 |

398 |

182 |

10 |

2 |

171 |

9 |

21% |

| PT-13 |

0 |

1 |

7871485.917 |

404344.321 |

4044 |

828 |

2158 |

21 |

7 |

21 |

45 |

3 |

814 |

1 |

601 |

201 |

83 |

5 |

1 |

79 |

5 |

20% |

| PT-14 |

0 |

1 |

7865827.869 |

403058.2396 |

6081 |

1306 |

2971 |

37 |

11 |

35 |

78 |

5 |

1396 |

1 |

955 |

306 |

137 |

8 |

1 |

134 |

7 |

21% |

| PT-15 |

0 |

1 |

7866820.888 |

404291.8603 |

4190 |

927 |

2167 |

27 |

9 |

24 |

57 |

4 |

798 |

1 |

681 |

213 |

101 |

6 |

1 |

96 |

6 |

21% |

| PT-15 |

1 |

2 |

7866820.888 |

404291.8603 |

2357 |

525 |

1215 |

16 |

6 |

14 |

33 |

2 |

437 |

0 |

386 |

120 |

57 |

3 |

1 |

63 |

4 |

21% |

| PT-16 |

0 |

1 |

7866556.862 |

404506.8706 |

2562 |

532 |

1327 |

16 |

6 |

14 |

32 |

2 |

522 |

1 |

386 |

126 |

56 |

3 |

1 |

66 |

4 |

20% |

| PT-17 |

0 |

1 |

7866258.134 |

404800.7815 |

1613 |

337 |

809 |

12 |

5 |

9 |

22 |

2 |

337 |

1 |

249 |

73 |

36 |

2 |

1 |

50 |

4 |

20% |

| PT-18 |

0 |

1 |

7865477.779 |

404446.4377 |

6102 |

1214 |

3183 |

34 |

10 |

32 |

72 |

4 |

1339 |

1 |

883 |

290 |

129 |

7 |

1 |

110 |

6 |

19% |

| PT-18 |

1 |

2 |

7865477.779 |

404446.4377 |

7202 |

1676 |

3326 |

46 |

14 |

45 |

103 |

6 |

1670 |

1 |

1231 |

389 |

179 |

10 |

1 |

173 |

8 |

22% |

| PT-18 |

2 |

3 |

7865477.779 |

404446.4377 |

5497 |

1179 |

2698 |

32 |

9 |

31 |

69 |

4 |

1263 |

1 |

861 |

279 |

125 |

7 |

1 |

111 |

5 |

21% |

| PT-19 |

0 |

1 |

7865657.084 |

404535.9645 |

5544 |

1181 |

2749 |

32 |

10 |

32 |

72 |

4 |

1244 |

1 |

865 |

277 |

131 |

7 |

1 |

111 |

7 |

21% |

| PT-19 |

1 |

2 |

7865657.084 |

404535.9645 |

5351 |

1108 |

2664 |

31 |

10 |

29 |

67 |

4 |

1238 |

1 |

803 |

267 |

116 |

7 |

1 |

107 |

6 |

20% |

| PT-20 |

0 |

1 |

7865452.759 |

404324.0375 |

5688 |

1209 |

2817 |

36 |

12 |

32 |

74 |

5 |

1259 |

1 |

883 |

282 |

132 |

7 |

1 |

138 |

8 |

20% |

| PT-20 |

1 |

2 |

7865452.759 |

404324.0375 |

5811 |

1210 |

2949 |

36 |

11 |

32 |

74 |

5 |

1261 |

1 |

883 |

284 |

131 |

8 |

1 |

129 |

7 |

20% |

| PT-21 |

0 |

1 |

7867642.384 |

405141.4953 |

6211 |

1306 |

3129 |

40 |

13 |

35 |

83 |

5 |

1336 |

1 |

953 |

305 |

139 |

8 |

1 |

154 |

8 |

20% |

| PT-21 |

1 |

2 |

7867642.384 |

405141.4953 |

7250 |

1507 |

3731 |

49 |

17 |

41 |

99 |

7 |

1456 |

1 |

1102 |

347 |

168 |

10 |

2 |

209 |

11 |

20% |

| PT-22 |

0 |

1 |

7867679.275 |

405045.3258 |

1885 |

335 |

1035 |

13 |

6 |

9 |

23 |

2 |

372 |

1 |

239 |

80 |

36 |

3 |

1 |

62 |

4 |

17% |

| PT-23 |

0 |

1 |

7868499.583 |

405216.0652 |

5447 |

1236 |

2555 |

34 |

10 |

33 |

74 |

4 |

1273 |

1 |

907 |

288 |

133 |

7 |

1 |

119 |

6 |

22% |

| PT-24 |

0 |

1 |

7868992.1 |

405763.2668 |

1706 |

347 |

839 |

12 |

5 |

8 |

21 |

2 |

382 |

1 |

255 |

78 |

36 |

2 |

1 |

59 |

4 |

20% |

| PT-25 |

0 |

1 |

7869012.943 |

405715.3824 |

1546 |

313 |

800 |

10 |

4 |

8 |

19 |

2 |

323 |

0 |

231 |

70 |

32 |

2 |

1 |

41 |

3 |

20% |

| PT-26 |

0 |

1 |

7838552.423 |

385327.4181 |

1451 |

182 |

977 |

6 |

2 |

4 |

10 |

1 |

235 |

0 |

132 |

43 |

18 |

1 |

0 |

21 |

2 |

12% |

| PT-27 |

0 |

1 |

7838674.698 |

385289.5999 |

3527 |

325 |

2577 |

11 |

4 |

7 |

20 |

2 |

514 |

0 |

235 |

77 |

29 |

2 |

1 |

45 |

3 |

9% |

| PT-28 |

0 |

1 |

7840193.993 |

390174.2897 |

426 |

46 |

296 |

2 |

2 |

1 |

3 |

0 |

58 |

0 |

33 |

11 |

4 |

0 |

0 |

14 |

2 |

10% |

| PT-29 |

0 |

1 |

7840174.773 |

388865.5112 |

627 |

85 |

394 |

4 |

2 |

2 |

5 |

1 |

112 |

0 |

61 |

20 |

8 |

1 |

0 |

16 |

2 |

13% |

| PT-30 |

0 |

1 |

7839685.226 |

388198.7858 |

1256 |

105 |

940 |

5 |

3 |

2 |

6 |

1 |

152 |

1 |

73 |

26 |

10 |

1 |

0 |

33 |

3 |

8% |

| PT-31 |

0 |

1 |

7839259.616 |

386861.3272 |

826 |

52 |

675 |

3 |

2 |

1 |

3 |

1 |

66 |

0 |

36 |

12 |

5 |

0 |

0 |

18 |

2 |

6% |

| PT-32 |

0 |

1 |

7839840.679 |

386591.9356 |

974 |

70 |

763 |

3 |

2 |

1 |

4 |

1 |

107 |

0 |

49 |

17 |

7 |

1 |

0 |

17 |

2 |

7% |

| PT-33 |

0 |

1 |

7841236.73 |

384705.4328 |

3614 |

794 |

1821 |

19 |

6 |

18 |

38 |

3 |

796 |

0 |

589 |

182 |

75 |

4 |

1 |

59 |

4 |

21% |

| PT-34 |

0 |

1 |

7841160.461 |

384496.1517 |

8930 |

2118 |

4083 |

53 |

15 |

54 |

126 |

7 |

2104 |

1 |

1592 |

461 |

214 |

12 |

1 |

200 |

7 |

23% |

| PT-34 |

1 |

2 |

7841160.461 |

384496.1517 |

8615 |

2182 |

3636 |

60 |

17 |

57 |

135 |

8 |

2108 |

1 |

1644 |

464 |

221 |

13 |

2 |

240 |

8 |

24% |

| PT-35 |

0 |

1 |

7844181.841 |

382675.5189 |

3282 |

724 |

1669 |

18 |

6 |

17 |

40 |

3 |

673 |

1 |

544 |

158 |

73 |

4 |

1 |

71 |

5 |

21% |

| PT-36 |

0 |

1 |

7845380.341 |

384873.0802 |

7181 |

1593 |

3563 |

37 |

11 |

39 |

87 |

5 |

1570 |

1 |

1198 |

350 |

158 |

9 |

1 |

146 |

6 |

22% |

| PT-37 |

0 |

1 |

7846622.379 |

384552.6567 |

730 |

132 |

387 |

6 |

4 |

3 |

8 |

1 |

145 |

1 |

95 |

29 |

13 |

1 |

1 |

34 |

4 |

17% |

| PT-38 |

0 |

1 |

7846381.078 |

383737.9697 |

1086 |

160 |

648 |

7 |

4 |

4 |

9 |

1 |

199 |

1 |

114 |

37 |

15 |

1 |

1 |

40 |

4 |

14% |

| PT-39 |

0 |

1 |

7845628.311 |

383624.1089 |

3126 |

619 |

1675 |

22 |

7 |

17 |

41 |

3 |

605 |

1 |

458 |

134 |

67 |

4 |

1 |

87 |

4 |

19% |

| PT-40 |

0 |

1 |

7853691.007 |

385824.6519 |

4342 |

879 |

2321 |

23 |

7 |

21 |

49 |

3 |

887 |

1 |

654 |

197 |

87 |

5 |

1 |

82 |

5 |

20% |

| PT-41 |

0 |

1 |

7853450.628 |

385544.7044 |

903 |

189 |

402 |

8 |

3 |

3 |

10 |

1 |

235 |

1 |

136 |

44 |

18 |

1 |

1 |

37 |

4 |

20% |

| PT-42 |

0 |

1 |

7854988.064 |

383520.773 |

4605 |

1096 |

2169 |

31 |

9 |

29 |

70 |

4 |

982 |

1 |

823 |

235 |

116 |

7 |

1 |

122 |

5 |

23% |

| PT-43 |

0 |

1 |

7854599.798 |

383201.6527 |

5980 |

1181 |

3211 |

26 |

8 |

27 |

58 |

3 |

1288 |

1 |

879 |

270 |

115 |

6 |

1 |

82 |

5 |

19% |

| PT-44 |

0 |

1 |

7856215.689 |

381334.7392 |

747 |

142 |

378 |

6 |

3 |

3 |

8 |

1 |

160 |

1 |

103 |

32 |

14 |

1 |

0 |

32 |

3 |

18% |

| PT-45 |

0 |

1 |

7856478.399 |

382570.7681 |

6418 |

1372 |

3182 |

37 |

13 |

34 |

80 |

6 |

1402 |

1 |

1026 |

300 |

137 |

8 |

2 |

180 |

9 |

21% |

| PT-46 |

0 |

1 |

7855995.628 |

384092.1924 |

2148 |

453 |

1112 |

15 |

5 |

12 |

29 |

2 |

430 |

0 |

335 |

100 |

49 |

3 |

1 |

51 |

3 |

20% |

| PT-47 |

0 |

1 |

7856236.697 |

384223.7552 |

3169 |

691 |

1639 |

17 |

6 |

16 |

34 |

2 |

650 |

1 |

517 |

154 |

69 |

3 |

1 |

54 |

5 |

21% |

| PT-48 |

0 |

1 |

7857095.047 |

388484.4584 |

4775 |

969 |

2512 |

30 |

9 |

27 |

61 |

4 |

984 |

1 |

722 |

211 |

105 |

6 |

1 |

95 |

7 |

20% |

| PT-49 |

0 |

1 |

7857168.355 |

388409.6511 |

3998 |

704 |

2325 |

22 |

7 |

18 |

41 |

3 |

736 |

1 |

522 |

156 |

75 |

4 |

1 |

80 |

5 |

17% |

| PT-50 |

0 |

1 |

7857512.637 |

389654.9839 |

2017 |

421 |

1071 |

13 |

4 |

11 |

26 |

2 |

391 |

0 |

319 |

86 |

43 |

3 |

0 |

44 |

3 |